Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

SBFC Finance IPO is a book built issue of Rs 1,025.00 crores. The issue is a combination of fresh issue of Rs 600.00 crores and offer for sale of Rs 425.00 crores.

SBFC Finance IPO bidding started from August 3, 2023 and ended on August 7, 2023. The allotment for SBFC Finance IPO was finalized on Thursday, August 10, 2023. The shares got listed on BSE, NSE on August 16, 2023.

SBFC Finance IPO price band is set at ₹54 to ₹57 per share. The minimum lot size for an application is 260 Shares. The minimum amount of investment required by retail investors is ₹14,820. The minimum lot size investment for sNII is 14 lots (3,640 shares), amounting to ₹207,480, and for bNII, it is 68 lots (17,680 shares), amounting to ₹1,007,760.

The issue includes a reservation of up to 1,863,636 shares for employees offered at a discount of Rs 2 to the issue price.

ICICI Securities Limited, Axis Capital Limited and Kotak Mahindra Capital Company Limited are the book running lead managers of the SBFC Finance IPO, while Kfin Technologies Limited is the registrar for the issue.

Refer to SBFC Finance IPO RHP for detailed information.

| IPO Date | August 3, 2023 to August 7, 2023 |

| Listing Date | August 16, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹54 to ₹57 per share |

| Lot Size | 260 Shares |

| Total Issue Size | [.] shares (aggregating up to ₹1,025.00 Cr) |

| Fresh Issue | [.] shares (aggregating up to ₹600.00 Cr) |

| Offer for Sale | [.] shares of ₹10 (aggregating up to ₹425.00 Cr) |

| Employee Discount | Rs 2 per share |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 958,908,906 |

| Share holding post issue | 1,064,237,454 |

SBFC Finance IPO offers 179,889,948 shares. 35,605,261 (19.79%) to QIB, 26,703,948 (14.84%) to NII, 62,309,210 (34.64%) to RII, 1,863,636 (1.04%) to employees 53,407,893 (29.69%) to Anchor investors. 239,650 RIIs will receive minimum 260 shares and 2,445 (sNII) and 4,890 (bNII) will receive minimum 3,640 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 53,407,893 (29.69%) | NA |

| QIB Shares Offered | 35,605,261 (19.79%) | NA |

| NII (HNI) Shares Offered | 26,703,948 (14.84%) | |

| bNII > ₹10L | 17,802,632 (9.90%) | 4,890 |

| sNII < ₹10L | 8,901,316 (4.95%) | 2,445 |

| Retail Shares Offered | 62,309,210 (34.64%) | 239,650 |

| Employee Shares Offered | 1,863,636 (1.04%) | NA |

| Total Shares Offered | 179,889,948 (100%) |

SBFC Finance IPO raises Rs 304.42 crore from anchor investors. SBFC Finance IPO Anchor bid date is August 2, 2023. SBFC Finance IPO Anchor Investors list

| Bid Date | August 2, 2023 |

| Shares Offered | 53,407,893 |

| Anchor Portion Size (In Cr.) | 304.42 |

| Anchor lock-in period end date for 50% shares (30 Days) | September 9, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | November 8, 2023 |

SBFC Finance IPO opens on August 3, 2023, and closes on August 7, 2023.

| IPO Open Date | Thursday, August 3, 2023 |

| IPO Close Date | Monday, August 7, 2023 |

| Basis of Allotment | Thursday, August 10, 2023 |

| Initiation of Refunds | Friday, August 11, 2023 |

| Credit of Shares to Demat | Monday, August 14, 2023 |

| Listing Date | Wednesday, August 16, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 7, 2023 |

Investors can bid for a minimum of 260 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 260 | ₹14,820 |

| Retail (Max) | 13 | 3380 | ₹192,660 |

| S-HNI (Min) | 14 | 3,640 | ₹207,480 |

| S-HNI (Max) | 67 | 17,420 | ₹992,940 |

| B-HNI (Min) | 68 | 17,680 | ₹1,007,760 |

| Lot Size Calculator | |||

SBFC Holdings Pte. Ltd., Clermont Financial Pte. Ltd., Arpwood Partners Investment Advisors LLP, Arpwood Capital Private Limited and Eight45 Services LLP are the company promoters.

| Share Holding Pre Issue | 78.83% |

| Share Holding Post Issue | 64.03% |

Incorporated in 2008, SBFC Finance Limited is a systemically important, non-deposit-taking Non-Banking Finance Company (NBFC-ND-SI). The primary customer base of the company includes entrepreneurs, small business owners, self-employed individuals, and salaried and working-class individuals.

