Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Bondada Engineering IPO is a fixed price issue of Rs 42.72 crores. The issue is entirely a fresh issue of 56.96 lakh shares.

Bondada Engineering IPO bidding started from August 18, 2023 and ended on August 22, 2023. The allotment for Bondada Engineering IPO was finalized on Friday, August 25, 2023. The shares got listed on BSE SME on August 30, 2023.

Bondada Engineering IPO price is ₹75 per share. The minimum lot size for an application is 1600 Shares. The minimum amount of investment required by retail investors is ₹120,000. The minimum lot size investment for HNI is 2 lots (3,200 shares) amounting to ₹240,000.

Vivro Financial Services Private Limited is the book running lead manager of the Bondada Engineering IPO, while Kfin Technologies Limited is the registrar for the issue. The market maker for Bondada Engineering IPO is Rikhav Securities.

Refer to Bondada Engineering IPO RHP for detailed information.

| IPO Date | August 18, 2023 to August 22, 2023 |

| Listing Date | August 30, 2023 |

| Face Value | ₹10 per share |

| Price | ₹75 per share |

| Lot Size | 1600 Shares |

| Total Issue Size | 5,696,000 shares (aggregating up to ₹42.72 Cr) |

| Fresh Issue | 5,696,000 shares (aggregating up to ₹42.72 Cr) |

| Issue Type | Fixed Price Issue IPO |

| Listing At | BSE SME |

| Share holding pre issue | 15,906,059 |

| Share holding post issue | 21,602,059 |

| Market Maker portion | 288,000 shares Rikhav Securities |

Bondada Engineering IPO offers 5,696,000 shares. 2,704,000 (47.47%) to NII, 2,704,000 (47.47%) to RII.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | - |

| Market Maker Shares Offered | 288,000 (5.06%) |

| Other Shares Offered | 2,704,000 (47.47%) |

| Retail Shares Offered | 2,704,000 (47.47%) |

| Total Shares Offered | 5,696,000 (100%) |

Bondada Engineering IPO opens on August 18, 2023, and closes on August 22, 2023.

| IPO Open Date | Friday, August 18, 2023 |

| IPO Close Date | Tuesday, August 22, 2023 |

| Basis of Allotment | Friday, August 25, 2023 |

| Initiation of Refunds | Monday, August 28, 2023 |

| Credit of Shares to Demat | Tuesday, August 29, 2023 |

| Listing Date | Wednesday, August 30, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 22, 2023 |

Investors can bid for a minimum of 1600 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹120,000 |

| Retail (Max) | 1 | 1600 | ₹120,000 |

| HNI (Min) | 2 | 3,200 | ₹240,000 |

| Lot Size Calculator | |||

Raghavendra Rao Bondada, Neelima Bondada and Satyanarayana Baratam are the promoters of the company.

| Share Holding Pre Issue | 86.00% |

| Share Holding Post Issue | 63.33% |

Incorporated in 2012, Bondada Engineering Limited provides engineering, procurement, and construction (EPC) services and operations and maintenance (O&M) services to companies operating in the telecom and solar energy industry.

The company provides passive telecom infrastructure services which include cell site construction, erection, operation, and maintenance of telecom towers with civil, electrical, and mechanical works; supply of poles and towers, laying and maintenance of optical fiber cables, supply of power equipment and other telecom infrastructure related services to major telecom companies and telecom tower operators in India. The company has installed over 11,600 telecom towers and poles out of which, 7,700 telecom towers and poles were installed in the last three fiscal.

Bondada Engineering also provides O&M services to telecom and tower operating companies such as cell site maintenance with preventive and corrective maintenance of passive infrastructure and equipment, backup power systems, manning services and supply of riggers, surveillance, and corrective maintenance of optical fiber cable routes and other maintenance related facilities.

Bondada's manufacturing facility is located in Keesara Mandal, Medchal, Telangana, with an installation capacity of ~12 thousand MTPA for tower fabrication.

The company has over 550 employees.

| Period Ended | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 17,091.69 | 15,761.73 | 25,115.46 |

| Revenue | 28,832.29 | 33,420.96 | 37,095.77 |

| Profit After Tax | 920.55 | 1,013.53 | 1,825.19 |

| Net Worth | 4,775.88 | 5,789.41 | 7,837.54 |

| Reserves and Surplus | 4,693.88 | 5,707.41 | 6,246.93 |

| Total Borrowing | 4,667.31 | 3,803.23 | 8,422.65 |

The market capitalization of Bondada Engineering IPO is Rs 162.02 Cr.

| KPI | Values |

|---|---|

| ROE | 22.77% |

| ROCE | 35.63% |

| Debt/Equity | 1.07 |

| RoNW | 22.77% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 11.43 | |

| P/E (x) | 6.56 |

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

[Dilip Davda] BEL is engaged in an integrated infrastructure segment with EPS and OM services. It has posted steady growth in its top and bottom lines and has an order book worth Rs. 1520 as of March 31, 2023. Based on FY23 earnings, the issue is lucratively priced. Investors may consider parking funds for medium to long-term rewards. Read detail review...

