Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

2.33% 1,905,641 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

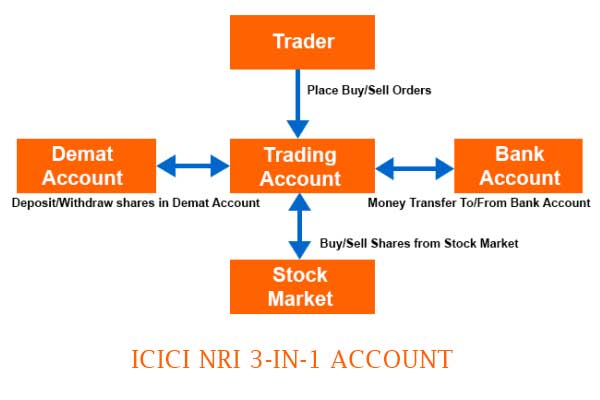

ICICI Bank offers trading and investment opportunities in India stock market to NRIs through ICICI NRI 3-in-1 account. It is a combination of an NRI saving bank account, an NRI Demat, and an NRI trading account.

The ICICI 3 in 1 Account for NRI enables you to trade online in BSE & NSE without the worry to monitor the settlement cycles, transfer funds from bank to trading account, etc. It offers a range of services including online investment in Equity, Derivatives (F&O), Mutual Fund, Bond, NCD, FD, IPO, and ETF.

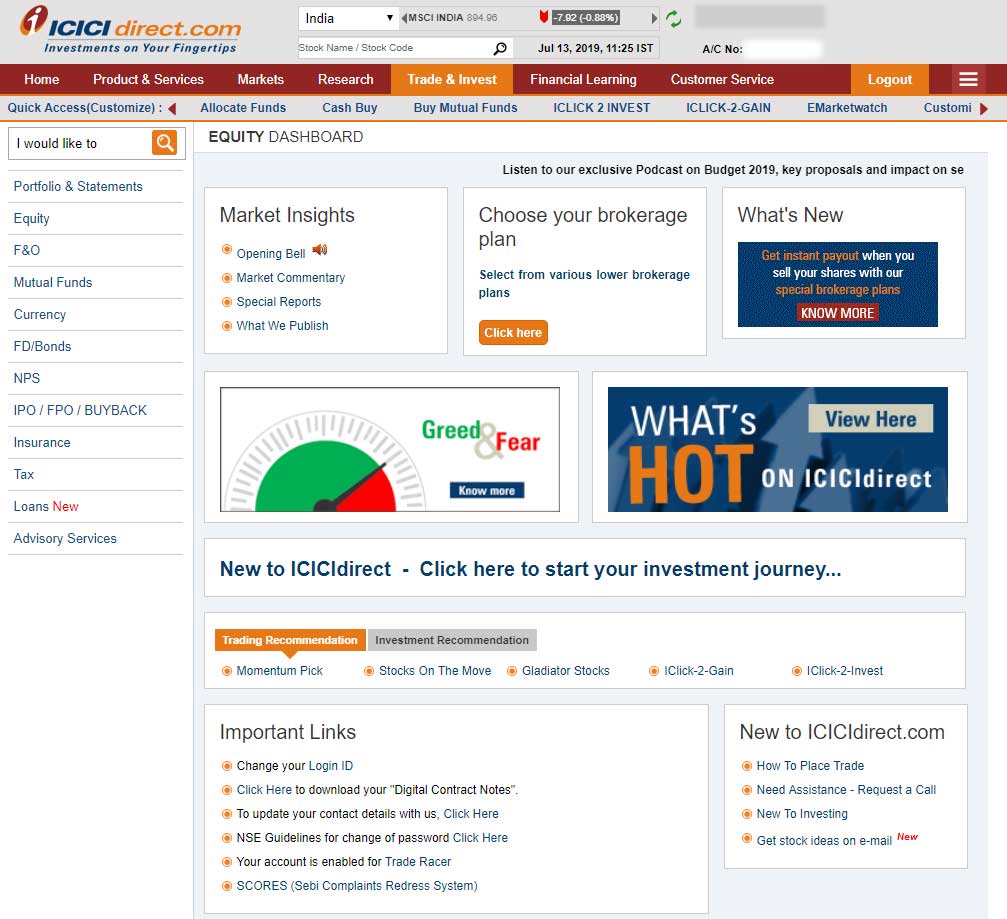

ICICI Bank offers trading and investment services to Non-resident Indian (NRI) customers through its subsidiary ICICI Securities. The online trading and services are offered via its flagship website ICICIDirect.com.