SBFC provides its services in the form of Secured MSME Loans and Loans against Gold.

SBFC Finance tends to extend its services to entrepreneurs and small business owners who are underserved or unserved by traditional financial institutions like banks. There are various factors taken into consideration while offering financial assistance in the form of loans. SBFC Finance offers its services so that entrepreneurs can fulfill their financial requirements and thrive.

The entity has a diversified pan-India presence through its extensive network. As of December 31, 2022, SBFC Finance had established its footprints in over 105 cities in 16 Indian states and two union territories. They currently have 137 branches.

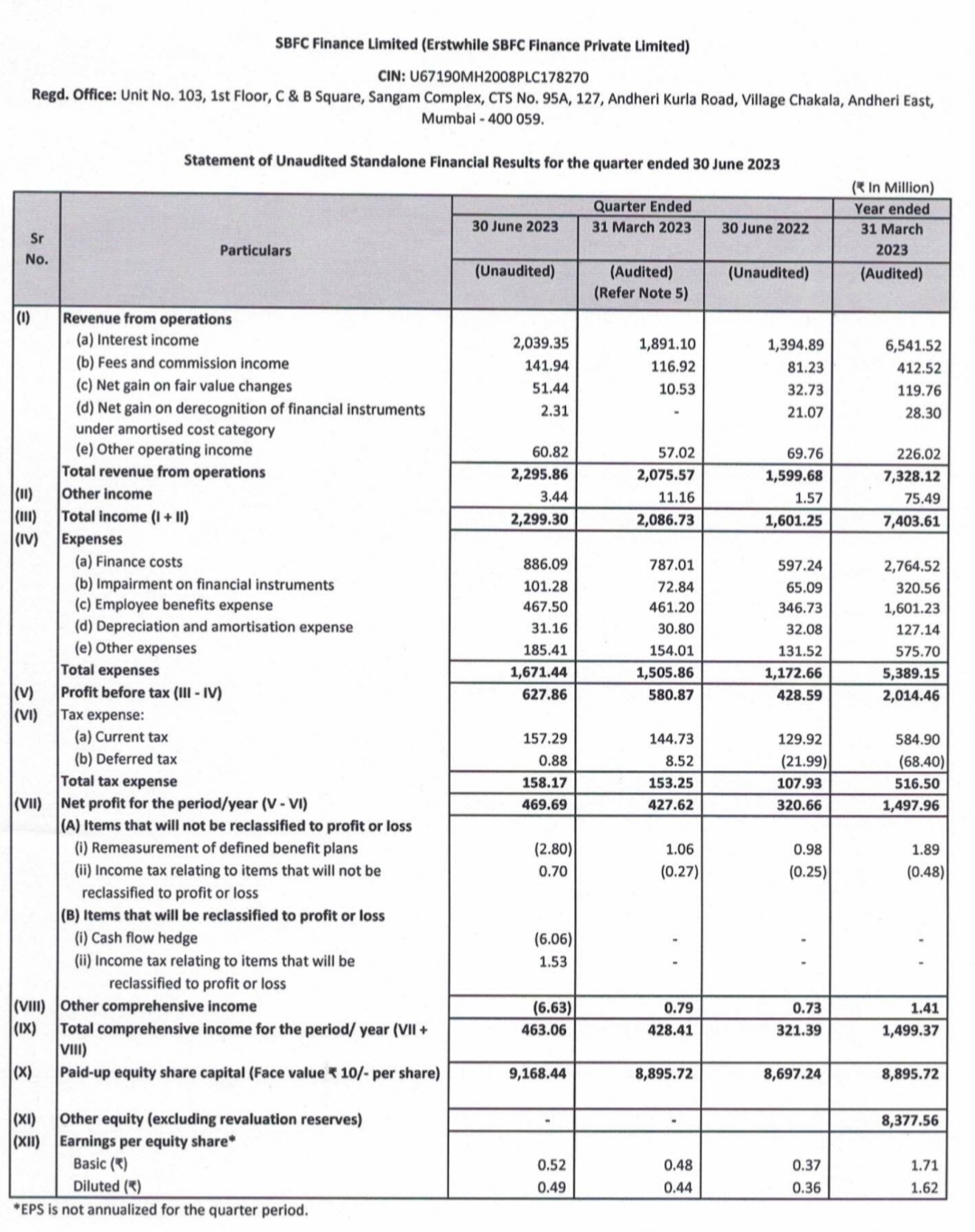

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 4,207.99 | 4,231.19 | 4,515.03 | 5,746.44 |

| Revenue | 444.85 | 511.53 | 530.70 | 740.36 |

| Profit After Tax | 35.50 | 85.01 | 64.52 | 149.74 |

| Net Worth | 752.09 | 944.72 | 1,026.78 | 1,466.88 |

| Reserves and Surplus | ||||

| Total Borrowing | 3,056.38 | 2,772.55 | 2,948.82 | 3,745.83 |

The market capitalization of SBFC Finance IPO is Rs 6065.78 Cr.

| KPI | Values |

|---|---|

| ROE | 9.93% |

| Debt/Equity | 2.2 |

| RoNW | 7.97% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 1.25 | |

| P/E (x) | 40.42 |

The Company proposes to utilize the Net Proceeds towards augmenting the Company's capital base to meet their future capital requirements arising out of the growth of the business and assets.

[Dilip Davda] Of late we have media reports of MSME loans turning NPAs for financiers, however, this company has shown a decline in its NPAs over the past three fiscals. But with rising competition, and RBI's frequently changing monetary policies, the company may suffer going forward as it has already marked a decline in its NIM for the last three fiscals. Based on its FY23 earnings, the IPO appears aggressively priced compared to its peers. Only well-informed/cash surplus/ risk seeker investors may park funds for the medium to long term in this costly IPO. Read detail review...

