Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Short Call (Naked Call) and Short Strangle (Sell Strangle) options trading strategies. Find similarities and differences between Short Call (Naked Call) and Short Strangle (Sell Strangle) strategies. Find the best options trading strategy for your trading needs.

| Short Call (Naked Call) | Short Strangle (Sell Strangle) | |

|---|---|---|

|

|

|

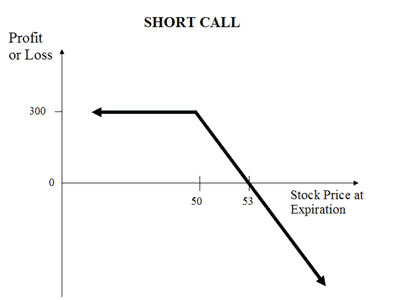

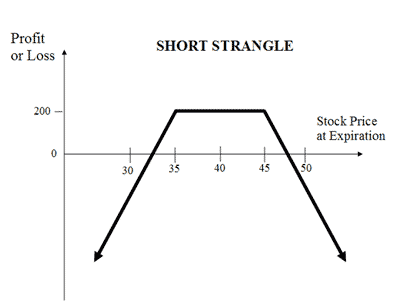

| About Strategy | Short Call (or Naked Call) strategy involves the selling of the Call Options (or writing call option). In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. This strategy is highly risky with potential for unlimited losses and is generally preferred by experienced traders. The strategy involves taking a single position of selling a Call Option of any type i.e. ITM or OTM. These naked calls are also known as Out-Of-The-Money Naked Call and In-The-Money Naked Call based on the type you choose. This strategy has limited rewards (max profit is premium received) and unlimited loss potential. When the trader goes short on call, the trader sells a call option and e... Read More | The Short Strangle (or Sell Strangle) is a neutral strategy wherein a Slightly OTM Call and a Slightly OTM Put Options are sold simultaneously of same underlying asset and expiry date. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. It is a limited profit and unlimited risk strategy. The maximum profit earn is the net premium received. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. A net credit is taken to enter into this strategy. For this reason, the Short Strangles are Credit Spreads. The usual Short Strangle Strategy looks like as below for NIFTY current index value at 10400 (NIFTY S... Read More |

| Market View | Bearish | Neutral |

| Strategy Level | Advance | Advance |

| Options Type | Call | Call + Put |

| Number of Positions | 1 | 2 |

| Risk Profile | Unlimited | Unlimited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike Price of Short Call + Premium Received | two break-even points |

| Short Call (Naked Call) | Short Strangle (Sell Strangle) | |

|---|---|---|

| When to use? | It is an aggressive strategy and involves huge risks. It should be used only in case where trader is certain about the bearish market view on the underlying. |

The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. |

| Market View | Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. |

Neutral When you are expecting little volatility and movement in the price of the underlying. |

| Action |

|

Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. |

| Breakeven Point | Strike Price of Short Call + Premium Received Break even is achieved when the price of the underlying is equal to total of strike price and premium received. |

two break-even points A strangle has two break-even points. Lower Break-even = Strike Price of Put - Net Premium Upper Break-even = Strike Price of Call+ Net Premium" |

| Short Call (Naked Call) | Short Strangle (Sell Strangle) | |

|---|---|---|

| Risks | Unlimited There risk is unlimited and depend on how high the price of the underlying moves. |

Unlimited The maximum loss is unlimited in this strategy. You will incur losses when the price of the underlying moves significantly either upwards or downwards at expiration. Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received Or Loss = Strike Price of Short Put - Price of Underlying - Net Premium Received |

| Rewards | Limited The profit is limited to the premium received. |

Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. The maximum profit is limited to the net premium received while selling the Options. Maximum Profit = Net Premium Received |

| Maximum Profit Scenario | When underline asset goes down and option not exercised.

|

Both Option not exercised |

| Maximum Loss Scenario | When underline asset goes up and option exercised.

|

One Option exercised |

| Short Call (Naked Call) | Short Strangle (Sell Strangle) | |

|---|---|---|

| Advantages | This strategy allows you to profit from falling prices in the underlying asset. |

The strategy offers higher chance of profitability in comparison to Short Straddle due to selling of OTM Options. |

| Disadvantage | There's unlimited risk on the upside as you are selling Option without holding the underlying. Rewards are limited to premium received only. |

Limited reward with high risk exposure. |

| Simillar Strategies | Covered Put, Covered Calls, Bear Call Spread | Short Straddle, Long Strangle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|