Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

| Exchange | BSE, NSE, MCX |

| Segments | NSE Cash, BSE Cash, NSE F&O, BSE F&O, CDS, MCX |

| Products | CNC, MIS, NRML, BO, CO |

| Order Types | Limit, Market, SL, SL-M |

| Website | Yes |

| Mobile App | Yes |

| Installable Trading Terminal | No |

| API's | Yes |

| Online IPO | No |

| Mutual Funds | No |

| Integrated Backoffice | No |

| Chart Types | 6 |

| Chart Indicators | 100 |

| Charts in same window | 4 |

Zerodha KITE is an online trading software. It allows customers to trade at BSE, NSE and MCX. It's a front-end application which is built in-house by Zerodha engineers. KITE platform offers 3 main products, all for free to its customers:

A website based trading application (runs on browser like a normal website) with streaming quotes, advance charts, keyboard shortcuts, elegant UI and all available order types.

Zerodha Kite App is available for Android and iOS. Kite Mobile is a powerful and simple mobile trading app. The Kite Mobile App give you access to all the features available in Kite Web.

Kite APIs are simple HTTP/JSON APIs for developers who would like to build their own front-end platforms or tools to trade. These API's are offered as 'platform as a service'.

| Pros | Cons |

|---|---|

|

|

Zerodha is a leading stock broker in India with lakhs of customers. The company offers online discount stock & commodity broking services at NSE, BSE and MCX. It also offers Mutual Fund investments and demat account services.

Kite is superior trading platform loaded with many features which are not provided by its competitor. As Kite is under active development, Zerodha is bringing in 100's of new features every new version released. Here are few key features which make Kite a unique trading experience.

Kite offer most advanced charting with over 100 indicators, 6 chart types, 19 drawing tools, and facility to draw as many charts at a time. The chart intraday data is available from 2014 and daily charts for over 7 years for stocks, commodities, F&O, and currencies.

Key features of Zerodha Kite Charts:

Kite 'Funds' page is for customers to add fund or withdraw the money from the trading account. Kite fund transfer allows you to:

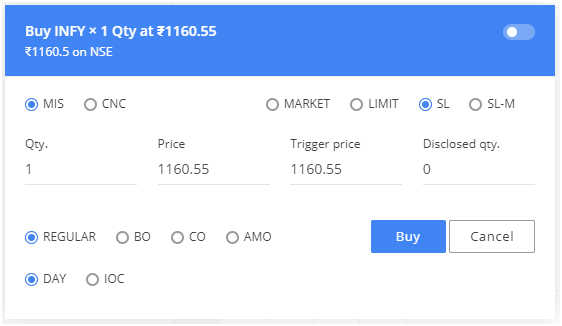

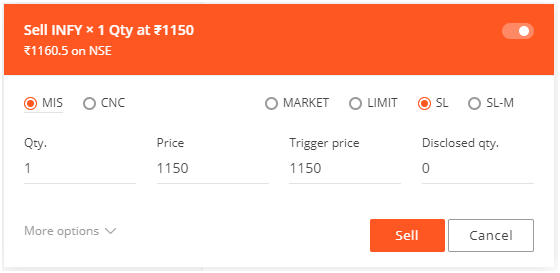

MIS orders are used for intraday trades in equity and F&O segments. Zerodha offers additional leverage/margin for trade under MIS.

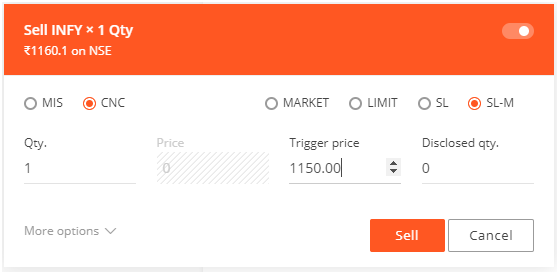

CNC orders are for delivery based 'Equity' trades. 100% money (margin) is required to buy share under this order type. To sell stocks using CNC, stocks need to be available in the linked demat account.

NRML orders are for intraday/overnight 'F&O' trades without additional leverage. Positions taken as NRML can be held until expiry as long as required margins maintained by the customer.

