Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Prudent Corporate Advisory Services IPO is a book built issue of Rs 538.61 crores. The issue is entirely an offer for sale of 0.85 crore shares.

Prudent Corporate Advisory Services IPO bidding started from May 10, 2022 and ended on May 12, 2022. The allotment for Prudent Corporate Advisory Services IPO was finalized on Wednesday, May 18, 2022. The shares got listed on BSE, NSE on May 20, 2022.

Prudent Corporate Advisory Services IPO price band is set at ₹595 to ₹630 per share. The minimum lot size for an application is 23 Shares. The minimum amount of investment required by retail investors is ₹14,490.

The issue includes a reservation of up to 113,835 shares for employees offered at a discount of Rs 59 to the issue price.

ICICI Securities Limited, Axis Capital Limited and Equirus Capital Private Limited are the book running lead managers of the Prudent Corporate Advisory Services IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Prudent Corporate Advisory Services IPO RHP for detailed information.

| IPO Date | May 10, 2022 to May 12, 2022 |

| Listing Date | May 20, 2022 |

| Face Value | ₹5 per share |

| Price Band | ₹595 to ₹630 per share |

| Lot Size | 23 Shares |

| Total Issue Size | 8,549,340 shares (aggregating up to ₹538.61 Cr) |

| Offer for Sale | 8,549,340 shares of ₹5 (aggregating up to ₹538.61 Cr) |

| Employee Discount | Rs 59 per share |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 41,406,680 |

| Share holding post issue | 41,406,680 |

Prudent Corporate Advisory Services IPO offers 6,018,689 shares. 1,687,101 (28.03%) to QIB, 1,265,326 (21.02%) to NII, 2,952,427 (49.05%) to RII, 113,835 (1.89%) to employees. 128,366 RIIs will receive minimum 23 shares and (sNII) and (bNII) will receive minimum 322 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | - | NA |

| QIB Shares Offered | 1,687,101 (28.03%) | NA |

| NII (HNI) Shares Offered | 1,265,326 (21.02%) | |

| Retail Shares Offered | 2,952,427 (49.05%) | 128,366 |

| Employee Shares Offered | 113,835 (1.89%) | NA |

| Total Shares Offered | 6,018,689 (100%) |

Prudent Corporate Advisory Services IPO opens on May 10, 2022, and closes on May 12, 2022.

| IPO Open Date | Tuesday, May 10, 2022 |

| IPO Close Date | Thursday, May 12, 2022 |

| Basis of Allotment | Wednesday, May 18, 2022 |

| Initiation of Refunds | Thursday, May 19, 2022 |

| Credit of Shares to Demat | Friday, May 20, 2022 |

| Listing Date | Friday, May 20, 2022 |

| Cut-off time for UPI mandate confirmation | 5 PM on May 12, 2022 |

Investors can bid for a minimum of 23 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 23 | ₹14,490 |

| Retail (Max) | 13 | 299 | ₹188,370 |

| Lot Size Calculator | |||

Sanjay Shah is the company promoter.

| Share Holding Pre Issue | 56.78% |

| Share Holding Post Issue | 56.78% |

Incorporated in 2003, Prudent Corporate Advisory Services Limited provides retail wealth management services. The company offers Mutual Fund products, Life and General Insurance solutions, Stock Broking services, SIP with Insurance, Gold Accumulation Plan, Asset Allocation, and Trading platforms.

The company offers digital wealth management (DWM) solutions through platforms, namely, FundzBazar, PrudentConnect, Policyworld, WiseBasket and CreditBasket.

Prudent Corporate Advisory Services provides investment and financial services platforms for the distribution of financial products through online and offline channels. Prudent Corporate Advisory Services is amongst the top 10 mutual fund distributors in terms of average assets under management AUM as of FY21.

As of December 31, 2021, Prudent Corporate Advisory Services provided wealth management services to 13,51,274 unique retail investors through 23,262 channel partners on the business-to-business-to-consumer (B2B2C) network, which is spread across 110 branches in 20 Indian states. The company is also associated as a distributor with 42 AMCs.

Prudent Corporate Advisory Services Limited is one of India's leading independent and fastest-growing financial services groups. The company has built a nationwide network, servicing 16,356 PIN codes. Prudent Corporate Advisory Services has 1,067 employees strength, 35.05 lakhs live folios and 15.25 lakhs live SIPs as of December 31, 2021.

Competitive Strengths:

