Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Bear Put Spread and Long Call Butterfly options trading strategies. Find similarities and differences between Bear Put Spread and Long Call Butterfly strategies. Find the best options trading strategy for your trading needs.

| Bear Put Spread | Long Call Butterfly | |

|---|---|---|

|

|

|

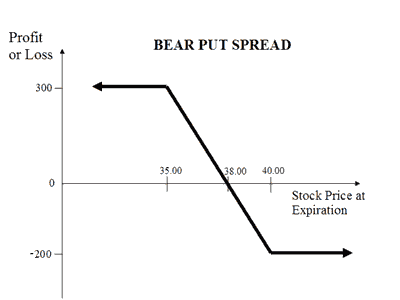

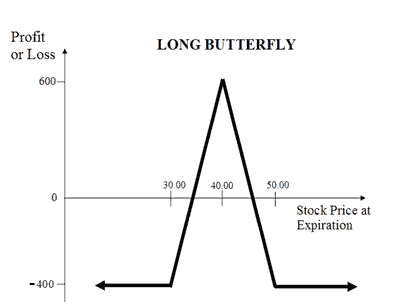

| About Strategy | The Bear Put strategy involves selling a Put Option while simultaneously buying a Put option. Contrary to Bear Call Spread, here you pay the higher premium and receive the lower premium. So there is a net debit in premium. Your risk is capped at the difference in premiums while your profit will be limited to the difference in strike prices of Put Option minus net premiums. This strategy is used when the trader believes that the price of underlying asset will go down moderately. This strategy is also known as the bear put debit spread as a net debit is taken upon entering the trade. This strategy has a limited risk as well as limited rewards. How to use the bear put spread options strategy? The bear put spread strategy looks like... Read More | Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. The strategy is a combination of bull Spread and bear Spread. It involves Buy 1 ITM Call, Sell 2 ATM Calls and Buy 1 OTM Call. The strike prices of all Options should be at equal distance from the current price. Suppose Nifty is currently trading at 10400. You expect very little volatility in it. You can implement the Long Call Butterfly by buying 1 ITM Call Option at 10300, selling 2 ATM Nifty Call Options at 10400, buying 1 OTM Call Option at 10500. Ensure that strike prices of Options are at equidistance. Your loss will be limited to the net premium paid on 4 positions while profit will be limited to strike price of short calls.... Read More |

| Market View | Bearish | Neutral |

| Strategy Level | Advance | Advance |

| Options Type | Put | Call |

| Number of Positions | 2 | 4 |

| Risk Profile | Limited | Limited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike Price of Long Put - Net Premium | |

| Bear Put Spread | Long Call Butterfly | |

|---|---|---|

| When to use? | The bear call spread options strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of prime movements going against your expectations. |

This strategy should be used when you're expecting no volatility in the price of the underlying. |

| Market View | Bearish When you are expecting the price of the underlying to moderately drop. |

Neutral Neutral on the underlying asset and bearish on the volatility. |

| Action |

|

|

| Breakeven Point | Strike Price of Long Put - Net Premium The breakeven point is achieved when the price of the underlying is equal to strike price of long Put minus net premium. |

Upper Breakeven = Higher Strike Price - Net Premium Lower Breakeven = Lower Strike Price + Net Premium |

| Bear Put Spread | Long Call Butterfly | |

|---|---|---|

| Risks | Limited The maximum loss is limited to net premium paid. It occurs when the price of the underlying is less than strike price of long Put.. Max Loss = Net Premium Paid. |

Limited Risk in the Long Call Butterfly options strategy is limited to the net premium paid. |

| Rewards | Limited The maximum profit is achieved when the strike price of short Put is greater than the price of the underlying.. Max Profit = Strike Price of Long Put - Strike Price of Short Put - Net Premium Paid. |

Limited Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. |

| Maximum Profit Scenario | Underlying goes down and both options exercised |

Only ITM Call exercised |

| Maximum Loss Scenario | Underlying goes up and both options not exercised |

All options exercised or all options not exercised. |

| Bear Put Spread | Long Call Butterfly | |

|---|---|---|

| Advantages | Risk is limited. It reduces the cost of investment. |

Profit earning strategy with limited risk in a less volatile market. |

| Disadvantage | The profit is limited. |

Premiums and brokerage paid on multiple position may eat your profits. |

| Simillar Strategies | Bear Call Spread, Bull Call Spread |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|