Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Box Spread (Arbitrage) and Covered Strangle options trading strategies. Find similarities and differences between Box Spread (Arbitrage) and Covered Strangle strategies. Find the best options trading strategy for your trading needs.

| Box Spread (Arbitrage) | Covered Strangle | |

|---|---|---|

|

|

|

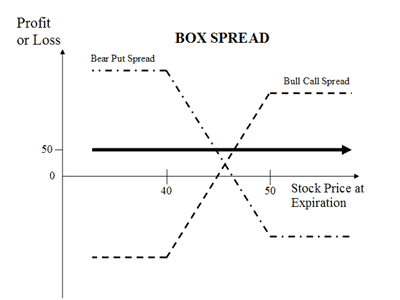

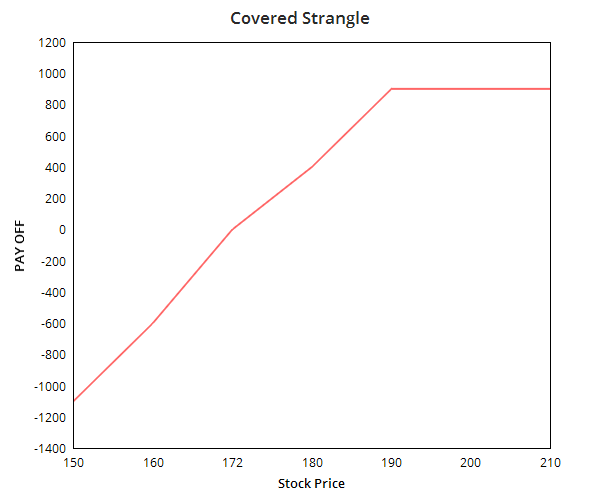

| About Strategy | Box Spread (also known as Long Box) is an arbitrage strategy. It involves buying a Bull Call Spread (1 ITM and I OTM Call) together with the corresponding Bear Put Spread (1 ITM and 1 OTM Put), with both spreads having the same strike prices and expiration dates. The strategy is called Box Spread as it is combination of 2 spreads (4 trades) and the profit/loss calculated together as 1 trade. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. The expiration value of the box spread is actually the difference between the strike prices of the options involved. The Long Box strategy is opposite to Short Box strategy. It is used when the spreads are under-priced with respe... Read More | The covered strangle option strategy is a bullish strategy. The strategy is created by owning or buying a stock and selling an OTM Call and OTM Put. It is called covered strangle because the upside risk of the strangle is covered or minimized. The strategy is perfect to use when you are prepared to sell the holding or bought shares at a higher price if the market moves up but would also is ready to buy more shares if the market moves downwards. The profit and in this strategy is unlimited while the risk is only on the downside. |

| Market View | Neutral | Bullish |

| Strategy Level | Advance | Advance |

| Options Type | Call + Put | Call + Put + Underlying |

| Number of Positions | 4 | 3 |

| Risk Profile | None | Limited |

| Reward Profile | Limited | Limited |

| Breakeven Point | two break-even points | |

| Box Spread (Arbitrage) | Covered Strangle | |

|---|---|---|

| When to use? | Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. The earning from this strategy varies with the strike price chosen by the trader. i.e. Earning from strike price '10400, 10700' will be different from strike price combination of '9800,11000'. The long box strategy should be used when the component spreads are underpriced in relation to their expiration values. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. Note: If the spreads are overprices, another strategy named Short Box can be used for a profit. This strategy should be used by advanced traders as the gains are minimal. The brokerage payable when implementing this strategy can take away all the profits. This strategy should only be implemented when the fees paid are lower than the expected profit. |

A covered strangle strategy can be used when you are bullish on the market but also want to cover any downside risk. You are prepared to sell the shares on profit but are also willing to buy more shares in case the prices fall. |

| Market View | Neutral The market view for this strategy is neutral. The movement in underlying security doesn't affect the outcome (profit/loss). This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. |

Bullish The Strategy is perfect to apply when you're bullish on the market and expecting less volatility in the market. |

| Action |

Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. The trader could execute Long Box strategy by buying 1 ITM Call and 1 ITM Put while selling 1 OTM Call and 1 OTM Put. There is no risk of loss while the profit potential would be the difference between two strike prices minus net premium. |

Buy 100 shares + Sell OTM Call +Sell OTM Put The covered strangle options strategy can be executed by buying 100 shares of a stock while simultaneously selling an OTM Put and Call of the same the stock and similar expiration date. |

| Breakeven Point | two break-even points There are 2 break-even points in the covered strangle strategy. One is the Upper break even point which is the sum of strike price of the Call option and premium received while the other is the lower break-even point which is the difference strike price of short Put and premium received. |

| Box Spread (Arbitrage) | Covered Strangle | |

|---|---|---|

| Risks | None The Box Spread Options Strategy is a relatively risk-free strategy. There is no risk in the overall position because the losses in one spread will be neutralized by the gains in the other spread. The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. The small risks of this strategy include:

|

Limited The risk on this strategy is only on the downside when the price moves below the strike price of the Put option. |

| Rewards | Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Being an arbitrage strategy, the profits are very small. It's an extremely low-risk options trading strategy. |

Limited The maximum profit on this strategy happens when the stock price is above the call price on expiry. The profit is the total of the gain from buying/selling stocks and net premium received on selling options. |

| Maximum Profit Scenario | You will earn the maximum profit when the price of the stock is above the Call option strike price on expiry. You will be assigned on the Call option, would be able to sell holding shares on profit while retaining the premiums received while selling the options. |

|

| Maximum Loss Scenario | The maximum loss would be when the stock price falls drastically and turns worthless. The premiums received while selling the options will compensate for some of the loss. |

| Box Spread (Arbitrage) | Covered Strangle | |

|---|---|---|

| Advantages |

|

|

| Disadvantage |

|

|

| Simillar Strategies | Long Strangle, Short Strangle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|