@Kanwarjit ji

I am not an expert and I tried to dive down into this group and company. I will tell you my limited view about this company and sector and accordingly you can take decision related to PP as per your choice.

Fertilizer Stocks like Coromandel, Chambal, Deepak fertilizers made good wealth in long term for investors and even Agrochemical companies too. There is growing demand of food in india and world (geopolitical tension made food scarcity too and india has abundant and potential to grow huge). Monsoon is also in favour from last few years and Government have good budgetary support & till will continue till next election at least.

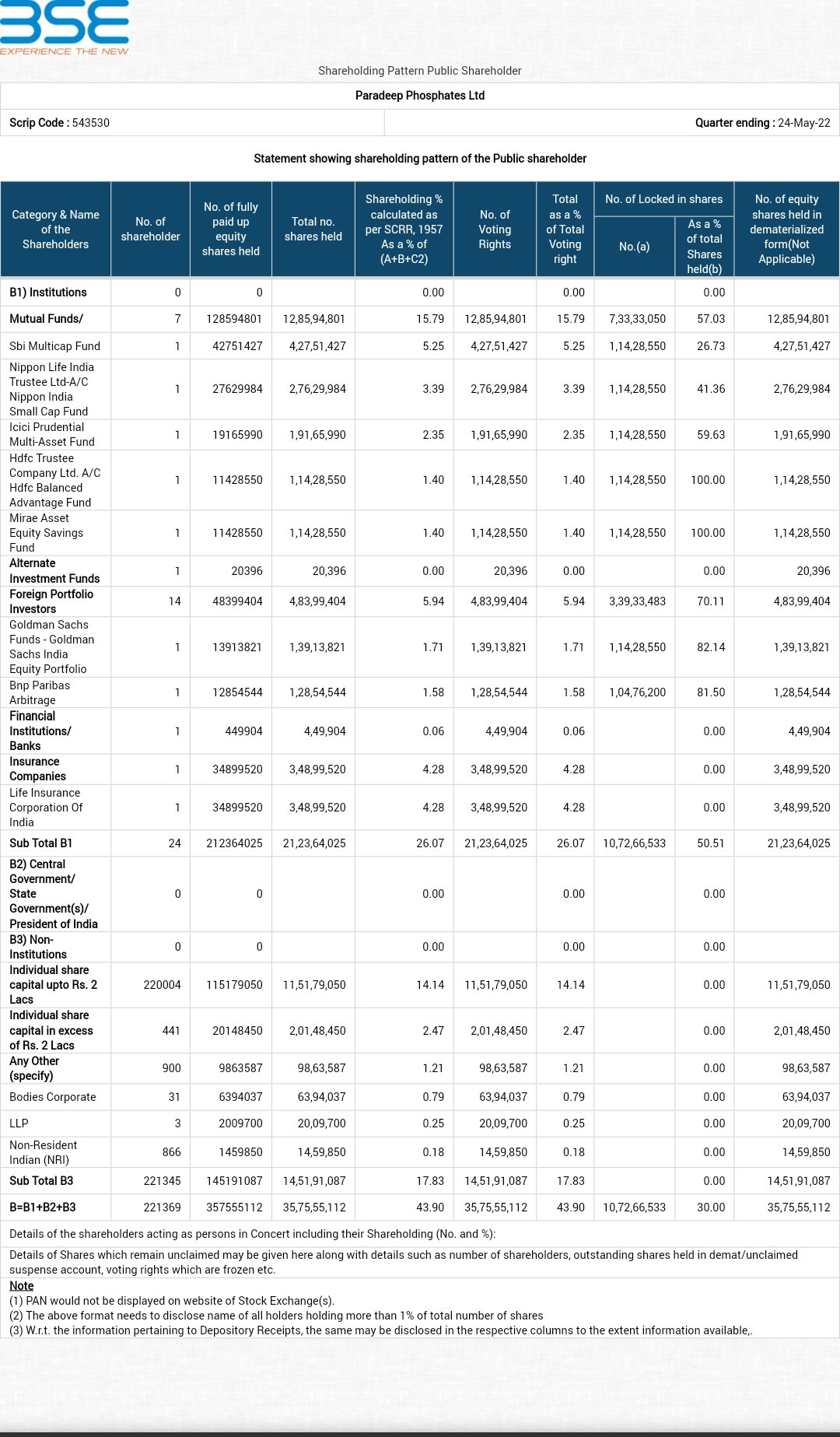

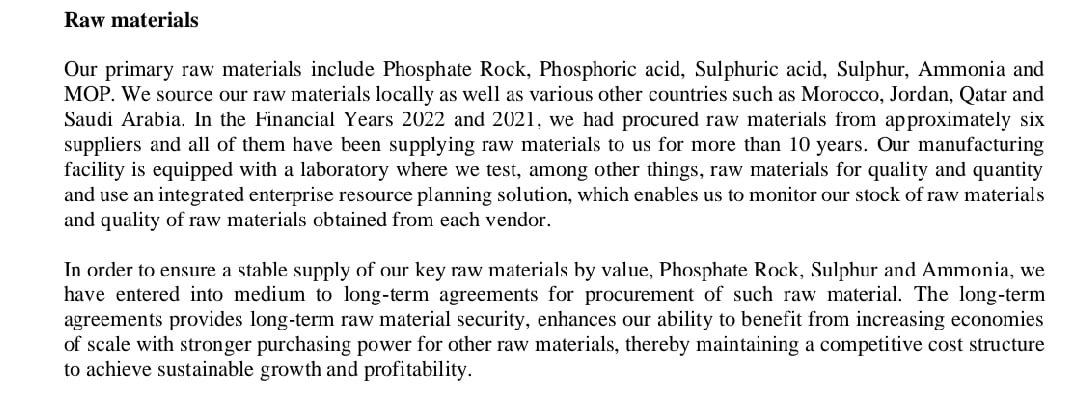

Now coming to this company i.e PP, this company has best in sector margin, raw material price stability (because it sources its RM from morrocan JV), valuation is also attractive (before till new acquisition of Goa unit).

Now I will tell you what worries me about this company and I didn't apply in IPO because of only these reasons:

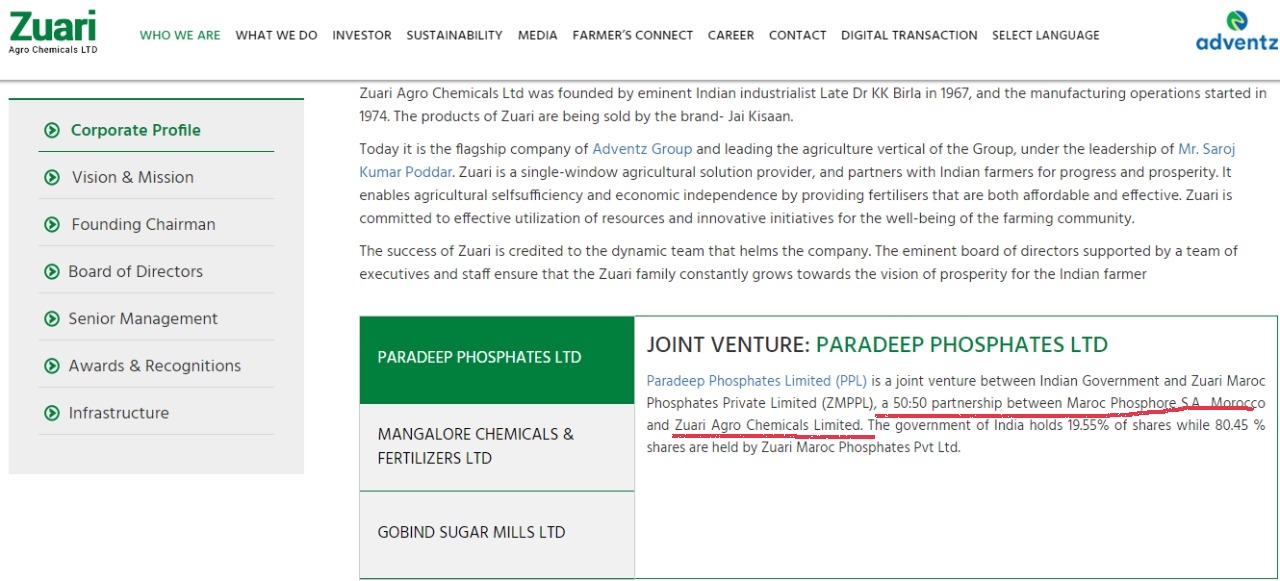

PP made acquisition of Goa unit (loss making with negative cash flow from last three years from group company i.e ZACL(Zuari Agrochemical Company Ltd). This PP is also JV between ZACL and a morrocan company. Here promoter sold a loss making company to PP and encashed their money. It would be opportunity and challenge for PP to turnaround (make profitable) Goa unit and I would like to wait and watch how Goa unit is managed.

I have some concern related efficiency of promoter group too because Mangalore Chemicals and Fertilizers Ltd (a listed company) is also a subsidiary company of Zuari group and this company hasn't performed well either on financial record or share price record.

In the long term PP might able to make synergy between Paradeep unit and Goa unit but in near term this Goa unit will definitely impact financial of PP because turnaround doesn't happen overnight and we are not very sure whether they will able to do it or not because if the promoter is same then why they can't able to do till now and they made decision to sell it to another group company.

Market is always forward looking and the current valuation (P/E 6) doesn't include loss of Goa unit and Goa unit financial will start combining with PP from next year and I don't know how it will impact.

This was my research which put me away from applying in PP's IPO. There are a lot of If & but in this company and I chose to stay away.

Whether you want to hold or sell then in my opinion if you applied for short term then trade with stoploss (your loss bearing capacity) and if you applied for long term then keep track of its quarter result and further updates company gives.

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)