The Bondada Engineering IPO is subscribed 112.28 times on August 22, 2023 7:02:00 PM. The public issue subscribed 100.05 times in the retail category, times in the QIB category, and 115.46 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| Other | 115.46 |

| Retail | 100.05 |

| Total | 112.28 |

Total Application : 146,586 (86.74 times)

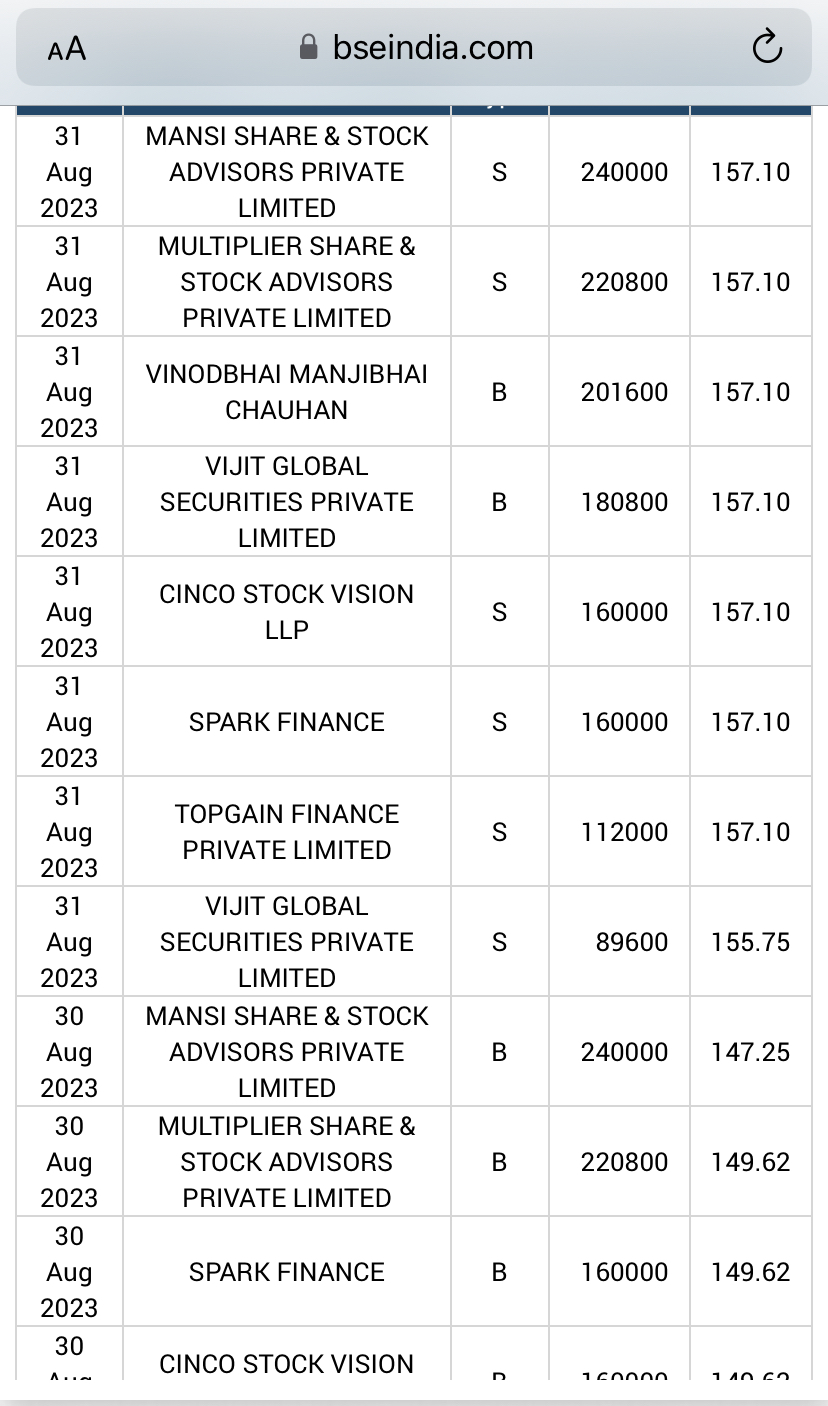

| Listing Date | August 30, 2023 |

| BSE Script Code | 543971 |

| NSE Symbol | |

| ISIN | INE0Q8P01011 |

| Final Issue Price | ₹75 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE SME |

|---|

| ₹75.00 |

| ₹142.50 |

| ₹142.50 |

| ₹149.62 |

| ₹149.62 |

Bondada Engineering Limited

1-1-27/37,

Ashok Manoj Nagar Kapra,

Hyderabad - 500062

Phone: +91 72070 34662

Email: cs@bondada.net

Website: https://bondada.net/

Kfin Technologies Limited

Phone: 04067162222, 04079611000

Email: bel.ipo@kfintech.com

Website: https://kosmic.kfintech.com/ipostatus/

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Bondada Engineering IPO is a SME IPO of 5,696,000 equity shares of the face value of ₹10 aggregating up to ₹42.72 Crores. The issue is priced at ₹75 per share. The minimum order quantity is 1600 Shares.

The IPO opens on August 18, 2023, and closes on August 22, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE SME.

Zerodha customers can apply online in Bondada Engineering IPO using UPI as a payment gateway. Zerodha customers can apply in Bondada Engineering IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Bondada Engineering IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Bondada Engineering IPO opens on August 18, 2023 and closes on August 22, 2023.

Bondada Engineering IPO lot size is 1600 Shares, and the minimum amount required is ₹120,000.

You can apply in Bondada Engineering IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Bondada Engineering IPO will be done on Friday, August 25, 2023, and the allotted shares will be credited to your demat account by Tuesday, August 29, 2023. Check the Bondada Engineering IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|