The SBFC Finance IPO is subscribed 74.06 times on August 7, 2023 7:02:00 PM. The public issue subscribed 11.60 times in the retail category, 203.61 times in the QIB category, and 51.82 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 203.61 |

| NII | 51.82 |

| bNII (bids above ₹10L) | 56.69 |

| sNII (bids below ₹10L) | 42.07 |

| Retail | 11.60 |

| Employee | 6.21 |

| Total | 74.06 |

Total Application : 2,429,631 (10.14 times)

| Listing Date | August 16, 2023 |

| BSE Script Code | 543959 |

| NSE Symbol | SBFC |

| ISIN | INE423Y01016 |

| Final Issue Price | ₹57 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹57.00 |

| ₹81.99 |

| ₹81.99 |

| ₹95.30 |

| ₹92.21 |

| NSE |

|---|

| ₹57.00 |

| ₹82.00 |

| ₹82.00 |

| ₹95.45 |

| ₹92.20 |

SBFC Finance Limited

103, 1st Floor, C&B Square, Sangam Complex,

Andheri Kurla Road, Village Chakala,

Andheri (East), Mumbai - 400 059

Phone: 022 6787 5344

Email: complianceofficer@sbfc.com

Website: http://www.sbfc.com/

Kfin Technologies Limited

Phone: 04067162222, 04079611000

Email: Sbfc.ipo@kfintech.com

Website: https://kosmic.kfintech.com/ipostatus/

SBFC Finance IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹1,025.00 Crores. The issue is priced at ₹54 to ₹57 per share. The minimum order quantity is 260 Shares.

The IPO opens on August 3, 2023, and closes on August 7, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in SBFC Finance IPO using UPI as a payment gateway. Zerodha customers can apply in SBFC Finance IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in SBFC Finance IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The SBFC Finance IPO opens on August 3, 2023 and closes on August 7, 2023.

SBFC Finance IPO lot size is 260 Shares, and the minimum amount required is ₹14,820.

You can apply in SBFC Finance IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for SBFC Finance IPO will be done on Thursday, August 10, 2023, and the allotted shares will be credited to your demat account by Monday, August 14, 2023. Check the SBFC Finance IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|