@Lokesh Chiru Thanks for sharing your wonderful thoughts. I agree with your observations on PAT and EBITDA margins, but need to be looked at from Volume/ revenue growth perspective too.

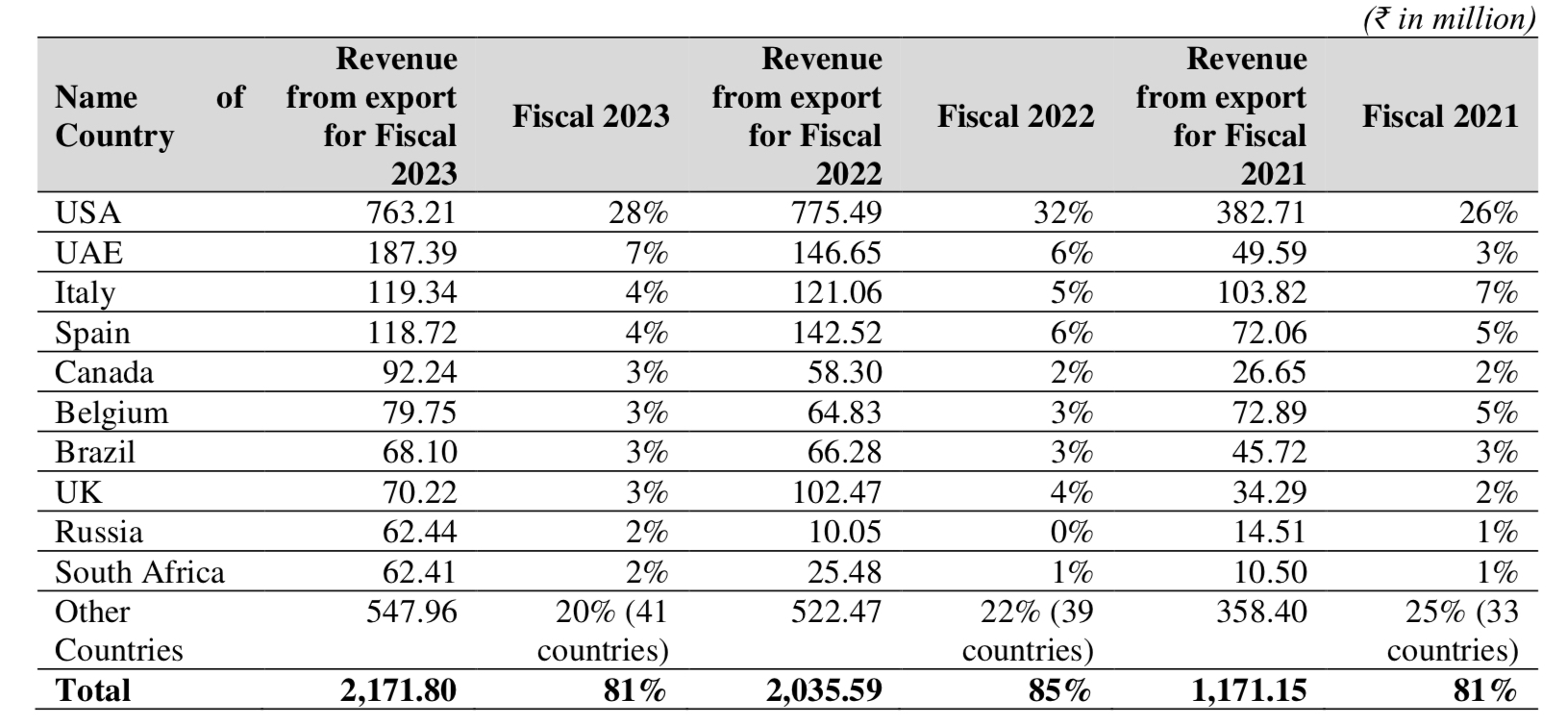

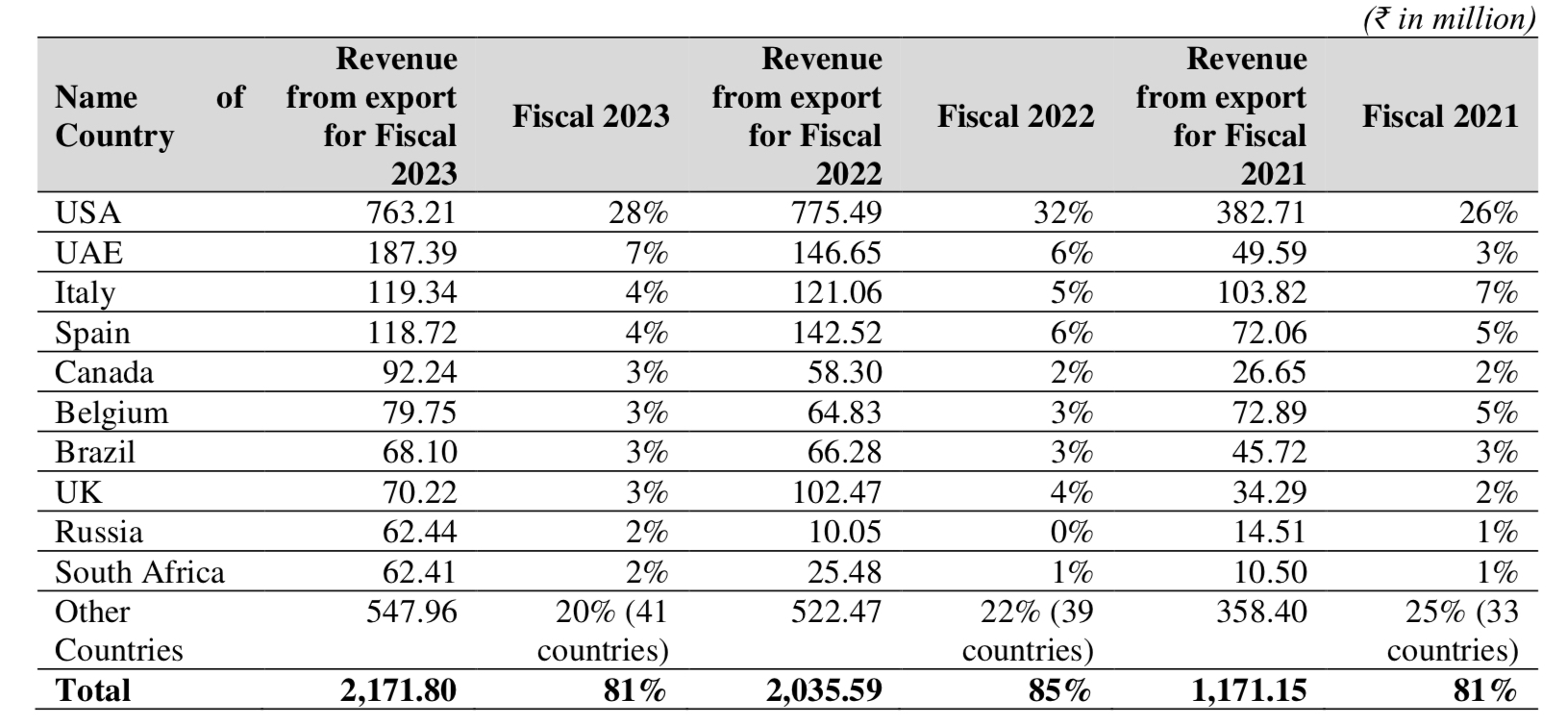

Concurrent to what you just mentioned, Aeroflex made most revenue from the affected markets/ sectors - US/ EU, Metals/ Chemicals/ Steel industries. See images attached below.

You’ll notice even for FY23, the revenue increase from FY22 wasn’t as significant as how it increased from FY21. This softening of demand, in my view, will be most crucial to understand the trend for ongoing FY24.

Regarding, marquee investors, that’s exactly why I said it may still fetch some investor fancy. But also bear in mind, it is already a multibagger for them 😊.

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)

Zerodha (Trading Account)