Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Short Straddle (Sell Straddle or Naked Straddle) and Short Strangle (Sell Strangle) options trading strategies. Find similarities and differences between Short Straddle (Sell Straddle or Naked Straddle) and Short Strangle (Sell Strangle) strategies. Find the best options trading strategy for your trading needs.

| Short Straddle (Sell Straddle or Naked Straddle) | Short Strangle (Sell Strangle) | |

|---|---|---|

|

|

|

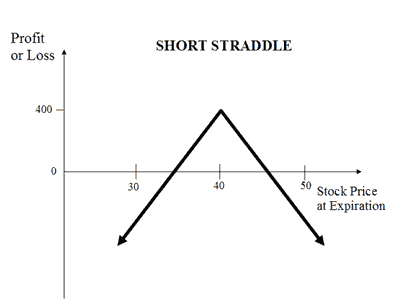

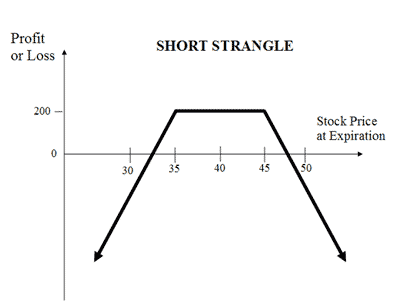

| About Strategy | The Short Straddle (or Sell Straddle or naked Straddle) is a neutral options strategy. This strategy involves simultaneously selling a call and a put option of the same underlying asset, same strike price and same expire date. A Short Straddle strategy is used in case of little volatility market scenarios wherein you expect none or very little movement in the price of the underlying. Such scenarios arise when there is no major news expected until expire. This is a limited profit and unlimited loss strategy. The maximum profit earned when, on expire date, the underlying asset is trading at the strike price at which the options are sold. The maximum loss is unlimited and occurs when underlying asset price moves sharply in upward or down... Read More | The Short Strangle (or Sell Strangle) is a neutral strategy wherein a Slightly OTM Call and a Slightly OTM Put Options are sold simultaneously of same underlying asset and expiry date. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. It is a limited profit and unlimited risk strategy. The maximum profit earn is the net premium received. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. A net credit is taken to enter into this strategy. For this reason, the Short Strangles are Credit Spreads. The usual Short Strangle Strategy looks like as below for NIFTY current index value at 10400 (NIFTY S... Read More |

| Market View | Neutral | Neutral |

| Strategy Level | Advance | Advance |

| Options Type | Call + Put | Call + Put |

| Number of Positions | 2 | 2 |

| Risk Profile | Unlimited | Unlimited |

| Reward Profile | Limited | Limited |

| Breakeven Point | 2 Breakeven Points | two break-even points |

| Short Straddle (Sell Straddle or Naked Straddle) | Short Strangle (Sell Strangle) | |

|---|---|---|

| When to use? | This strategy is to be used when you expect a flat market in the coming days with very less movement in the prices of underlying asset. |

The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. |

| Market View | Neutral When trader don't expect much movement in its price in near future. |

Neutral When you are expecting little volatility and movement in the price of the underlying. |

| Action |

|

Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. |

| Breakeven Point | 2 Breakeven Points There are 2 break even points in this strategy. The upper break even is hit when the underlying price is equal to the total of strike price of short call and net premium paid. The lower break even is hit when the underlying price is equal to the difference between strike price of short Put and net premium paid. Break-even points: Lower Breakeven = Strike Price of Put - Net Premium Upper breakeven = Strike Price of Call+ Net Premium |

two break-even points A strangle has two break-even points. Lower Break-even = Strike Price of Put - Net Premium Upper Break-even = Strike Price of Call+ Net Premium" |

| Short Straddle (Sell Straddle or Naked Straddle) | Short Strangle (Sell Strangle) | |

|---|---|---|

| Risks | Unlimited There is a possibility of unlimited loss in the short straddle strategy. The loss occurs when the price of the underlying significantly moves upwards and downwards. Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received Or Loss= Strike Price of Short Put - Price of Underlying - Net Premium Received |

Unlimited The maximum loss is unlimited in this strategy. You will incur losses when the price of the underlying moves significantly either upwards or downwards at expiration. Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received Or Loss = Strike Price of Short Put - Price of Underlying - Net Premium Received |

| Rewards | Limited Maximum profit is limited to the net premium received. The profit is achieved when the price of the underlying is equal to either strike price of short Call or Put. |

Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. The maximum profit is limited to the net premium received while selling the Options. Maximum Profit = Net Premium Received |

| Maximum Profit Scenario | Both Option not exercised | Both Option not exercised |

| Maximum Loss Scenario | One Option exercised |

One Option exercised |

| Short Straddle (Sell Straddle or Naked Straddle) | Short Strangle (Sell Strangle) | |

|---|---|---|

| Advantages | It allows you to benefit from double time decay and earn profit in a less volatile scenario. |

The strategy offers higher chance of profitability in comparison to Short Straddle due to selling of OTM Options. |

| Disadvantage | Unlimited losses if the price of the underlying move significantly in either direction. |

Limited reward with high risk exposure. |

| Simillar Strategies | Short Strangle, Long Straddle | Short Straddle, Long Strangle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|