Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Paradeep Phosphates IPO is a book built issue of Rs 1,501.73 crores. The issue is a combination of fresh issue of 23.9 crore shares aggregating to Rs 1,004.00 crores and offer for sale of 11.85 crore shares aggregating to Rs 497.73 crores.

Paradeep Phosphates IPO bidding started from May 17, 2022 and ended on May 19, 2022. The allotment for Paradeep Phosphates IPO was finalized on Tuesday, May 24, 2022. The shares got listed on BSE, NSE on May 27, 2022.

Paradeep Phosphates IPO price band is set at ₹39 to ₹42 per share. The minimum lot size for an application is 350 Shares. The minimum amount of investment required by retail investors is ₹14,700.

Axis Capital Limited, ICICI Securities Limited, Jm Financial Limited and SBI Capital Markets Limited are the book running lead managers of the Paradeep Phosphates IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Paradeep Phosphates IPO RHP for detailed information.

| IPO Date | May 17, 2022 to May 19, 2022 |

| Listing Date | May 27, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹39 to ₹42 per share |

| Lot Size | 350 Shares |

| Total Issue Size | 357,555,112 shares (aggregating up to ₹1,501.73 Cr) |

| Fresh Issue | 239,047,619 shares (aggregating up to ₹1,004.00 Cr) |

| Offer for Sale | 118,507,493 shares of ₹10 (aggregating up to ₹497.73 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 575,450,000 |

| Share holding post issue | 814,497,619 |

Paradeep Phosphates IPO offers 268,676,858 shares. 80,705,162 (30.04%) to QIB, 56,391,509 (20.99%) to NII, 131,580,187 (48.97%) to RII. 375,943 RIIs will receive minimum 350 shares and (sNII) and (bNII) will receive minimum 4,900 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | - | NA |

| QIB Shares Offered | 80,705,162 (30.04%) | NA |

| NII (HNI) Shares Offered | 56,391,509 (20.99%) | |

| Retail Shares Offered | 131,580,187 (48.97%) | 375,943 |

| Total Shares Offered | 268,676,858 (100%) |

Paradeep Phosphates IPO opens on May 17, 2022, and closes on May 19, 2022.

| IPO Open Date | Tuesday, May 17, 2022 |

| IPO Close Date | Thursday, May 19, 2022 |

| Basis of Allotment | Tuesday, May 24, 2022 |

| Initiation of Refunds | Wednesday, May 25, 2022 |

| Credit of Shares to Demat | Thursday, May 26, 2022 |

| Listing Date | Friday, May 27, 2022 |

| Cut-off time for UPI mandate confirmation | 5 PM on May 19, 2022 |

Investors can bid for a minimum of 350 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 350 | ₹14,700 |

