Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

BLS E-Services IPO is a book built issue of Rs 310.91 crores. The issue is entirely a fresh issue of 2.3 crore shares.

BLS E-Services IPO bidding started from January 30, 2024 and ended on February 1, 2024. The allotment for BLS E-Services IPO was finalized on Friday, February 2, 2024. The shares got listed on BSE, NSE on February 6, 2024.

BLS E-Services IPO price band is set at ₹129 to ₹135 per share. The minimum lot size for an application is 108 Shares. The minimum amount of investment required by retail investors is ₹14,580. The minimum lot size investment for sNII is 14 lots (1,512 shares), amounting to ₹204,120, and for bNII, it is 69 lots (7,452 shares), amounting to ₹1,006,020.

Unistone Capital Pvt Ltd is the book running lead manager of the BLS E-Services IPO, while Kfin Technologies Limited is the registrar for the issue.

Refer to BLS E-Services IPO RHP for detailed information.

| IPO Date | January 30, 2024 to February 1, 2024 |

| Listing Date | February 6, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹129 to ₹135 per share |

| Lot Size | 108 Shares |

| Total Issue Size | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Fresh Issue | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 66,726,485 |

| Share holding post issue | 89,756,485 |

BLS E-Services IPO offers 23,030,000 shares. 6,218,154 (27.00%) to QIB, 3,109,050 (13.50%) to NII, 2,072,700 (9.00%) to RII and 9,327,096 (40.50%) to Anchor investors. 19,191 RIIs will receive minimum 108 shares and 685 (sNII) and 1,370 (bNII) will receive minimum 1,512 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 9,327,096 (40.50%) | NA |

| QIB Shares Offered | 6,218,154 (27.00%) | NA |

| NII (HNI) Shares Offered | 3,109,050 (13.50%) | |

| bNII > ₹10L | 2,072,700 (9.00%) | 1,370 |

| sNII < ₹10L | 1,036,350 (4.50%) | 685 |

| Retail Shares Offered | 2,072,700 (9.00%) | 19,191 | Other Shares Offered | 2,303,000 (10.00%) | NA |

| Total Shares Offered | 23,030,000 (100%) |

BLS E-Services IPO raises Rs 125.92 crore from anchor investors. BLS E-Services IPO Anchor bid date is January 29, 2024. BLS E-Services IPO Anchor Investors list

| Bid Date | January 29, 2024 |

| Shares Offered | 9,327,096 |

| Anchor Portion Size (In Cr.) | 125.92 |

| Anchor lock-in period end date for 50% shares (30 Days) | March 3, 2024 |

| Anchor lock-in period end date for remaining shares (90 Days) | May 2, 2024 |

BLS E-Services IPO opens on January 30, 2024, and closes on February 1, 2024.

| IPO Open Date | Tuesday, January 30, 2024 |

| IPO Close Date | Thursday, February 1, 2024 |

| Basis of Allotment | Friday, February 2, 2024 |

| Initiation of Refunds | Monday, February 5, 2024 |

| Credit of Shares to Demat | Monday, February 5, 2024 |

| Listing Date | Tuesday, February 6, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 1, 2024 |

Investors can bid for a minimum of 108 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 108 | ₹14,580 |

| Retail (Max) | 13 | 1404 | ₹189,540 |

| S-HNI (Min) | 14 | 1,512 | ₹204,120 |

| S-HNI (Max) | 68 | 7,344 | ₹991,440 |

| B-HNI (Min) | 69 | 7,452 | ₹1,006,020 |

| Lot Size Calculator | |||

The promoter of the company is BLS International Services Limited

| Share Holding Pre Issue | 93.80% |

| Share Holding Post Issue | 68.90% |

Incorporated in April 2016, BLS-E Services Limited is a digital service provider that offers Business Correspondence services to major banks in India, Assisted E-Services, and E-Governance Services at the grassroots level in India.

The company's service offerings can be categorized into three parts (i) Business Correspondents Services; (ii) Assisted E-services; and (iii) E-Governance Services.

The company being a subsidiary of BLS International Services Limited provides visa, passport, consular, and other citizen services to state and provincial governments across Asia, Africa, Europe, South America, North America, and the Middle East through its technology-enabled platform. It is the only listed company engaged in this domain in India.