BO's are intraday limit orders with a target and stoploss and an optional trailing SL all placed simultaneously.

CO's are intraday market orders with a predetermined stoploss order. Higher leverage is provided for these orders as they have fixed stoploss.

Orders placed for next trading day in advance. AMO orders can be placed from between 4.00 pm to 9.14 am.

| Segment | Order Time |

|---|---|

| Equity | NSE: 3:45 PM to 8:57 AM BSE: 3:45 PM to 8:59 AM |

| Equity F&O | 3:45 PM to 9:10 AM |

| Currency | 3:45 PM to 8:59 AM |

| Commodity | Anytime during the day* |

* If MCX AMO order is placed during the market hours the order will go through the next day at 9 AM.

To place orders (buy or sell) at current market price Say, if Infosys is being currently traded at Rs 1160, a customer will be able to place a buy/sell order at Rs 1160.

To place orders (buy or sell) at predefined price. Say Infosys is being traded at Rs 1160 but customer can place a limit buy order to buy shares at Rs 1150. The orders will be queued and get executed only when the price reaches Rs 1150.

SL orders are design to limit the investor's loss. It can also be used to buy/sell stocks when it reaches a certain price (trigger price).

Same as SL order but with Stop Loss 'Market Order' instead of 'Limit Order'.

Zerodha Kite doesn't offer any reports. Customer has to get the reports from Zerodha backoffice.

Kite is made available for free to all customers.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Zerodha Kite helpline number is +91 80 4718 1888. The Zerodha support lines are open from 8:30 AM to 6:00 PM on weekdays.

Zerodha Call & Trade Number is +91 80 4718 1888. The Zerodha call & trade lines are open from 9:00 AM to 11:55 PM on trading days.

Zerodha Kite user guide is available on the Zerodha website. The FAQs about Zerodha are available on the Zerodha support portal.

Steps to change Zerodha Kite Password

Zerodha account opening charges are Rs 200 for online account opening and Rs 300 for offline paper-based account opening.

Besides, Zerodha charges Rs 300 per year Demat Account AMC that is paid Rs 75 quarterly in advance.

Zerodha Kite Web is a website based trading application. It does not require any download. You can open the website in any web browser on a computer or mobile phone to trade.

Zerodha Kite Mobile App is available for download at Android/iOS stores.

Note: Zerodha kite is not available in an installable trading terminal format. Zerodha does not offer exe based desktop trading software.

You can check your Demat Holdings in Zerodha Kite Web or Mobile App by clicking on the Holdings tab.

Note that stocks bought as CNC (equity delivery) will show up in the holdings from the next trading day. These stocks will be available in the demat account only after two days (T+2) from purchasing. Until stocks are delivered, they show up as T1 holdings.

Zerodha Kite does not provide the facility to apply in IPOs. You have to use Zerodha Console to apply in IPO. Check Steps to apply in IPO with Zerodha for more detail.

Zerodha offers UPI based online IPO application. You should have the UPI id of your bank account to invest in IPO using the Zerodha IPO application. Zerodha IPO application doesn't allow you to invest in IPO using Minor, HUF, or corporate account as UPI doesn't support it.

You can also apply in IPO by visiting the net-banking website or app of your bank. Almost all banks offer online IPO applications using ASBA as a payment option.

Zerodha ledger details are available in Zerodha Console, the back-office software. Zerodha console website also provides detailed reports of your trade, trade history, portfolio, profit & loss, tax statements, etc.

The Zerodha ledger is a statement that reflects the details of your fund movement within the account along with the transaction details.

Steps to check ledger in Zerodha:

You can also download the ledger in excel format for easy reference.

Zerodha Kite does not offer referral form or links. To refer a friend, you have to log in to Zerodha Console (back-office) website and visit the referral section. Refer to our step by step guide for Zerodha Referral.

Yes, Zerodha offers Zerodha Kite mobile app to trade in Equities, Commodities, Equity Derivatives, Currency Derivatives, and bonds. Kite mobile app is available for both Android as well as iOS devices.

To download the Kite mobile app, go to the Google Play store or the App Store as required and type Zerodha Kite and click on install.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|