| Retail (Max) | 13 | 4550 | ₹191,100 |

| Lot Size Calculator | |||

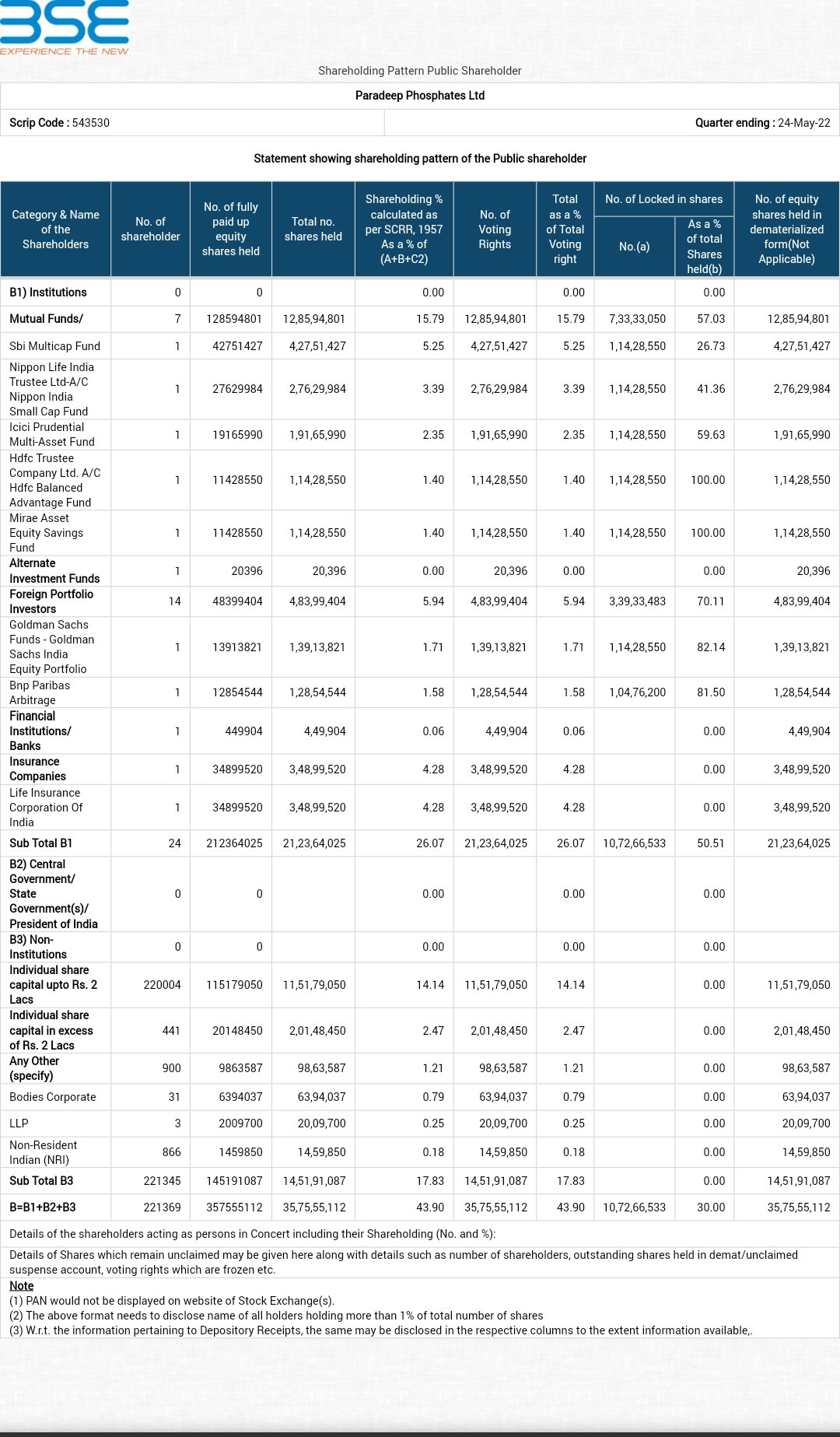

Zuari Maroc Phosphates Private Limited, Zuari Agro Chemicals Limited, OCP S.A and President of India, acting through the Ministry of Chemicals and Fertilizers, Government of India are the company promoters.

| Share Holding Pre Issue | 100% |

| Share Holding Post Issue |

Incorporated in 1981, Paradeep Phosphates Limited is a manufacturer of non-urea fertilizers in India. The company is engaged in manufacturing, trading, distribution and sales of a variety of complex fertilizers such as DAP, three grades of Nitrogen-Phosphorus-Potassium (namely NPK-10, NPK-12 and NP-20), Zypmite, Phospho-gypsum and Hydroflorosilicic Acid.

Paradeep Phosphates Limited is the second largest private sector manufacturer of non-urea fertilizers and Di-Ammonium Phosphate(DAP) in terms of volume sales for the nine months ended December 31, 2021. The company's fertilisers are marketed under the brand names Jai Kisaan-Navratna and Navratna.

The manufacturing facility of Paradeep Phosphates Limited is located in Paradeep, Odisha, and includes a DAP and NPK production facility, a Sulphuric acid production plant and a Phosphoric acid production plant. The facility can store up to 120,000 MT, 65,000 MT, 55,000 MT and 35,000 MT of Phosphate Rock, Phosphoric acid, Sulphur and MOP, respectively.

The company established an extensive sales and distribution network, with a strong presence in the eastern part of India. As of March 31, 2022, Paradeep Phosphates distributed products across 14 states in India through the network of 11 regional marketing offices and 468 stock points.

As of March 31, 2022, the company's network includes 4,761 dealers and over 67,150 retailers serving over five million farmers in India.

Competitive Strengths

| Particulars | For the year/period ended (₹ in Millions) | ||||

|---|---|---|---|---|---|

| 31-Dec-21 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | ||

| Total Assets | 71,862.67 | 44,231.67 | 50,103.25 | 56,276.58 | |

| Total Revenue | 59,736.88 | 51,839.41 | 42,277.76 | 43,972.13 | |

| Profit After Tax | 3,627.84 | 2,232.68 | 1,932.20 | 1,589.63 | |

The market capitalization of Paradeep Phosphates IPO is Rs 3420.89 Cr.

| Pre IPO | Post IPO | |

|---|---|---|

| P/E (x) | 7.07 |

The net proceeds of the Fresh Issue are proposed to be utilised in the following manner:

[Dilip Davda] PPL is the second-largest non-urea fertiliser manufacturer in the country. Considering the primary thrust on the agriculture segment by the Government, this company is poised for bright prospects in the future. The issue is too reasonably priced and is worth considering for medium to long term rewards. Read detail review...

The Paradeep Phosphates IPO is subscribed 1.75 times on May 19, 2022 5:00:00 PM. The public issue subscribed 1.37 times in the retail category, 3.01 times in the QIB category, and 0.82 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 3.01 |

| NII | 0.82 |

| Retail | 1.37 |

| Total | 1.75 |

| Listing Date | May 27, 2022 |

| BSE Script Code | 543530 |

| NSE Symbol | PARADEEP |

| ISIN | INE088F01024 |

| Final Issue Price | ₹42 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹42.00 |

| ₹43.55 |

| ₹42.95 |

| ₹47.25 |

| ₹43.95 |

| NSE |

|---|

| ₹42.00 |

| ₹44.00 |

| ₹43.00 |

| ₹47.25 |

| ₹43.90 |

Paradeep Phosphates Limited

5 th Floor, Orissa State Handloom Weavers'

Co-Operative Building, Pandit J.N Marg,

Bhubaneswar 751 001,

Phone: +91 080 45855561

Email: cs.ppl@adventz.com

Website: http://www.paradeepphosphates.com/

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: ppl.ipo@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

Paradeep Phosphates IPO is a main-board IPO of 357,555,112 equity shares of the face value of ₹10 aggregating up to ₹1,501.73 Crores. The issue is priced at ₹39 to ₹42 per share. The minimum order quantity is 350 Shares.

The IPO opens on May 17, 2022, and closes on May 19, 2022.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in Paradeep Phosphates IPO using UPI as a payment gateway. Zerodha customers can apply in Paradeep Phosphates IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Paradeep Phosphates IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Paradeep Phosphates IPO opens on May 17, 2022 and closes on May 19, 2022.

Paradeep Phosphates IPO lot size is 350 Shares, and the minimum amount required is ₹14,700.

You can apply in Paradeep Phosphates IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Paradeep Phosphates IPO will be done on Tuesday, May 24, 2022, and the allotted shares will be credited to your demat account by Thursday, May 26, 2022. Check the Paradeep Phosphates IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Co. informs that, the operations of Ammonia and Urea Plants of the Company at Goa, have resumed operations after the annual maintenance activities.