ICICIdirect NRI brokerage charges range from 0.50% to 1.25% for Equity Delivery trades, from o.03% to 0.05% for Equity Futures trades and flat Rs 70 to Rs 95 for Equity Options trading. The ICICI NRI trading account charges vary by the total trade volume of the customer.

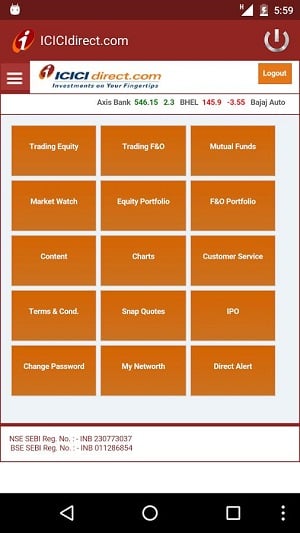

ICICI Securities offers a range of online trading software to its customers. This includes ICICIDirect.com website, ICICIdirect Mobile Trading App and Trade Racer, an installable trading terminal.

ICICI also offers online mutual funds to NRIs. Investors can choose from a range of schemes and invest without the hassles of any paperwork.

To invest in India Stock Market or Mutual funds in India an NRI has to open ICICI NRI 3-in-1 Account.

ICICIdirect 3-in-1 Online Trading Account Features

This combo account includes:

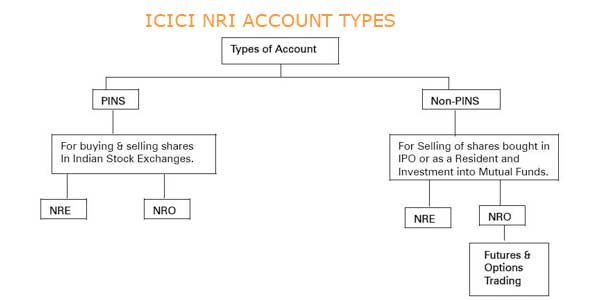

ICICI Bank offers 2 type NRI account types:

Visit NRE Vs NRO Bank Account for the detailed comparison of NRI Bank Accounts.

In addition, each NRI bank account is tagged as PIS or Non-PIS account. PIS (Portfolio Investment Scheme) is an RBI scheme through which NRIs and PIOs can buy and sell shares, mutual funds, bonds, etc in India stock exchange.

Note that

NRI Trading Account allows customers to buy/sell stocks, bonds, NCD, ETF, etc from a stock exchange like BSE and NSE. The trading account is required if you are planning to invest/trade in India Stock Market.

The ICICI Securities NRI Trading Account can be accessed by visiting ICICIDirect.com or using ICICIdirect Mobile App on Android or Apple phones.

The ICICI trading account charges for NRIs (i.e. AMC, Brokerage) are different for resident Indian trading account. In most cases, the NRI charges are 5 to 10 times higher because of the lengthy trade settlement process and tough compliance.

ICICI Bank offers NRI demat account through its membership with NSDL and CDSL. A demat account is mandatory to invest/trade in India Stock Market. It's an online account which holds the securities you bought in electronic format. The demat account is a secure way to keep your stocks, mutual funds, ETF, Bonds, etc.

The ICICI Securities NRI Demat Account can be accessed from ICICIDirect.com, ICICIdirect Mobile App or by login directly on NSDL or CDSL website.

ICICI NRI Demat Services Review

ICICI offers a completely online and fast trading experience to NRI investors. Once your 3-in-1 account is opened, the step-by-step ICICIDirect NRI trading procedure for trading in Equity Delivery segment is as follows:

Login to ICICIDirect.com and place a buy or a sell order online. ICICI's system will check the funds and shares available in your bank and the demat account. If everything is alright then your order will be executed on the exchange.

Depending on whether it is a buy or sell order, your linked NRI bank account, and linked NRI demat account is automatically credited or debited.

The transaction is automatically reported by ICICI Securities to ICICI Bank for onward reporting to RBI, as per the Regulations.

ICICIdirect NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹4000 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.50% - 1.25% |

| Equity Future Brokerage | 0.03% - 0.05% |

| Equity Options Brokerage | ₹70 to ₹95 |

| Other Charges |

The trading platform offered by ICICI Securities is the same for resident Indians as well as NRIs.

