Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

SAMHI Hotels IPO is a book built issue of Rs 1,370.10 crores. The issue is a combination of fresh issue of 9.52 crore shares aggregating to Rs 1,200.00 crores and offer for sale of 1.35 crore shares aggregating to Rs 170.10 crores.

SAMHI Hotels IPO bidding started from September 14, 2023 and ended on September 18, 2023. The allotment for SAMHI Hotels IPO was finalized on Friday, September 22, 2023. The shares got listed on BSE, NSE on September 22, 2023.

SAMHI Hotels IPO price band is set at ₹119 to ₹126 per share. The minimum lot size for an application is 119 Shares. The minimum amount of investment required by retail investors is ₹14,994. The minimum lot size investment for sNII is 14 lots (1,666 shares), amounting to ₹209,916, and for bNII, it is 67 lots (7,973 shares), amounting to ₹1,004,598.

Jm Financial Limited and Kotak Mahindra Capital Company Limited are the book running lead managers of the SAMHI Hotels IPO, while Kfin Technologies Limited is the registrar for the issue.

Refer to SAMHI Hotels IPO RHP for detailed information.

| IPO Date | September 14, 2023 to September 18, 2023 |

| Listing Date | September 22, 2023 |

| Face Value | ₹1 per share |

| Price Band | ₹119 to ₹126 per share |

| Lot Size | 119 Shares |

| Total Issue Size | 108,738,095 shares (aggregating up to ₹1,370.10 Cr) |

| Fresh Issue | 95,238,095 shares (aggregating up to ₹1,200.00 Cr) |

| Offer for Sale | 13,500,000 shares of ₹1 (aggregating up to ₹170.10 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding post issue | 218,035,326 |

SAMHI Hotels IPO offers 108,738,095 shares. 32,621,429 (30.00%) to QIB, 16,310,714 (15.00%) to NII, 10,873,809 (10.00%) to RII 48,932,143 (45.00%) to Anchor investors. 91,376 RIIs will receive minimum 119 shares and 3,263 (sNII) and 6,526 (bNII) will receive minimum 1,666 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 48,932,143 (45.00%) | NA |

| QIB Shares Offered | 32,621,429 (30.00%) | NA |

| NII (HNI) Shares Offered | 16,310,714 (15.00%) | |

| bNII > ₹10L | 10,873,809 (10.00%) | 6,526 |

| sNII < ₹10L | 5,436,905 (5.00%) | 3,263 |

| Retail Shares Offered | 10,873,809 (10.00%) | 91,376 |

| Total Shares Offered | 108,738,095 (100%) |

SAMHI Hotels IPO raises Rs 616.55 crore from anchor investors. SAMHI Hotels IPO Anchor bid date is September 13, 2023. SAMHI Hotels IPO Anchor Investors list

| Bid Date | September 13, 2023 |

| Shares Offered | 48,932,143 |

| Anchor Portion Size (In Cr.) | 616.55 |

| Anchor lock-in period end date for 50% shares (30 Days) | October 22, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | December 21, 2023 |

SAMHI Hotels IPO opens on September 14, 2023, and closes on September 18, 2023.

| IPO Open Date | Thursday, September 14, 2023 |

| IPO Close Date | Monday, September 18, 2023 |

| Basis of Allotment | Friday, September 22, 2023 |

| Initiation of Refunds | Monday, September 25, 2023 |

| Credit of Shares to Demat | Tuesday, September 26, 2023 |

| Listing Date | Friday, September 22, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 18, 2023 |

Investors can bid for a minimum of 119 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 119 | ₹14,994 |

| Retail (Max) | 13 | 1547 | ₹194,922 |

| S-HNI (Min) | 14 | 1,666 | ₹209,916 |

| S-HNI (Max) | 66 | 7,854 | ₹989,604 |

| B-HNI (Min) | 67 | 7,973 | ₹1,004,598 |

| Lot Size Calculator | |||

Incorporated in 2010, SAMHI Hotels Limited is a branded hotel ownership and asset management platform in India.

