Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Covered Call and Long Call Butterfly options trading strategies. Find similarities and differences between Covered Call and Long Call Butterfly strategies. Find the best options trading strategy for your trading needs.

| Covered Call | Long Call Butterfly | |

|---|---|---|

|

|

|

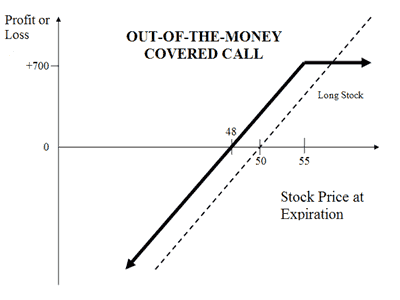

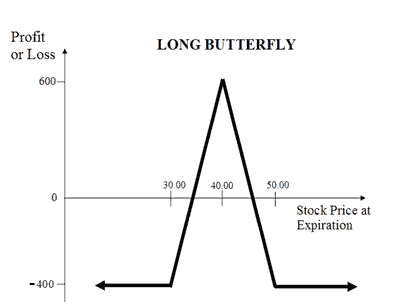

| About Strategy | A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. It is a strategy in which you own shares of a company and Sell OTM Call Option of the company in similar proportion. The Call Option would not get exercised unless the stock price increases. Till then you will earn the Premium. This a unlimited risk and limited reward strategy. Let's assume you own TCS Shares and your view is that its price will rise in the near future. You will Sell OTM Call Option of TCS at a price, where you target to sell your shares. You will receive premium amount for selling the Call option and the premium is your income. | Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. The strategy is a combination of bull Spread and bear Spread. It involves Buy 1 ITM Call, Sell 2 ATM Calls and Buy 1 OTM Call. The strike prices of all Options should be at equal distance from the current price. Suppose Nifty is currently trading at 10400. You expect very little volatility in it. You can implement the Long Call Butterfly by buying 1 ITM Call Option at 10300, selling 2 ATM Nifty Call Options at 10400, buying 1 OTM Call Option at 10500. Ensure that strike prices of Options are at equidistance. Your loss will be limited to the net premium paid on 4 positions while profit will be limited to strike price of short calls.... Read More |

| Market View | Bullish | Neutral |

| Strategy Level | Advance | Advance |

| Options Type | Call + Underlying | Call |

| Number of Positions | 2 | 4 |

| Risk Profile | Unlimited | Limited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Purchase Price of Underlying- Premium Recieved | |

| Covered Call | Long Call Butterfly | |

|---|---|---|

| When to use? | The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. |

This strategy should be used when you're expecting no volatility in the price of the underlying. |

| Market View | Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. |

Neutral Neutral on the underlying asset and bearish on the volatility. |

| Action |

Let's assume you own TCS Shares and your view is that its price will rise in the near future. You will Sell OTM Call Option of TCS at a price, where you target to sell your shares. You will receive premium amount for selling the Call option and the premium is your income. |

|

| Breakeven Point | Purchase Price of Underlying- Premium Recieved |

Upper Breakeven = Higher Strike Price - Net Premium Lower Breakeven = Lower Strike Price + Net Premium |

| Covered Call | Long Call Butterfly | |

|---|---|---|

| Risks | Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. Loss happens when price of underlying goes below the purchase price of underlying. Loss = (Purchase Price of Underlying - Price of Underlying) + Premium Received |

Limited Risk in the Long Call Butterfly options strategy is limited to the net premium paid. |

| Rewards | Limited You earn premium for selling a call. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. Max Profit= [Call Strike Price - Stock Price Paid] + Premium Received |

Limited Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. |

| Maximum Profit Scenario | Underlying rises to the level of the higher strike or above. |

Only ITM Call exercised |

| Maximum Loss Scenario | Underlying below the premium received |

All options exercised or all options not exercised. |

| Covered Call | Long Call Butterfly | |

|---|---|---|

| Advantages | It helps you generate income from your holdings. Also allows you to benefit from 3 movements of your stocks: rise, sidewise and marginal fall. |

Profit earning strategy with limited risk in a less volatile market. |

| Disadvantage | Unlimited risk for limited reward. |

Premiums and brokerage paid on multiple position may eat your profits. |

| Simillar Strategies | Bull Call Spread |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|