Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Long Put and Long Call Butterfly options trading strategies. Find similarities and differences between Long Put and Long Call Butterfly strategies. Find the best options trading strategy for your trading needs.

| Long Put | Long Call Butterfly | |

|---|---|---|

|

|

|

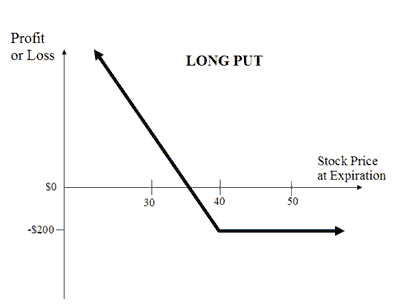

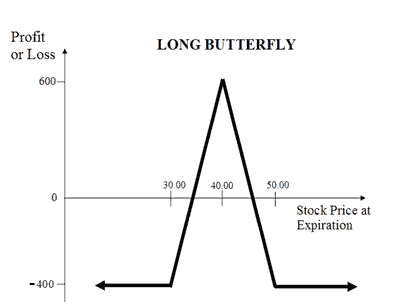

| About Strategy | A Long Put strategy is a basic strategy with the Bearish market view. Long Put is the opposite of Long Call. Here you are trying to take a position to benefit from the fall in the price of the underlying asset. The risk is limited to premium while rewards are unlimited. Long put strategy is similar to short selling a stock. This strategy has many advantages over short selling. This includes the maximum risk is the premium paid and lower investment. The challenge with this strategy is that options have an expiry, unlike stocks which you can hold as long as you want. Let's assume you are bearish on NIFTY and expects its price to fall. You can deploy a Long Put strategy by buying an ATM PUT Option of NIFTY. If the price of NIFTY share... Read More | Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. The strategy is a combination of bull Spread and bear Spread. It involves Buy 1 ITM Call, Sell 2 ATM Calls and Buy 1 OTM Call. The strike prices of all Options should be at equal distance from the current price. Suppose Nifty is currently trading at 10400. You expect very little volatility in it. You can implement the Long Call Butterfly by buying 1 ITM Call Option at 10300, selling 2 ATM Nifty Call Options at 10400, buying 1 OTM Call Option at 10500. Ensure that strike prices of Options are at equidistance. Your loss will be limited to the net premium paid on 4 positions while profit will be limited to strike price of short calls.... Read More |

| Market View | Bearish | Neutral |

| Strategy Level | Beginners | Advance |

| Options Type | Put | Call |

| Number of Positions | 1 | 4 |

| Risk Profile | Limited | Limited |

| Reward Profile | Unlimited | Limited |

| Breakeven Point | Strike Price of Long Put - Premium Paid | |

| Long Put | Long Call Butterfly | |

|---|---|---|

| When to use? | A long put option strategy works well when you're expecting the underlying asset to sharply decline or be volatile in near future. |

This strategy should be used when you're expecting no volatility in the price of the underlying. |

| Market View | Bearish When you are expecting a drop in the price of the underlying and rise in the volatility. |

Neutral Neutral on the underlying asset and bearish on the volatility. |

| Action |

Let's assume you're Bearish on Nifty currently trading at 10,400. You expect it to fall to 10,000 level. You buy a Put option with a strike price 10,000. If the Nifty goes below 10,000, you will make a profit on exercising the option. In case the Nifty rises contrary to expectation, you will incur a maximum loss of the premium. |

|

| Breakeven Point | Strike Price of Long Put - Premium Paid The breakeven is achieved when the strike price of the Put Option is equal to the premium paid. |

Upper Breakeven = Higher Strike Price - Net Premium Lower Breakeven = Lower Strike Price + Net Premium |

| Long Put | Long Call Butterfly | |

|---|---|---|

| Risks | Limited The risk for this strategy is limited to the premium paid for the Put Option. Maximum loss will happen when price of underlying is greater than strike price of the Put option. |

Limited Risk in the Long Call Butterfly options strategy is limited to the net premium paid. |

| Rewards | Unlimited This strategy has the potential to earn unlimited profit. The profit will depend on how low the price of the underlying drops. |

Limited Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. |

| Maximum Profit Scenario | Underlying goes down and Option exercised

|

Only ITM Call exercised |

| Maximum Loss Scenario | Underlying goes up and Option not exercised

|

All options exercised or all options not exercised. |

| Long Put | Long Call Butterfly | |

|---|---|---|

| Advantages | Unlimited profit potential with risk only limited to loss of premium. |

Profit earning strategy with limited risk in a less volatile market. |

| Disadvantage | You may incur 100% loss in premium if the underlying price rises. |

Premiums and brokerage paid on multiple position may eat your profits. |

| Simillar Strategies | Protective Call, Short Put, Long Straddle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|