SAMHI Hotels has a portfolio of 4,801 keys across 31 operating hotels in 14 of India's key urban consumption centers, including Bengaluru, Karnataka; Hyderabad, Telangana; National Capital Region (NCR); Pune, Maharashtra; Chennai, Tamil Nadu; and Ahmedabad, Gujarat as of March 31, 2023. The company also has 2 hotels under development with a total of 461 keys in Kolkata and Navi Mumbai.

On August 10, 2023, the company acquired Asiya Capital and the ACIC SPVs (the ACIC SSPA) which gained the company an additional 962 keys across six operating hotels and land for the development of a hotel in Navi Mumbai, Maharashtra.

SAMHI's hotels operate under well-recognized hotel operators such as Courtyard by Marriott, Sheraton, Hyatt Regency, Hyatt Place, Fairfield by Marriott, Four Points by Sheraton, and Holiday Inn Express, which provide its hotels' access to the operator's loyalty programs, management and operational expertise, industry best practices, online reservation systems, and marketing strategies.

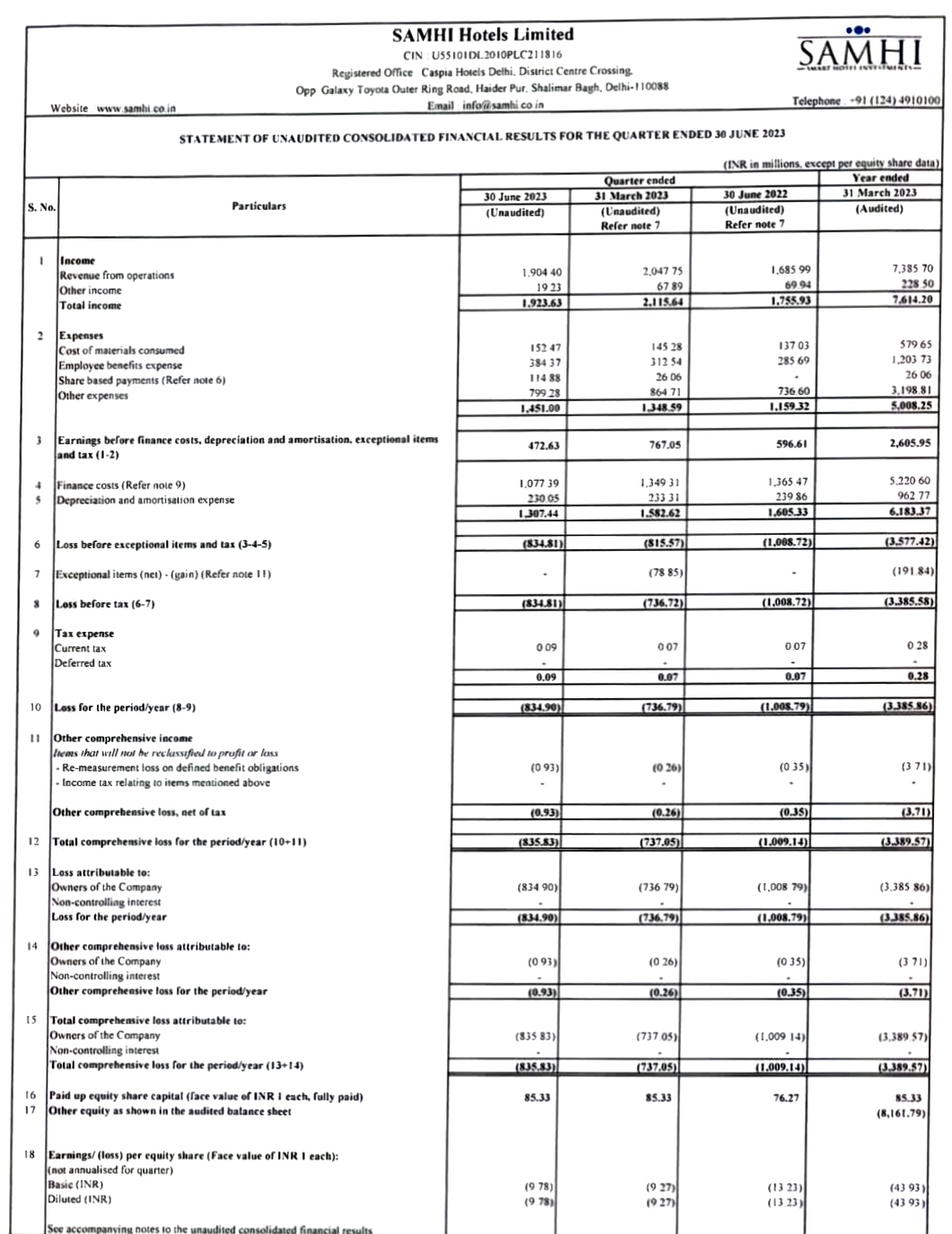

| Period Ended | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 2,488.00 | 2,386.58 | 2,263.00 |

| Revenue | 179.25 | 333.10 | 761.42 |

| Profit After Tax | -477.73 | -443.25 | -338.59 |

| Net Worth | -259.28 | -702.63 | -871.43 |

| Reserves and Surplus | -203.12 | -646.47 | -816.18 |

| Total Borrowing | 2,424.40 | 2,597.69 | 2,787.54 |

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

[Dilip Davda] The company is trying to encase its brand value with many premium brands. It has been posting losses for all these years so far and has a negative NAV. No doubt, we are witnessing fancy for the hospitality sector post-Covid, and this company may attract more investors once it turns the corner. However, well-informed/cash surplus/risk seeker investors may park moderate funds for long-term rewards. Read detail review...

The SAMHI Hotels IPO is subscribed 5.57 times on September 18, 2023 7:02:00 PM. The public issue subscribed 1.17 times in the retail category, 9.18 times in the QIB category, and 1.29 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 9.18 |

