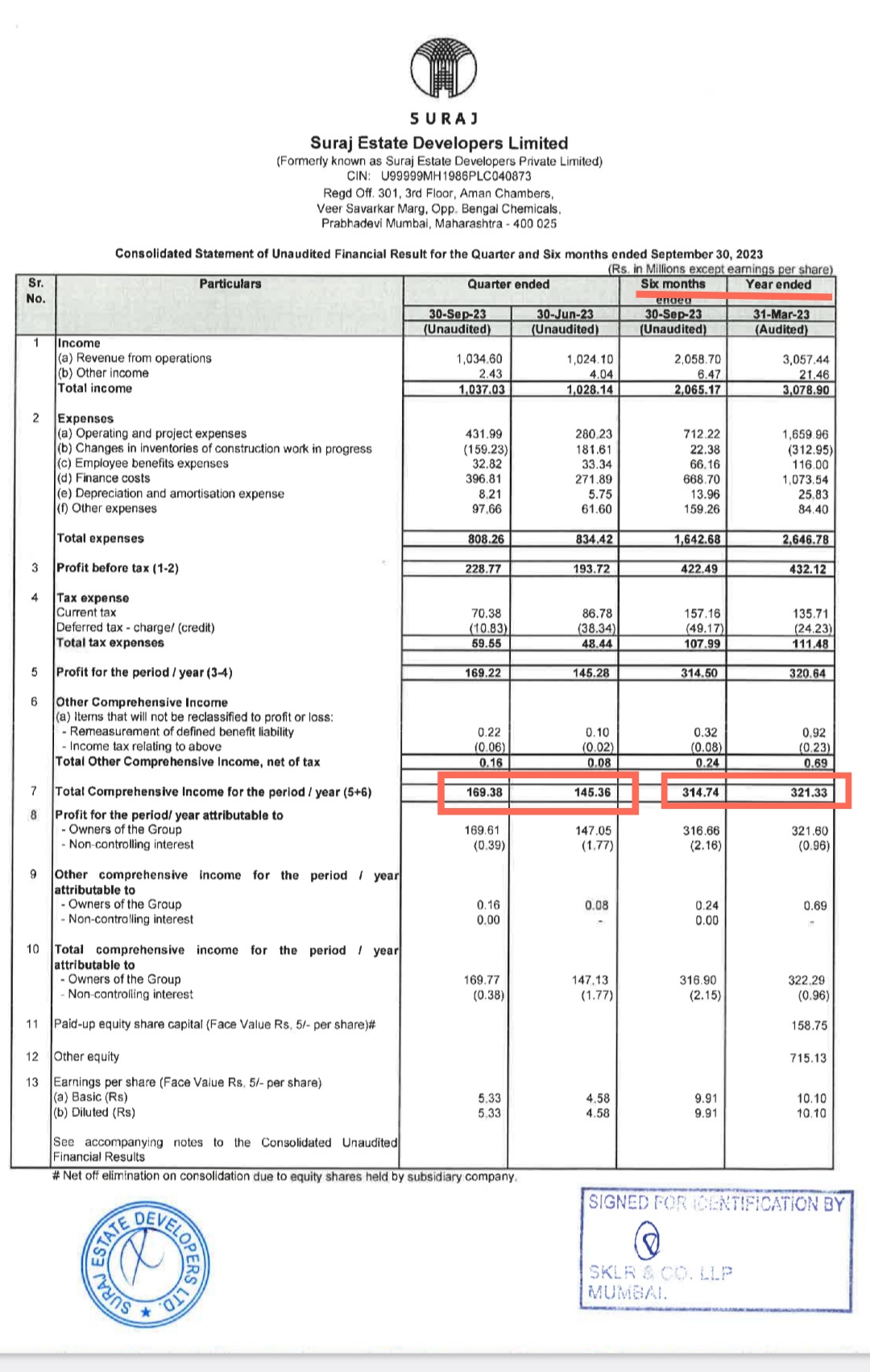

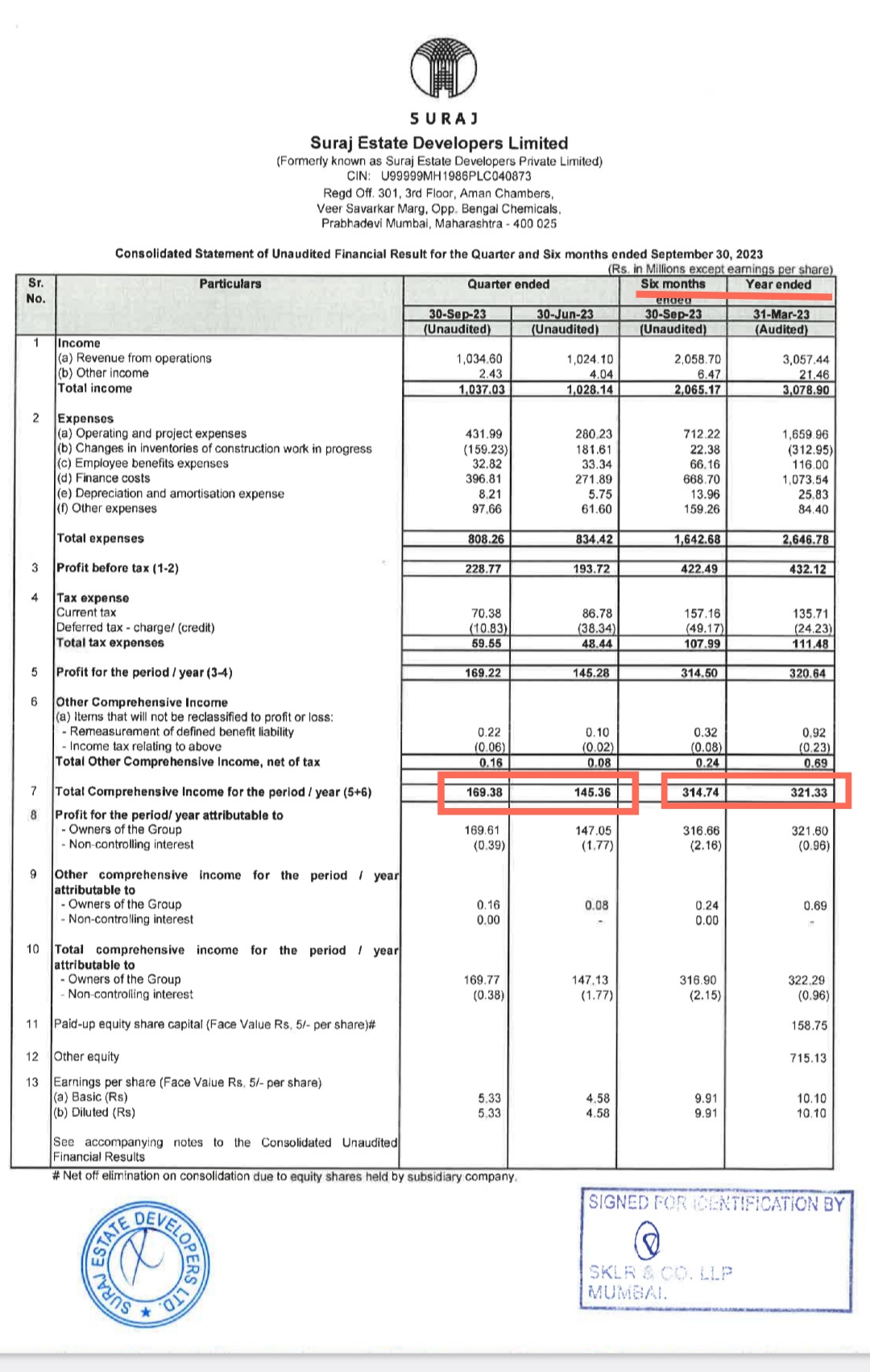

Suraj estate posted great result for September quarter ,

PAT 17 cr vs 14.5 cr in June quarter

So QoQ is good.

Also 6 month ending PAT is alone 31.5 cr vs Whole year PAT 32 cr of last FY23.

So FY 24 would be growth minimum 80-100% compared to FY23

Plus 400 cr Fully fresh IPO is used for repayment of borrowing and capex so future results would be better as less interest cost.

Q4 would be blockbuster as huge borrowing will be reduced and intrest cost would be lesser.

I don't find risk in holding it currently as downside is minimum and could perform like signature global...

Though Take your own decision accordingly

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)