Dear Dharmendra..since you have asked.

I don't generally consider IPOs for long term as these are mostly brought at valuations which benefits promoters the most.

Promoters bring IPOs when they want your money and offload their stakes. Having said that

Good companies often make a strong base post IPOs after a considerable period of time. e.g Map My India, Zomato, Tega etc..

I got allotment in these and I sold during listing only to re enter after proper base formation.. and earned handsomely.

MapMyIndia ~1000, zomato~50, 65, 80..

I got Saakshi Medtech as allotment and sold once it reaches my Target ~260.. that was a stretch for me... As I was expecting 211 as target..it went to 290

I bought Phantom only recently around 380...And Maitreya Around 130 as I believe these are under valued as compared to growth expected and peer.

In Maitrey I see some good investors are also entering.. Rahul Gupta (who owns 18% in SG mart)

Pritesh Vora (Director in Mission Holdings.. an investment firm founded by Saurabh Mittal)

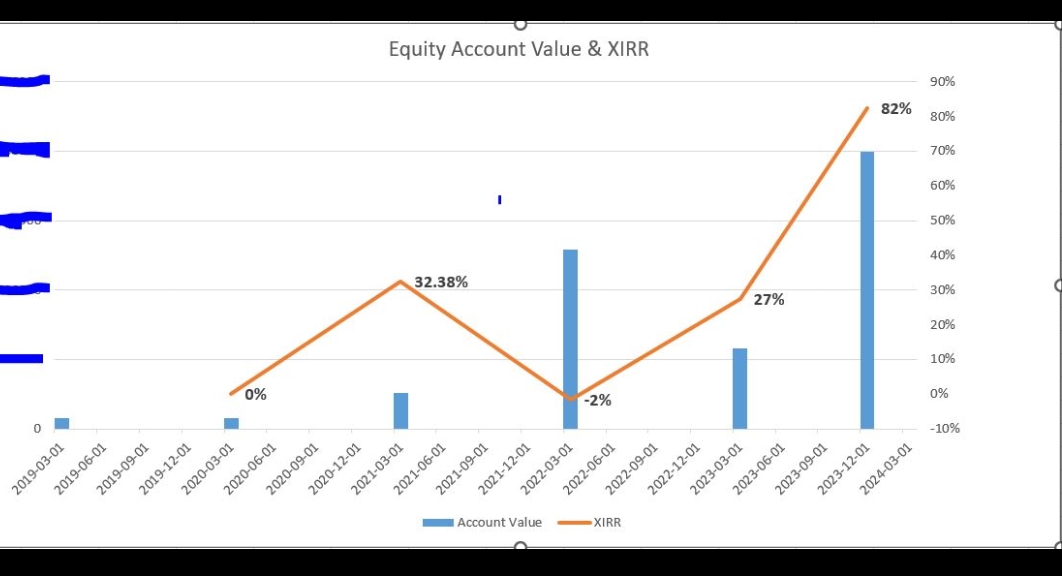

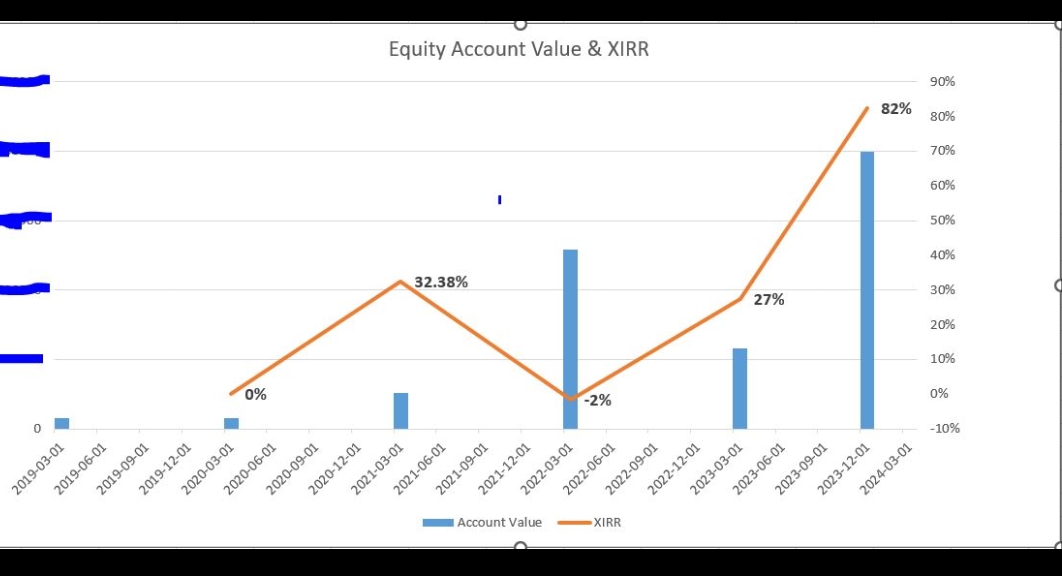

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)