Amazing 🤩

Aether's promoters, SBI MF and Mine confidence look similar in this company 😂

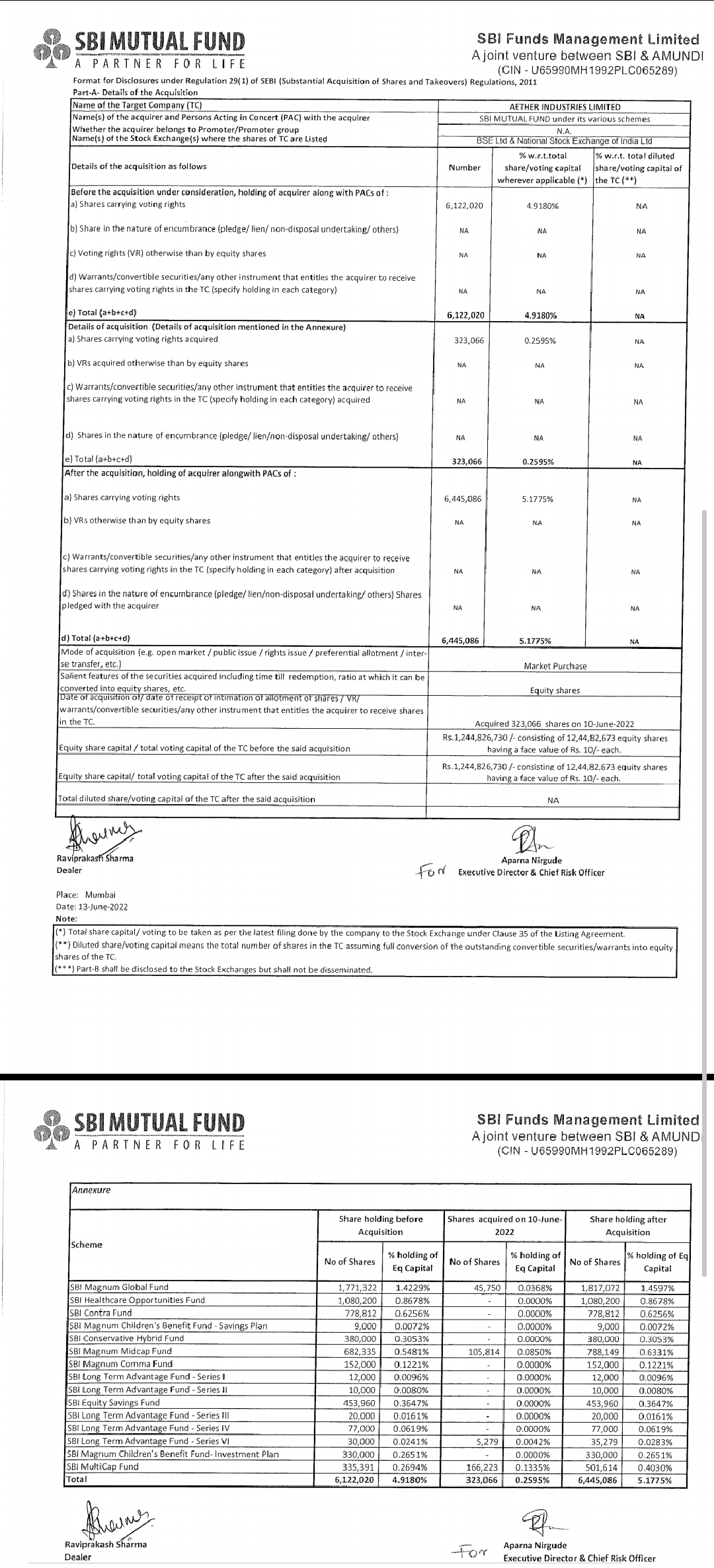

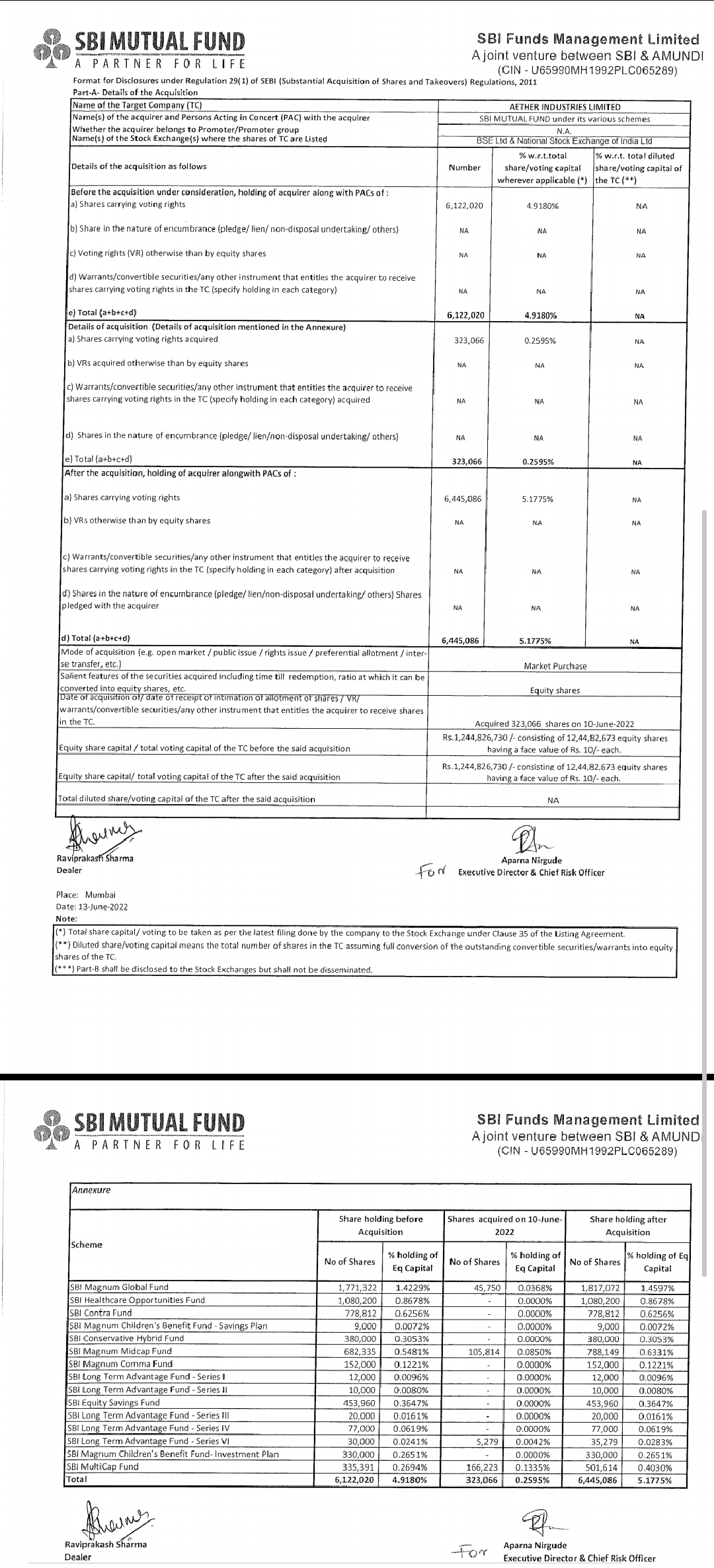

Promoters have 87% stake and now SBI MFs have cornered more than 5%. White Oak, IIFL and Ashoka fund too have pre-ipo allocation (minimum lock-in for 6 months).

When most of stakes of a good company are cornered by big players then supply chokes and if any positive development happens in such company then stock fly like rocket. It's very unlikely that this company will fall post anchor's share supply and most anchor investors won't supply because 35% of Anchor investors are Pre-Ipo allottee (SBI MF, Ashoka India, IIFL) and they must have taken stake for long term growth of the company.

SBI bought in Pre-Ipo placement then again in Anchor book(SBI MF holds 19% of Anchor allocation) and now bought in open market too. Ashoka india is also Pre-Ipo allottee and it holds 10.82% of Anchor book too. The same with IIFL it also holds both Pre-Ipo allocation and Anchor allocation too(5.2% of anchor book). Some other marquee anchor investors are Goldman Sachs and Nomura(10.46% each of Anchor book).

Perfect supply choke has been created.

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)