| NII | 1.29 |

| bNII (bids above ₹10L) | 1.42 |

| sNII (bids below ₹10L) | 1.02 |

| Retail | 1.17 |

| Total | 5.57 |

Total Application : 90,561 (0.99 times)

| Listing Date | September 22, 2023 |

| BSE Script Code | 543984 |

| NSE Symbol | SAMHI |

| ISIN | INE08U801020 |

| Final Issue Price | ₹126 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹126.00 |

| ₹130.55 |

| ₹127.45 |

| ₹146.45 |

| ₹143.55 |

| NSE |

|---|

| ₹126.00 |

| ₹134.50 |

| ₹127.25 |

| ₹146.60 |

| ₹143.40 |

SAMHI Hotels Limited

Caspia Hotels Delhi, District Centre Crossing,

Opposite Galaxy Toyota, Outer Ring Road,

Haider Pur, Shalimar Bagh, New Delhi - 110 088

Phone: +91 124 4910 100

Email: compliance@samhi.co.in

Website: https://www.samhi.co.in/index.php

Kfin Technologies Limited

Phone: 04067162222, 04079611000

Email: samhihotels.ipo@kfintech.com

Website: https://kosmic.kfintech.com/ipostatus/

SAMHI Hotels IPO is a main-board IPO of 108,738,095 equity shares of the face value of ₹1 aggregating up to ₹1,370.10 Crores. The issue is priced at ₹119 to ₹126 per share. The minimum order quantity is 119 Shares.

The IPO opens on September 14, 2023, and closes on September 18, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in SAMHI Hotels IPO using UPI as a payment gateway. Zerodha customers can apply in SAMHI Hotels IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in SAMHI Hotels IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The SAMHI Hotels IPO opens on September 14, 2023 and closes on September 18, 2023.

SAMHI Hotels IPO lot size is 119 Shares, and the minimum amount required is ₹14,994.

You can apply in SAMHI Hotels IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for SAMHI Hotels IPO will be done on Friday, September 22, 2023, and the allotted shares will be credited to your demat account by Tuesday, September 26, 2023. Check the SAMHI Hotels IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|