Availability of Good Till Canceled (GTC, GTD or VTD) and After Market Order (AMO) order types make ICICIDirect most favorite trading portal for NRI's.

ICICIDirect offers 3 trading software:

Read ICICI online trading software review for more detail.

The investment options available to an NRI at ICICIdirect.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others | ETF, Corporate Bonds, NCD, FD, Insurance |

To trade/invest with ICICI, An NRI has to open a 3-in-1 NRI account.

ICICIDirect offers a number of ways to open an account based on the country where you reside. Below are a few popular ways to open an account with ICICI:

ICICI bank offers online account opening to US based NRIs. The paperless account opening is not available in any other country.

An NRI from the US can open an NRI bank account in just 2 days. Below are the steps to open paperless NRI bank account with ICICI:

In case of any clarification required, an email is sent to the customer and also an ICICI representative gets in touch with you.

ICICI Securities has its offices in Oman, Bahrain, Abudhabi, and Dubai. You can visit any of the nearest ICICI Securities Center or ICICI Bank branch and get assistance on opening an NRI 3-in-1 account. You can also hand over your completed Account Opening form at these branches.

One of the preferred ways to open an NRI 3-in-1 account is visiting the ICICI branch when you are visiting India. This process is easy and convenient.

Note:

You need to provide the following documents to open an NRI account with ICICI:

All the required documents need to be self-attested and to be attested by the Indian Embassy or any other competent authority like Consulate General / Notary Public / Any Court / Magistrate / Judge / Local Banker of the country where you are currently residing.

Please note that in case you do not have a PAN card, ICICI offers free assistance in applying for a PAN number.

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

ICICIdirect offers online investment services in Mutual funds. The process is hassle-free and paperless for ICICI NRI 3-in-1 account holders.

Key Features of ICICIDirect NRI Mutual Fund

ICICIdirect NRI Support Desk contact information. Find ICICIdirect NRI contact number.

| ICICIdirect NRI Helpline | Number |

|---|---|

| ICICIdirect NRI Customer Care Number | +91-22-28307780 |

| ICICIdirect NRI Customer Care Email ID | nri@icicidirect.com |

ICICI is a highly recommended trading account for NRIs who are looking for investing in the stock market and mutual funds in India. It offers a convenient way to invest with competitive brokerage charges. It offers a range of investment options along with a dedicated RM, NRI support desk, free research, and tips. GTC and AMO order helps NRI customers to place an order in their own convenient timings.

Yes, an NRI can open an account with ICICI Direct to trade in India stock market or invest in Mutual funds. NRIs can open a demat account in ICICI by filling an online application form. They need to open an NRI 3-in-1 account which includes 3 accounts; NRI Bank Account (PIS or Non-PIS), NRI Trading Account (NRE or NRO) and NRI Demat Account (NRE or NRO).

ICICI Bank offers 2 types of NRI bank accounts:

Read NRE Vs NRO Bank Account for the detailed comparison of NRI Bank Accounts.

NRI Trading Account allows NRIs to trade stocks, bonds, NCD, ETF, etc from stock exchanges like BSE and NSE. The trading account is of 2 types depending on whether it is linked with your NRE or NRO bank accounts.

ICICI Bank offers an NRI demat account through its membership with NSDL and CDSL. The NRI Demat Account is linked with the NRO or NRE bank account.

Once your 3-in-1 account is opened, you can buy/sell shares, derivatives and bonds etc., online using the various trading software offered by the stock broker.

Note:

ICICI NRI Account is a bank account for Non-resident Indian (NRI) to invest their foreign earnings in India or to manage the money they are earning in India.

NRI customers who would like to invest in India stock market, Mutual funds, IPO, FDs, etc. need an NRI account. Almost all large banks in India offers NRI account.

ICICI Bank offers two types of saving bank accounts to NRI:

Visit NRE Vs NRO Bank Account to find the difference between NRE and NRO account.

Note:

ICICI NRI Account offer convenience to save and invest in India. An NRI can open an account in the following ways:

Note: US based NRIs can open an NRI account online through a complete paperless process. The account is opened in just 2 days. This facility is not available to residents in any other countries.

Steps to close ICICI Bank NRI account online:

Note:

Closure proceeds of NRO Savings account cannot be transferred to an NRE or any third party account.

