Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Bull Call Spread and Box Spread (Arbitrage) options trading strategies. Find similarities and differences between Bull Call Spread and Box Spread (Arbitrage) strategies. Find the best options trading strategy for your trading needs.

| Bull Call Spread | Box Spread (Arbitrage) | |

|---|---|---|

|

|

|

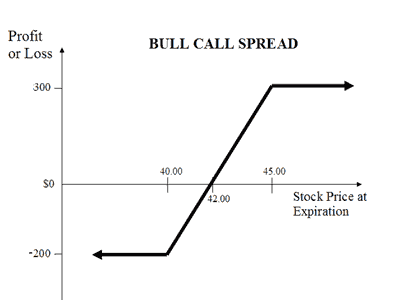

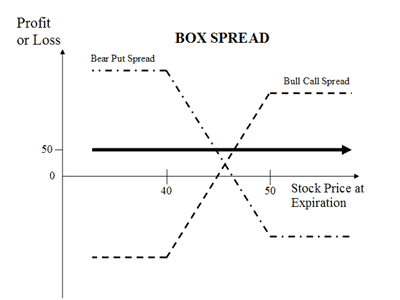

| About Strategy | A Bull Call Spread (or Bull Call Debit Spread) strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. The risk and reward in this strategy is limited. A Bull Call Spread strategy involves Buy ITM Call Option and Sell OTM Call Option.For example, if you are of the view that NIFTY will rise moderately in near future then you can Buy NIFTY Call Option at ITM and Sell Nifty Call Option at OTM. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. | Box Spread (also known as Long Box) is an arbitrage strategy. It involves buying a Bull Call Spread (1 ITM and I OTM Call) together with the corresponding Bear Put Spread (1 ITM and 1 OTM Put), with both spreads having the same strike prices and expiration dates. The strategy is called Box Spread as it is combination of 2 spreads (4 trades) and the profit/loss calculated together as 1 trade. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. The expiration value of the box spread is actually the difference between the strike prices of the options involved. The Long Box strategy is opposite to Short Box strategy. It is used when the spreads are under-priced with respe... Read More |

| Market View | Bullish | Neutral |

| Strategy Level | Beginners | Advance |

| Options Type | Call | Call + Put |

| Number of Positions | 2 | 4 |

| Risk Profile | Limited | None |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike price of purchased call + net premium paid | |

| Bull Call Spread | Box Spread (Arbitrage) | |

|---|---|---|

| When to use? | A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. |

Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. The earning from this strategy varies with the strike price chosen by the trader. i.e. Earning from strike price '10400, 10700' will be different from strike price combination of '9800,11000'. The long box strategy should be used when the component spreads are underpriced in relation to their expiration values. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. Note: If the spreads are overprices, another strategy named Short Box can be used for a profit. This strategy should be used by advanced traders as the gains are minimal. The brokerage payable when implementing this strategy can take away all the profits. This strategy should only be implemented when the fees paid are lower than the expected profit. |

| Market View | Bullish When you are expecting a moderate rise in the price of the underlying. |

Neutral The market view for this strategy is neutral. The movement in underlying security doesn't affect the outcome (profit/loss). This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. |

| Action |

A Bull Call Spread strategy involves Buy ITM Call Option + Sell OTM Call Option. For example, if you are of the view that Nifty will rise moderately in near future then you can Buy NIFTY Call Option at ITM and Sell NIFTY 50 Call Option at OTM. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. |

Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. The trader could execute Long Box strategy by buying 1 ITM Call and 1 ITM Put while selling 1 OTM Call and 1 OTM Put. There is no risk of loss while the profit potential would be the difference between two strike prices minus net premium. |

| Breakeven Point | Strike price of purchased call + net premium paid |

| Bull Call Spread | Box Spread (Arbitrage) | |

|---|---|---|

| Risks | Limited The trade will result in a loss if the price of the underlying decreases at expiration. The maximum loss is limited to net premium paid. Max Loss = Net Premium Paid Max Loss happens when the strike price of Call is less than or equal to price of the underlying. |

None The Box Spread Options Strategy is a relatively risk-free strategy. There is no risk in the overall position because the losses in one spread will be neutralized by the gains in the other spread. The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. The small risks of this strategy include:

|

| Rewards | Limited Limited To The Difference Between Two Strike Prices Minus Net Premium Maximum profit happens when the price of the underlying rises above strike price of two Calls. The profit is limited to the difference between two strike prices minus net premium paid. Max Profit = (Strike Price of Call 1 - Strike Price of Call 2) - Net Premium Paid |

Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Being an arbitrage strategy, the profits are very small. It's an extremely low-risk options trading strategy. |

| Maximum Profit Scenario | Both options exercised |

|

| Maximum Loss Scenario | Both options unexercised |

| Bull Call Spread | Box Spread (Arbitrage) | |

|---|---|---|

| Advantages | Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments. |

|

| Disadvantage | Profit potential is limited. |

|

| Simillar Strategies | Collar, Bull Put Spread |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

I understand the Advantage of time decay.

On dis-advantage, how time decay may go against in loss situations ?