Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Aeroflex Industries IPO is a book built issue of Rs 351.00 crores. The issue is a combination of fresh issue of 1.5 crore shares aggregating to Rs 162.00 crores and offer for sale of 1.75 crore shares aggregating to Rs 189.00 crores.

Aeroflex Industries IPO bidding started from August 22, 2023 and ended on August 24, 2023. The allotment for Aeroflex Industries IPO was finalized on Tuesday, August 29, 2023. The shares got listed on BSE, NSE on August 31, 2023.

Aeroflex Industries IPO price band is set at ₹102 to ₹108 per share. The minimum lot size for an application is 130 Shares. The minimum amount of investment required by retail investors is ₹14,040. The minimum lot size investment for sNII is 15 lots (1,950 shares), amounting to ₹210,600, and for bNII, it is 72 lots (9,360 shares), amounting to ₹1,010,880.

Pantomath Capital Advisors Pvt Ltd is the book running lead manager of the Aeroflex Industries IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Aeroflex Industries IPO RHP for detailed information.

| IPO Date | August 22, 2023 to August 24, 2023 |

| Listing Date | August 31, 2023 |

| Face Value | ₹2 per share |

| Price Band | ₹102 to ₹108 per share |

| Lot Size | 130 Shares |

| Total Issue Size | 32,500,000 shares (aggregating up to ₹351.00 Cr) |

| Fresh Issue | 15,000,000 shares (aggregating up to ₹162.00 Cr) |

| Offer for Sale | 17,500,000 shares of ₹2 (aggregating up to ₹189.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding post issue | 129,320,370 |

Aeroflex Industries IPO offers 32,817,647 shares. 6,276,490 (19.13%) to QIB, 4,932,353 (15.03%) to NII, 11,508,824 (35.07%) to RII 9,599,980 (29.25%) to Anchor investors. 88,529 RIIs will receive minimum 130 shares and 843 (sNII) and 1,686 (bNII) will receive minimum 1,950 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 9,599,980 (29.25%) | NA |

| QIB Shares Offered | 6,276,490 (19.13%) | NA |

| NII (HNI) Shares Offered | 4,932,353 (15.03%) | |

| bNII > ₹10L | 3,288,236 (10.02%) | 1,686 |

| sNII < ₹10L | 1,644,117 (5.01%) | 843 |

| Retail Shares Offered | 11,508,824 (35.07%) | 88,529 | Other Shares Offered | 500,000 (1.52%) | NA |

| Total Shares Offered | 32,817,647 (100%) |

Aeroflex Industries IPO raises Rs 103.68 crore from anchor investors. Aeroflex Industries IPO Anchor bid date is August 21, 2023. Aeroflex Industries IPO Anchor Investors list

| Bid Date | August 21, 2023 |

| Shares Offered | 9,599,980 |

| Anchor Portion Size (In Cr.) | 103.68 |

| Anchor lock-in period end date for 50% shares (30 Days) | September 28, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | November 27, 2023 |

Aeroflex Industries IPO opens on August 22, 2023, and closes on August 24, 2023.

| IPO Open Date | Tuesday, August 22, 2023 |

| IPO Close Date | Thursday, August 24, 2023 |

| Basis of Allotment | Tuesday, August 29, 2023 |

| Initiation of Refunds | Wednesday, August 30, 2023 |

| Credit of Shares to Demat | Thursday, August 31, 2023 |

| Listing Date | Thursday, August 31, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 24, 2023 |

Investors can bid for a minimum of 130 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 130 | ₹14,040 |

| Retail (Max) | 14 | 1820 | ₹196,560 |

| S-HNI (Min) | 15 | 1,950 | ₹210,600 |

| S-HNI (Max) | 71 | 9,230 | ₹996,840 |

| B-HNI (Min) | 72 | 9,360 | ₹1,010,880 |

| Lot Size Calculator | |||

Sat Industries Limited and Italica Global FZC are the promoters of the company.

| Share Holding Pre Issue | 91.09% |

| Share Holding Post Issue | 66.99% |

Incorporated in 1993, Aeroflex Industries Limited, previously known as Suyog Intermediates Private Limited, manufactures and supplies environment-friendly metallic flexible flow solution products.

