Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Bear Put Spread and Long Straddle (Buy Straddle) options trading strategies. Find similarities and differences between Bear Put Spread and Long Straddle (Buy Straddle) strategies. Find the best options trading strategy for your trading needs.

| Bear Put Spread | Long Straddle (Buy Straddle) | |

|---|---|---|

|

|

|

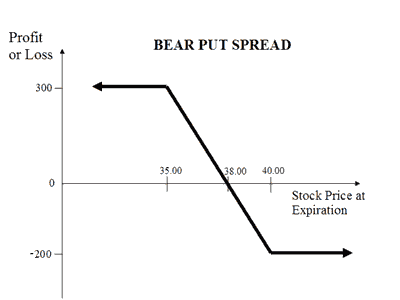

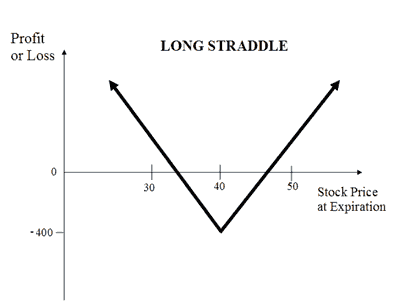

| About Strategy | The Bear Put strategy involves selling a Put Option while simultaneously buying a Put option. Contrary to Bear Call Spread, here you pay the higher premium and receive the lower premium. So there is a net debit in premium. Your risk is capped at the difference in premiums while your profit will be limited to the difference in strike prices of Put Option minus net premiums. This strategy is used when the trader believes that the price of underlying asset will go down moderately. This strategy is also known as the bear put debit spread as a net debit is taken upon entering the trade. This strategy has a limited risk as well as limited rewards. How to use the bear put spread options strategy? The bear put spread strategy looks like... Read More | The Long Straddle (or Buy Straddle) is a neutral strategy. This strategy involves simultaneously buying a call and a put option of the same underlying asset, same strike price and same expire date. A Long Straddle strategy is used in case of highly volatile market scenarios wherein you expect a big movement in the price of the underlying but are not sure of the direction. Such scenarios arise when company declare results, budget, war-like situation etc. This is an unlimited profit and limited risk strategy. The profit earns in this strategy is unlimited. Higher volatility results in higher profits. The maximum loss is limited to the net premium paid. The max loss occurs when underlying asset price on expire remains at the strike price. ... Read More |

| Market View | Bearish | Neutral |

| Strategy Level | Advance | Beginners |

| Options Type | Put | Call + Put |

| Number of Positions | 2 | 2 |

| Risk Profile | Limited | Limited |

| Reward Profile | Limited | Unlimited |

| Breakeven Point | Strike Price of Long Put - Net Premium | 2 break-even points |

| Bear Put Spread | Long Straddle (Buy Straddle) | |

|---|---|---|

| When to use? | The bear call spread options strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of prime movements going against your expectations. |

The strategy is perfect to use when there is market volatility expected due to results, elections, budget, policy change, war etc. |

| Market View | Bearish When you are expecting the price of the underlying to moderately drop. |

Neutral When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. |

| Action |

|

|

| Breakeven Point | Strike Price of Long Put - Net Premium The breakeven point is achieved when the price of the underlying is equal to strike price of long Put minus net premium. |

2 break-even points A straddle has two break-even points. Lower Breakeven = Strike Price of Put - Net Premium Upper breakeven = Strike Price of Call + Net Premium |

| Bear Put Spread | Long Straddle (Buy Straddle) | |

|---|---|---|

| Risks | Limited The maximum loss is limited to net premium paid. It occurs when the price of the underlying is less than strike price of long Put.. Max Loss = Net Premium Paid. |

Limited The maximum loss for long straddle strategy is limited to the net premium paid. It happens the price of underlying is equal to strike price of options. Maximum Loss = Net Premium Paid |

| Rewards | Limited The maximum profit is achieved when the strike price of short Put is greater than the price of the underlying.. Max Profit = Strike Price of Long Put - Strike Price of Short Put - Net Premium Paid. |

Unlimited There is unlimited profit opportunity in this strategy irrespective of the direction of the underlying. Profit occurs when the price of the underlying is greater than strike price of long Put or lesser than strike price of long Call. |

| Maximum Profit Scenario | Underlying goes down and both options exercised |

Max profit is achieved when at one option is exercised. |

| Maximum Loss Scenario | Underlying goes up and both options not exercised |

When both options are not exercised. This happens when underlying asset price on expire remains at the strike price. |

| Bear Put Spread | Long Straddle (Buy Straddle) | |

|---|---|---|

| Advantages | Risk is limited. It reduces the cost of investment. |

Earns you unlimited profit in a volatile market while minimizing the loss. |

| Disadvantage | The profit is limited. |

The price change has to be bigger to make good profits. |

| Simillar Strategies | Bear Call Spread, Bull Call Spread | Long Strangle, Short Straddle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|