Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

10.69% 1,382,036 Clients

Kotak Securities Account Opening Enquiry

Kotak Securities - Pay ZERO Intraday Brokerage + F&O Rs 20 per trade. Open Instant Account Now

Incorporated in 1994, Kotak Securities is a subsidiary of Kotak Mahindra Bank and part of Kotak Group. The company is a full-service stock broker and offers a range of trading and investment services. It offers retail trading services in Equities, Commodities, Currency and Derivatives etc. In investments, it offers online IPO, Mutual Funds, Bonds and other fixed-income instruments to its customers.

Key Facts About Kotak Securities

Kotak Securities has invested significantly in technology and offers a range of online trading software to its customers. Major platforms and tools offered by the company include:

Kotak also offers many trading tools like:

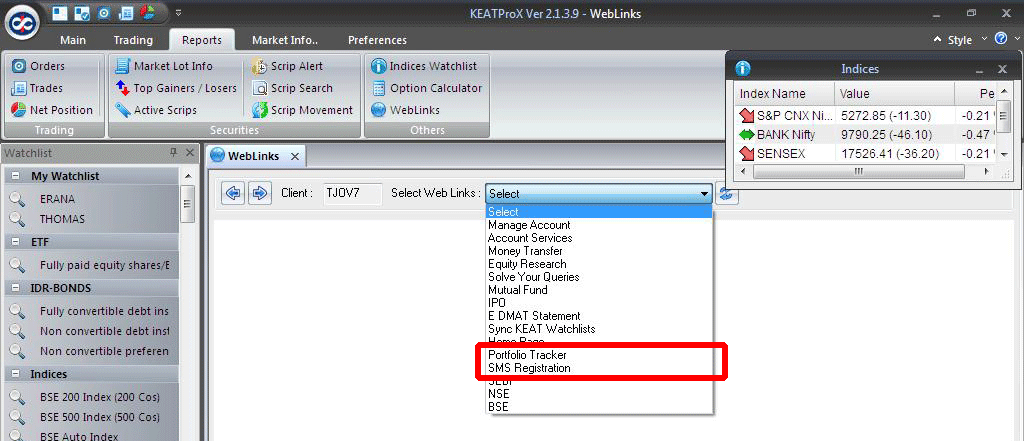

Kotak KEAT Pro X is a free, user-friendly and high-speed online trading software. The software can be downloaded on a desktop or a laptop for online trading in BSE, NSE currency markets and MCX Commodities. Key features of the KEAT Pro X trading platform are-

Kotak KEAT Pro X Application Download (Kotak KEAT Pro X online trading software free download)

The Kotak KEAT Pro X online trading software is downloadable. It is available for download for Windows .Kotak customers can download KEAT pro x for windows from the company's website.

Steps to download KEAT Pro X for Windows and Mac-

Kotak KEAT Pro X Demo

Each trading platform is unique in features, functions and capabilities. Kotak KEAT Pro X offers a range of advanced features which would require some understanding to use optimally and intuitively. Kotak Securities provides a demo video that explains all the features of the desktop trading platform. The Kotak KEAT Pro X demo video is available on its website.

Steps to Watch Kotak KEAT Pro X demo video

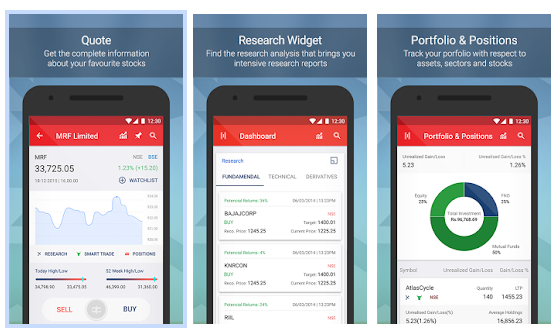

The Kotak Stock Trader is a mobile trading app. It is available free to all Kotak online trading customers and non-customers. Non-customers can download the app and sign in as a guest user and access its various features. The Kotak Stock Trader mobile trading software enables monitoring the markets, provides live quotes, helps traders create watchlists and view intraday charts. Key features of the Kotak mobile trading app are-

Kotak Stock Trader Download (Kotak Securities App Free Download)

The Kotak Securitiesmobile app is available for Android, iOS and Windows smartphone devices.

Kotak Stock Trader Demo (Kotak Mobile App Demo)

The Kotak stock trader app provides all the essential trading features of an online trading platform in a mobile app. If you wish to learn about how to use the Kotak stock trader app and know in detail about its various features then you can watch Kotak Stock Trader Demo video available in the youtube.