By 31st March 2023, the merchant network had grown to 92,427 in order to serve the underserved and unserved populations in hard-to-reach areas.

The revenue from operations in Fiscal years 2021, 2022 and 2023 were ₹6,448.72 lakhs, ₹9,669.82 lakhs and ₹24,306.07 lakhs, respectively.

As of June 30, 2023, the company has a total of 3,071 employees, including 2,413 contract employees.

BLS E-Services Limited's revenue increased by 150.31% and profit after tax (PAT) rose by 277.94% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 30 Sep 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 213.77 | 179.47 | 55.93 | 40.59 |

| Revenue | 158.05 | 246.29 | 98.40 | 65.23 |

| Profit After Tax | 14.68 | 20.33 | 5.38 | 3.15 |

| Net Worth | 120.37 | 106.94 | 15.07 | 9.68 |

| Total Borrowing | 0.00 | 0.00 | 8.76 | 11.02 |

| Amount in ₹ Crore | ||||

The market capitalization of BLS E-Services IPO is Rs 1226.56 Cr.

| KPI | Values |

|---|---|

| ROE | 33.33% |

| ROCE | 30.62% |

| Debt/Equity | 0.05 |

| RoNW | 16.46% |

| P/BV | 7.2 |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 3.05 | 2.24 |

| P/E (x) | 44.31 | 60.33 |

The company proposes to utilise the Net Proceeds towards funding the following objects:

[Dilip Davda] BEL is a one-point technology enabled digital service provider and providing almost all related services under one roof. Considering “Digital India” move by the government, this company has very bright prospects going forward. Based on annualized FY24 earnings, though the issue appears fully priced, it has bright prospects ahead with major infra in place. Investors may park funds for the medium to long term rewards. Read detail review...

The BLS E-Services IPO is subscribed 162.38 times on February 1, 2024 7:02:00 PM. The public issue subscribed 236.53 times in the retail category, 123.30 times in the QIB category, and 300.05 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 123.30 |

| NII | 300.05 |

| bNII (bids above ₹10L) | 305.27 |

| sNII (bids below ₹10L) | 289.59 |

| Retail | 236.53 |

| Others | 15.30 |

| Total | 162.38 |

Total Application : 3,961,160 (206.41 times)

Investors holding shares of BLS E-Services as of January 23, 2024 (the date of filing of the RHP with SEBI) are eligible to apply in the shareholder category of the BLS E-Services IPO. BLS International shareholders reservation portion of up to 23,03,000 Equity Shares available for allocation to BLS International Shareholders, on a proportionate basis. As per the RHP:

1. BLS E-Services shareholders holding more than and up to Rs 2 Lakh are eligible to apply for the SH category.

2. BLS E-Services shareholders (bidding up to Rs 2 lakhs) are also eligible to apply in the Retail Category.

3. Maximum Subscription Amount for Retail Investor & BLS International Shareholders Category is Rs. 2,00,000.

4. If you are a shareholder of BLS International as of January 23, 2024, you can apply under the BLS shareholder category up to Rs. 2,00,000.

5. To clarify, you can apply in the retail category up to Rs 2 lakhs and also in the BLS shareholder category up to Rs 2 lakhs. Similarly, you can apply in the S-HNI category over Rs 2 lakhs and also in the BLS International Reservation up to Rs 2 lakhs. You can apply either in the Retail category along with the BLS shareholder category or the SHNI category along with the BLS shareholder category.

6. Applicants in the BLS E-Services Shareholders Reservation Portion who bid up to Rs 200,000 are allowed to bid at the Cut-off Price.

