Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

An NRI account is a bank account opened by an NRI in India. It is used to invest money earned in foreign countries, the money earned, or still earning in India.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

An NRI account is a savings bank account opened by an NRI (or PIO) in India with a bank authorized by the RBI. It can be used to invest the money earned in foreign countries and to manage the money earned or still earning in India.

Purpose of NRI Bank Account in India

NRI accounts are classified into two types based on the above requirements:

The Non-Resident External (NRE) Bank Account is opened with the purpose to facilitate the transfer of income earned abroad to India. It is a rupee dominated account and is repatriable i.e. allows you to transfer your foreign income to India. The interest earned from these accounts is tax-exempt.

The Non-resident Ordinary (NRO) Bank Account is opened to manage income like rent, dividend, pensions, etc., earned in India on non-repatriation basis.

Income earned abroad can also be deposited in this account. You can transfer abroad up to $1 million in a financial year. Interest earned is fully transferable.

When an Indian citizen becomes an NRI, his domestic bank accounts needs to be converted into an NRO account by the bank.

Read NRE vs NRO Account to understand in detail about key differences about NRE & NRO accounts.

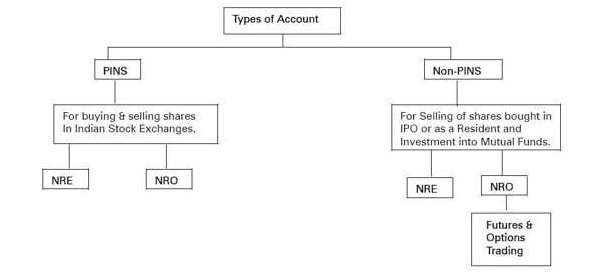

The NRI bank accounts are also categorized as PIS or Non-PIS account. Portfolio Investment Scheme (PIS) is an RBI scheme to facilitate trading and investments by NRIs and PIOs in India stock exchange.

Note:

At a high level the NRI Bank Accounts are classified in 3 types:

The purpose of these accounts is explained in the below diagram:

Note: An Indian individual can have one status at any point of time from taxation purposes; Resident Indian or Non-resident Indian (NRI). A resident Indian cannot hold an NRI account and an NRI cannot hold a resident bank account in India. The account should be converted according to the resident status when it changes.

NRI account and NRI investments in India are governed by:

Answered on

Following people are eligible to open NRI Bank Account:

To buy and sell shares in India, NRIs need PIS NRE or Non-PIS NRO savings bank accounts. PIS (Portfolio Investment Scheme) is an RBI scheme for NRI to invest in India.

The NRE PIS Bank Account is for the transfer of income earned abroad to India. The fund in this account is repatriable. The interest earned from these accounts is tax-exempt. This account is used commonly for NRI stock market investment in India.

The NRO Non-PIS Saving Bank Account is to manage NRIs income in India like rent, dividend, pensions, etc. It is a non-repatriable account. An NRI can use NRO Non-PIS Account for stock market investment but the funds in the account are non-repatriable.

Read NRE vs NRO Account to understand in detail about key differences about NRE & NRO accounts.

Note that all the transactions done through PIS Account are reported to RBI daily by the bank. Earlier, the PIS account was required to invest in stock markets on repatriation as well as non-repatriation basis. However, with a change in rules, RBI has waived the PIS requirement for trading on a non-repatriation basis i.e via NRO account. The PIS account should only be used for stock market investments by the NRI. For all other transactions, an NRI should use Non-PIS bank accounts.

NRI's can trade in Equity Derivatives (F&O) in India through a Non-PIS NRO bank account only.

In addition to NRO Bank Account, an NRI need an account with Custodial and a Custodial Participant code (CP code) to trade in Futures & Options in India.

An NRI doesn't need a PIS account to trade in derivatives.

Either NRE or NRO Saving Bank Accounts (Non-PIS) can be used to invest in Mutual Funds in India. However, For NRO Bank accounts, only the gains or profits from the investments are repatriable, not the principal amount.

The NRI Mutual Funds investment should be in Indian Rupee as Asset Management Companies (AMC) in India accepts investments only in Indian currency.

No, NRI's are not permitted to have resident saving account in India. The resident saving account should be converted to NRI account as soon as the status of person changes to Non-Resident. This is as per the RBI and Income Tax laws for NRIs.

Technically an individual cannot hold both the status i.e. resident and non-resident at the same time.

If the individual is an NRI, he needs to close the resident saving account and open NRI account.

If the individual is a resident Indian, then he needs to close the NRI account and open a normal saving account.

Non-Resident External (NRE) account is an external saving bank account opened for NRI's. NRE account is fully repatriable which means both principal, as well as interest, can easily be transferred back to the NRIs country of current residency. This account is for NRIs to invest their foreign earnings in India.

Non-Resident Ordinary (NRO) is an ordinary saving bank account opened for NRI's to manage the earnings and expenses in India. While an NRO account is generally non-repatriable, RBI permits NRI's to transfer money from NRO to NRE account with additional formalities. An NRI can transfer up to 1 million USD in a financial year from his NRO account to his country of current residency.

Check NRE vs NRO Account for detail comparison of NRE and NRO saving bank accounts.

Only NRE Demat Account is required to be linked with NRE PIS Bank Account for trading on a repatriation basis.

For NRO Demat Account, there is no requirement of PIS and trading can be done with Non-PIS NRO Bank, NRO Trading and NRO Demat account on non-repatriation basis.

Below are the account mappings explained for stocks, mutual funds and derivatives investment in India.

Type of Account for NRI

An NRI needs NRE Bank (with PIS permission), Trading and Demat account to trade in Equity on repatriation basis. For trading in equity on non-repatriation basis, they need NRO Bank, Trading and Demat account. The RBI PIS permission is not required for investing on a non-repatriation basis. Investment in Mutual Fund and trading in Equity and Current F&O is only allowed through NRO accounts.

| Products | Trading Account | Bank Account | Demat Account |

|---|---|---|---|

| Equity (Repatriable) | NRE (PIS) | NRE (PIS) | NRE |

| Equity (Not-Repatriable) | NRO | NRO | NRO |

| Mutual Funds (Repatriable) | NRE | NRE | NRE |

| Mutual Funds (Not-Repatriable) | NRO | NRO | NRO |

| Futures & Options | NRO | NRO | NRO |

The returning NRIs need to convert their NRI accounts to the resident account immediately upon their return before making any further investments in India.

NRI investments are governed by FEMA guidelines and as per FEMA, a person returning to India permanently is considered as a resident from Day 1 of their return. Thus, a returning NRI should inform the bank and broker of their residential status and get their existing NRI bank accounts, NRI Demat Account, and NRI trading account closed or converted to resident accounts.

The NRE and NRO bank account can be re-designated as resident accounts. However, in case a returning NRI wants to retain the foreign earnings without converting them to INR, they can open a Resident Foreign Currency (RFC) accounts and transfer the NRE proceeds in that account. However, the investments would be allowed only from resident bank accounts.

The existing securities holding in NRI Demat account can be transferred to the resident Demat account on conversion. In case of existing investment in mutual funds as an NRI, a returning NRI should change the residential status in mutual fund investments from NRI to a resident and also update the resident bank details to avoid any issues.

Thus, once the resident trading, Demat, and bank accounts are ready, a returning NRI is all set to start investing again as a resident Indian.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|