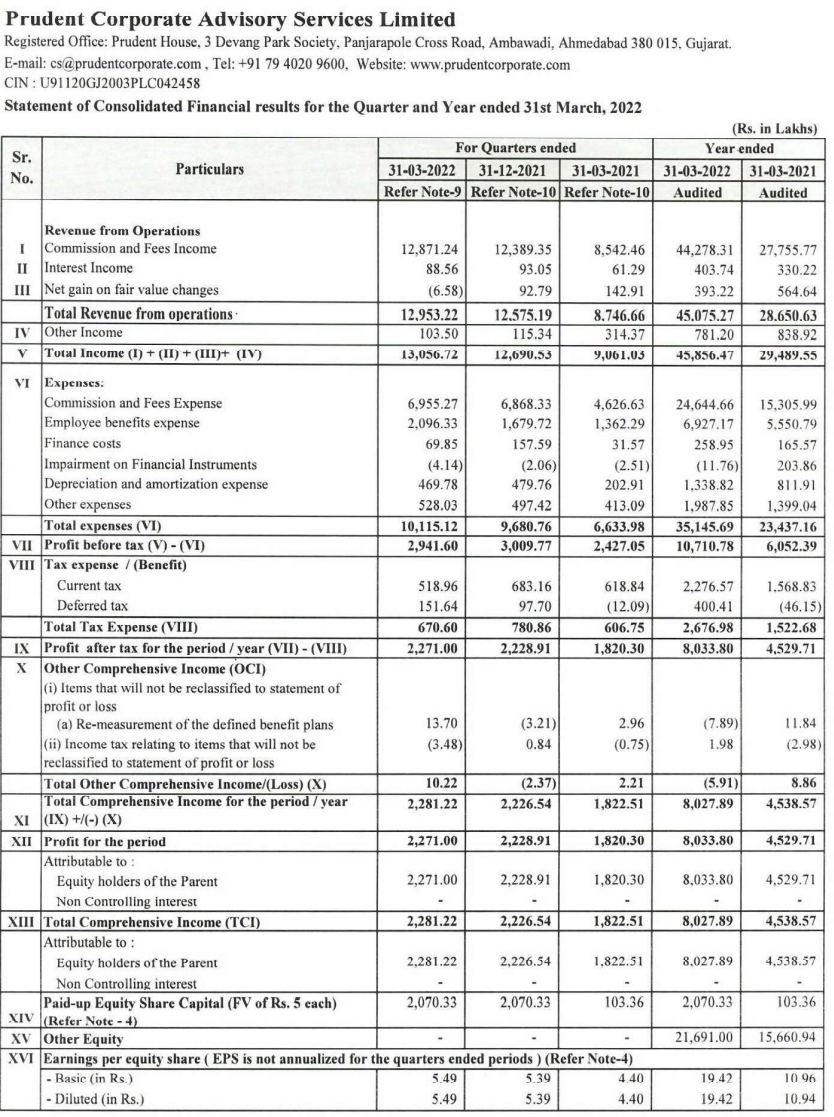

| Particulars | For the year/period ended (₹ in million) | ||||

|---|---|---|---|---|---|

| 31-Dec-21 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | ||

| Total Assets | 3,873.40 | 2,849.30 | 1,960.75 | 1,932.15 | |

| Total Revenue | 3,279.98 | 2,948.96 | 2,362.20 | 2,250.58 | |

| Profit After Tax | 576.28 | 452.97 | 278.53 | 210.19 | |

The market capitalization of Prudent Corporate Advisory Services IPO is Rs 2608.62 Cr.

| Pre IPO | Post IPO | |

|---|---|---|

| P/E (x) | 33.94 |

The company will not receive any proceeds from the Offer and all such proceeds will go to the Selling Shareholders.

[Dilip Davda] PCASL is operating in a competitive field and the IPO is fully priced based on its super earnings. The sustainability of such margins in bad times raises concern as its future prospects hinge on market behaviour. Cash surplus/risk seeker investors may consider a moderate investment with a long-term perspective. Read detail review...

The Prudent Corporate Advisory Services IPO is subscribed 1.22 times on May 12, 2022 5:00:00 PM. The public issue subscribed 1.29 times in the retail category, 1.26 times in the QIB category, and 0.99 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 1.26 |

| NII | 0.99 |

| Retail | 1.29 |

| Employee | 1.23 |

| Total | 1.22 |

| Listing Date | May 20, 2022 |

| BSE Script Code | 543527 |

| NSE Symbol | PRUDENT |

| ISIN | INE00F201020 |

| Final Issue Price | ₹630 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹630.00 |

| ₹660.00 |

| ₹541.15 |

| ₹660.00 |

| ₹562.70 |

| NSE |

|---|

| ₹630.00 |

| ₹650.00 |

| ₹541.00 |

| ₹650.00 |

| ₹561.75 |

Prudent Corporate Advisory Services Limited

Prudent House, 3 Devang Park Society,

Panjarapole Cross Road,

Ambawadi, Ahmedabad-380 015

Phone: +91 79 4020 9600

Email: cs@prudentcorporate.com

Website: https://www.prudentcorporate.com/

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: prudent.ipo@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

Prudent Corporate Advisory Services IPO is a main-board IPO of 8,549,340 equity shares of the face value of ₹5 aggregating up to ₹538.61 Crores. The issue is priced at ₹595 to ₹630 per share. The minimum order quantity is 23 Shares.

The IPO opens on May 10, 2022, and closes on May 12, 2022.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in Prudent Corporate Advisory Services IPO using UPI as a payment gateway. Zerodha customers can apply in Prudent Corporate Advisory Services IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Prudent Corporate Advisory Services IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Prudent Corporate Advisory Services IPO opens on May 10, 2022 and closes on May 12, 2022.

Prudent Corporate Advisory Services IPO lot size is 23 Shares, and the minimum amount required is ₹14,490.

You can apply in Prudent Corporate Advisory Services IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Prudent Corporate Advisory Services IPO will be done on Wednesday, May 18, 2022, and the allotted shares will be credited to your demat account by Friday, May 20, 2022. Check the Prudent Corporate Advisory Services IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|