Note: In the BLS International Shareholder Reservation, there is an upfront discount of Rs 7 and bids of 14 lots are allowed at the upper limit. However, due to lack of clarification to the bankers, many banks are not allowing 14 lots under this category.

| Listing Date | February 6, 2024 |

| BSE Script Code | 544107 |

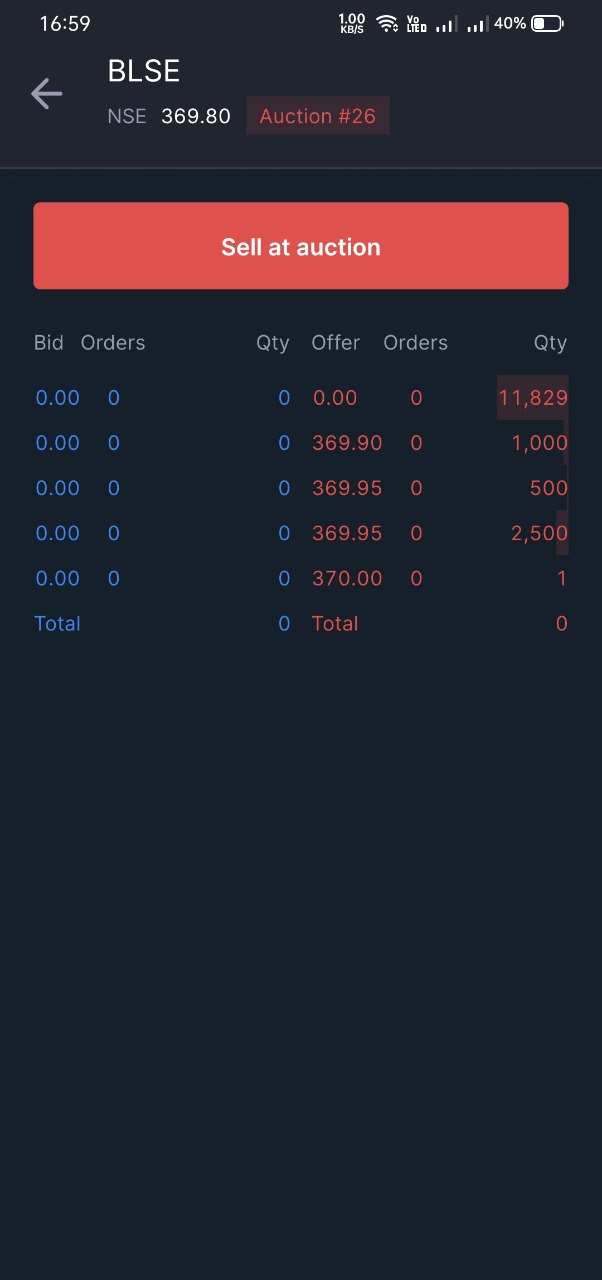

| NSE Symbol | BLSE |

| ISIN | INE0NLT01010 |

| Final Issue Price | ₹135 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹135.00 |

| ₹309.00 |

| ₹302.75 |

| ₹370.75 |

| ₹370.75 |

| NSE |

|---|

| ₹135.00 |

| ₹305.00 |

| ₹303.10 |

| ₹366.00 |

| ₹366.00 |

BLS E-Services Limited

G-4B-1, Extension, Mohan Co-operative

Indl. Estate Mathura Road,

South Delhi, New Delhi – 110044, India

Phone: +91-11- 45795002

Email: cs@blseservices.com

Website: https://www.blseservices.com/

Kfin Technologies Limited

Phone: 04067162222, 04079611000

Email: mb@unistonecapital.com

Website: https://kosmic.kfintech.com/ipostatus/

BLS E-Services IPO is a main-board IPO of 23,030,000 equity shares of the face value of ₹10 aggregating up to ₹310.91 Crores. The issue is priced at ₹129 to ₹135 per share. The minimum order quantity is 108 Shares.

The IPO opens on January 30, 2024, and closes on February 1, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in BLS E-Services IPO using UPI as a payment gateway. Zerodha customers can apply in BLS E-Services IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in BLS E-Services IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The BLS E-Services IPO opens on January 30, 2024 and closes on February 1, 2024.

BLS E-Services IPO lot size is 108 Shares, and the minimum amount required is ₹14,580.

You can apply in BLS E-Services IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for BLS E-Services IPO will be done on Friday, February 2, 2024, and the allotted shares will be credited to your demat account by Monday, February 5, 2024. Check the BLS E-Services IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

They are not ready for to give any compensation.

Today I have raised complain in SEBI (SEBIE/UP24/0000484/1) with all the proofs. Lets see now I have final hope from SEBI..

Please update your status as well.