Segment | Brokerage Charges |

|---|---|

Equity Delivery | 0.50% to 1.25% |

Equity Futures | 0.03% to 0.05% |

Equity Options | Rs 70 to Rs 95 |

Tax | Equity Delivery |

|---|---|

0.1% on both Buy and Sell | |

Transaction / Turnover Charges | NSE: 0.00325% | BSE: 0.003% per trade (each side) |

Goods and Services Tax (GST) | 18% on (Brokerage + Transaction Charge) |

SEBI Charges | Rs 15/Crore |

Stamp Charges | 0.01% on delivery based turnover and 0.002% on non-delivery based turnover |

Total Turnover (per month) | Brokerage |

|---|---|

Trades above Rs 50 lacs | 0.50% |

Rs 25 lacs to Rs 50 lacs | 0.75% |

Rs 10 lacs to Rs 25 lacs | 0.90% |

Rs 5 lacs to Rs 10 lacs | 1.00% |

Up to Rs 5 lacs | 1.25% |

How ICICI NRI Brokerage slabs are calculated?

If the total value of buy and sell transactions is Rs 5,00,001 or more in any calendar month, brokerage for the next month would come down to 1.00%. However if in the next calendar month, the total value of buy and sell transactions is less than Rs 5 lacs, the applicable brokerage fee for the next quarter would increase to 1.25%.

ICICI NRI Trading and Demat Account Conversion

A Resident Indian Trading and Demat account cannot be converted into a Non-Resident Indian (NRI) account. An NRI customer should close the resident account and open a new account with NRI status.

This is because NRI accounts have tough compliance requirements. These accounts are closely monitored by RBI in India and by the government of your country of current residence.

Thus changing ICICI account trading and demat status from Resident Indian to Non-Resident India is not possible.

Note:

ICICI NRI Bank Account Conversion from Resident to NRI

In case of a Resident Saving Bank Account, the account can be converted into NRO Saving Bank Account. The NRO account can be converted into an ICICI NRI 3-in-1 account by adding NRI Trading and Demat Account to it.

There are 3 possibilities of an NRI bank account goes to inactive status:

The process of opening ICICI NRI Account for UK based NRIs is same as the process for the rest of the world (except the US where account process is paperless).

To open ICICI NRI Account in the UK, an NRI has to:

Yes, An NRI can open an NRI Demat Account (NRE or NRO) with ICICI Bank.

The best option available for NRIs is to open ICICI NRI 3-in-1 account. This account is a combination of bank, trading and demat account, interlinked together for seamless transitions between these accounts.

The ICICI 3 in 1 account for NRI offers trading/investing in stocks, mutual funds, IPO, Bonds, NCDs, FD and equity derivatives.

ICICI NRI account opening process is a paper-based process (except for US residents). An NRI has to request a PDF form from the bank, fill it up, sign it, attached supporting documents, attach check/dd for account opening fee and send it to the ICICI Bank Mumbai Branch.

ICICI Bank offer complete online account opening to USA based NRIs. This paperless process enables NRI's to open NRE/NRO bank account in just 2 days.

The online account opening with Aadhar based digital signature is not available to NRIs.

US based NRIs can open an account online. This paperless process takes only takes 2 days to open an account once the online application is submitted.

For all other countries, an NRI has to download the PDF form, fill it, sign it and send it to ICICI Bank Mumbai office.

An NRI can open a demat account in ICICI either by opting for an NRI 3-in-1 account which allows an NRI to open a trading and bank account along with a demat account.

The NRI Demat Account opening process is a manual process where an NRI has to fill the form online, print it, sign it and send it to the ICICI Bank Mumbai office. It takes 2 days once the paper received by the bank to open the account.

The easiest way to open an NRI demat account is by visiting any of the nearest ICICI Securities Center or ICICI Bank branches while visiting India. ICICI Securities also has its offices in Oman, Bahrain, Abudhabi, and Dubai.

Steps to open NRI Demat Account in ICICI

Note:

NRO account in ICICI helps NRI to manage their funds originated in India. NRIs can also deposit foreign funds in the NRO account.

The following are the documents required for ICICI Bank NRO account opening:

Address Proofs (Any one):

Process to open NRO Account with ICICI Bank online:

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Friday, November 17, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Conclusion is ICICI is good to you as long as you bank with them onces things slow down...they dont care about you as a customer.