Steps To Watch Kotak Stock Trader Demo

The Kotak Securities Website is an online trading website that offers all the essential trading features to the customers. The easy-to-use website can be accessed from any browser. Some of the key features of the web-based trading platform are-

Kotak also offers smallcases, a 3rd party investment tool. This tool is offered by many other stock brokers like 5paisa, Zerodha etc. A smallcase is a portfolio or a basket of stocks and ETFs built around a theme, idea or strategy. It consists of 2 to 50 instruments. Key features of the smallcase platform are-

Kotak Securities Fastlane is designed for those traders who are using an old, slow computer. The Kotak Fastlane is a light and fast trading application built using Java technology. It even works on computers where installing .exe files is not permissible as in office computers. It doesn't require you to download or install any software. Key features offered by Kotak Fastlane are-

Kotak Securities Xtralite website is designed for traders who have slow internet connectivity and therefore are unable to use other online trading software. Xtralite is a light and fast online trading website to trade in stock markets. Key features of the website are-

Kotak Call and Trade facility allows a customer to place an order over the phone by calling Kotak Securities Call and Trade number. The Call & Trade facility allows you to place as many orders as you want in a single call. There is no limit to the number of calls in a trade. Kotak customers can trade in all scrips in the cash, IPO and derivative segments. Kotak Call & Trade charges vary depending on the type of account.

Account Type | Charges |

|---|---|

Gateway Account/ Advance Brokerage Account | First 20 calls free, Rs 20 per call charged after that |

Value Account | First 20 calls free, Rs 15 per call charged after that |

Privilege Account | Unlimited free calls |

High Trader Account | First 20 calls free, Rs 15 per call charged after that |

Kotak Securities is the first broking firm to allow customers to trade from WhatsApp & Telegram messaging apps. Customers can place a trade via Chat to Trade by sending a WhatsApp or Telegram message on 7400 102 102 from their registered mobile number. A once-in-lifetime 2-step authentication process is done, and if successful customers are connected by the system to their respective dealers. The facility also allows putting a request for fund transfer, margin requirement, portfolio information, and other service related queries.

The chat transcripts are recorded and stored in pdf format to ensure complete transparency.

Steps To Chat To Trade (How To Trade Using Kotak WhatsApp Facility)

In addition to advanced trading platforms and online trading services, Kotak Securities also offers good trading tools to its customers. These applications help customers in analyzing their trades, get market insights and keep a tab on market trends. Kotak Securities offer 3 trading tools or applications to its customers:

Kotak TradeSmart Derivatives is designed for derivatives traders and helps them monitor and analyze different types of derivatives instruments like Call Options, Put Options, and Futures Contracts etc. The application provides real-time information on trades to traders. Key features of Kotak TradeSmart Derivatives applications are-

Kotak Securities TradeSmart Insights brings you information and insights on markets and stocks from across the globe. The application provides real-time insights on stock markets, detects market sentiment, offers instant alerts, and provides recommendations from different brokerage to make informed trading decisions. Key features of the platform are-

Kotak Securities Smart Trends provides trends for each scrip in your portfolio or watchlists and helps you decide the levels to buy/sell a particular stock. Key features of the application are-

Kotak Securities doesn't offer commodity trading services. However, commodity services are offered by its sister company Kotak Commodities.

Kotak Securities offers currency derivatives trading. Kotak Securities customers can use any of the trading software online to trade in currency Futures and Options.

The steps to download Kotak Securities trading software is discussed above.

Key Takeaways

Open a 3-in-1 account and get:

Interested in opening a trading account? Open Instant Account Now

For buying stocks in Kotak Securities, you need to open a Trading and Demat account with the company. Kotak securities offer stock purchases through mobile, desktop, tablet, or laptop.

Steps to buying stocks in Kotak Securities:

You will receive a message confirming your order.

You can withdraw funds from your Kotak securities online through Kotak Securities web or mobile trading platform in a few steps:

Steps to withdraw money from Kotak Securities:

Points to Note:

Kotak Securities account requires activation when you log in to your Kotak Securities account for the first time.

Steps to log in to Kotak Securities first time:

Once your account gets activated, you can start your investment journey using the login credentials set during the account activation.

Kotak Securities user ID is an alphanumeric ID required to log in to your Kotak Securities trading account.

The User ID is unique to each customer and is provided once your Kotak Securities account gets opened. If you forget your User ID, you can click on Forgot User ID and provide your mobile number, PAN number and Date of Birth to retrieve your User ID.

MIS or Margin Intraday Square-Off is an order type used for intraday trading in Kotak Securities.

MIS facility in Kotak securities allows you to take higher exposure than the funds available in your account and trade intraday with margin benefits through cash and stocks. You can take multiple positions across segments using MIS, including cash, stock futures, index derivatives, and currency on the NSE and MCX exchanges.

The open MIS positions need to be squared-off as per the below cut-offs failing which the broker initiates auto-square off of these positions.

Auto Square Off Timings:

Kotak Securities offers traders the opportunity to place basket orders. With a basket order, you can place multiple orders for multiple scrips with a single click.

All you need to do is create a basket with multiple orders for the same or different stocks and combine these orders to place them in one go.

You can create up to 10 baskets of 50 securities each.

Each basket can contain stocks from different segments, i.e. equity derivatives, currency or commodity stocks can be included in one basket.

Baskets can also be created after the market closes. Once created, baskets remain saved, i.e. you can create baskets after the market closes and then execute them during market hours.

The basket order function can be used via the "Orders" tab in Neo mobile/web.

The steps to place a basket order with Kotak Securities are:

To sell shares through Kotak Securities app, follow the given steps:

Kotak Securities Account Opening Enquiry

Kotak Securities - Pay ZERO Intraday Brokerage + F&O Rs 20 per trade. Open Instant Account Now

Information on this page was last updated on Friday, July 5, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|