The company's product list includes braided hoses, unbraided hoses, solar hoses, gas hoses, vacuum hoses, braiding, interlock hoses, hose assemblies, lancing hose assemblies, jacketed hose assemblies, exhaust connectors, exhaust gas recirculation (EGR) tubes, expansion bellows, compensators, and related end fittings. As on March 31, 2023, the company recorded more than 1,700 Product SKUs (Stock Keeping Units) in its product portfolio.

Aeroflex Industries' manufacturing facility is located at Taloja, Navi Mumbai, Maharashtra, and is spread across 3,59,528 square feet of area. The facility is certified with Annex III, Module H of Directive 97/23/EC on Pressure Equipment, Management System as per ISO 9001:2015, Environmental Management System-ISO 14001:2015, ISO 45001:2015 (Occupational Health & Safety), Testing Certificate-Gas Hoses-1/2" NB Hose Assembly, NABL ISO /IEC 17025:2017, Statement of 153 Conformity for design, manufacturing, and testing of SS corrugated flexible Hose Assembly, Statement of Conformity for Quality Procedures applied standard EN ISO 10380:2012 and BS 6501-1 (E:2004), Certificate of Design Assessment required for quality management systems, environmental management systems, health and safety management systems.

The company's clientele includes distributors, fabricators, Maintenance Repair and Operations Companies (MROs), Original Equipment Manufacturers (OEMs), and companies operating in a wide range of industries.

Aeroflex recorded Rs. 2694.78 Lakhs in total revenue in Fiscal 2023 and Rs. 2409.92 Million in Fiscal 2022.

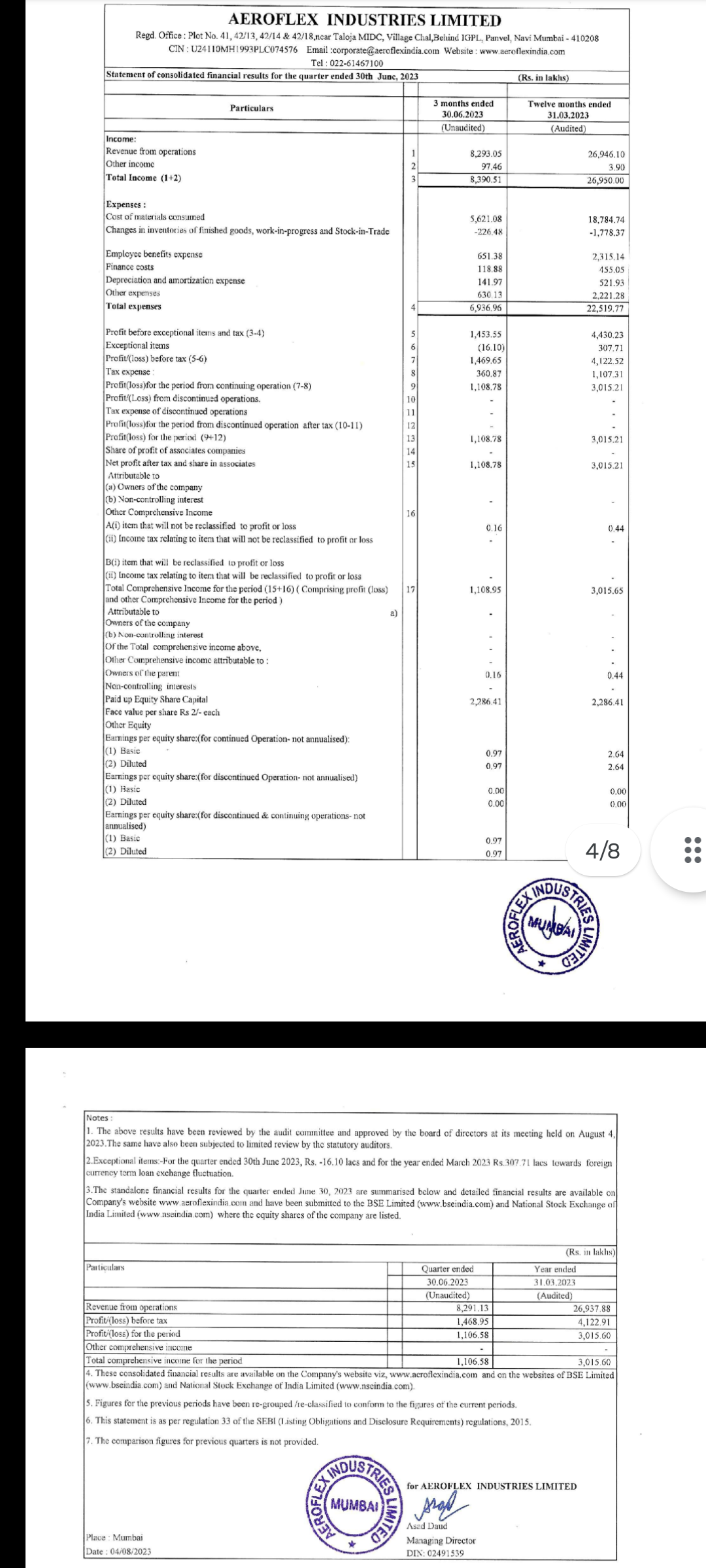

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 157.19 | 161.64 | 183.44 | 213.98 |

| Revenue | 144.94 | 144.84 | 240.99 | 269.48 |

| Profit After Tax | 4.69 | 6.01 | 27.51 | 30.15 |

| Net Worth | 52.70 | 58.72 | 86.22 | 114.09 |

| Reserves and Surplus | ||||

| Total Borrowing | 63.46 | 53.07 | 39.13 | 45.01 |

| KPI | Values |

|---|---|

| ROE | 26.43% |

| ROCE | 31.96% |

| Debt/Equity | 0.39 |

| RoNW | 26.43% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 2.64 | |

| P/E (x) | 40.91 |

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

[Dilip Davda] The company that enjoys a virtual monopoly has posted steady growth in its top and bottom lines for the reported periods. With over 80% export revenue it also has a status of EoU. It is a dividend-paying company. However, based on its working the IPO appears fully priced discounting all near-term positives. Well-informed investors may park funds for the medium to long-term rewards. Read detail review...

The Aeroflex Industries IPO is subscribed 97.11 times on August 24, 2023 7:02:00 PM. The public issue subscribed 34.41 times in the retail category, 194.73 times in the QIB category, and 126.13 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 194.73 |

| NII | 126.13 |

| bNII (bids above ₹10L) | 125.80 |

| sNII (bids below ₹10L) | 126.80 |

| Retail | 34.41 |

| Others | 28.52 |

| Total | 97.11 |

Total Application : 2,768,343 (31.27 times)

| Listing Date | August 31, 2023 |

| BSE Script Code | 543972 |

| NSE Symbol | AEROFLEX |

| ISIN | INE024001021 |

| Final Issue Price | ₹108 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹108.00 |

| ₹197.40 |

| ₹162.10 |

| ₹197.40 |

| ₹163.15 |

| NSE |

|---|

| ₹108.00 |

| ₹190.00 |

| ₹162.30 |

| ₹196.35 |

| ₹163.25 |

Aeroflex Industries Limited

Plot No. 41, 42/13, 42/14 & 42/18,

near Taloja MIDC, Village Chal, Behind IGPL,

Panvel, Navi Mumbai - 410 208

Phone: +91 22 61467100

Email: corporate@aeroflexindia.com

Website: https://www.aeroflexindia.com/

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: aeroflexindustries.ipo@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

Aeroflex Industries IPO is a main-board IPO of 32,500,000 equity shares of the face value of ₹2 aggregating up to ₹351.00 Crores. The issue is priced at ₹102 to ₹108 per share. The minimum order quantity is 130 Shares.

The IPO opens on August 22, 2023, and closes on August 24, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in Aeroflex Industries IPO using UPI as a payment gateway. Zerodha customers can apply in Aeroflex Industries IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Aeroflex Industries IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Aeroflex Industries IPO opens on August 22, 2023 and closes on August 24, 2023.

Aeroflex Industries IPO lot size is 130 Shares, and the minimum amount required is ₹14,040.

You can apply in Aeroflex Industries IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Aeroflex Industries IPO will be done on Tuesday, August 29, 2023, and the allotted shares will be credited to your demat account by Thursday, August 31, 2023. Check the Aeroflex Industries IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|