Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

2.33% 1,905,641 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

ICICI Direct, an ICICI Securities Ltd investment portal offers IPO's as a key product offering. With ICICIDirect.com, customers can apply in Initial Public Offers (IPO) and (Follow-on public offers) FPO at BSE & NSE.

Online IPO Application of ICICI Bank is the easiest, fastest and most convenient way to apply for IPO shares.

Below are few easy steps to apply in an IPO with ICICI:

Once you submit the online IPO form, ICICIdirect.com will complete the all the formalities related to submission of your IPO form, using the Power of Attorney issued by you at the time of account opening.

Apply IPO with ICICI Direct in 5 easy step. Follow the screenshots below:

As of Sept 2016, ICICI Bank doesn't offer online applications for SME IPO's (IPO's at BSE SME and NSE Emerge exchange).

ICICI Customer has to apply in SME IPO's by filling the paper IPO application forms.

Follow the below simple steps to check the status of you IPO application through ICICI:

ICICI Bank Online IPO Application is free for all its customers having 3-in-1 account. Customer do not pay any fee, charges or taxes to apply for IPO shares.

Note: Customer has to pay brokerage and taxes when they sell the shares allocated to them through IPO. The changes are same as you sell any shares bought directly from the stock market.

ICICIDirect is most expensive stock broker in India and there brokerage are highest in the industry. Discount stock brokers like ProStocks charges 60 to 90% less brokerage charge but they do not offer IPO as a product.

On allotment, the IPO shares are directly credited to your demat account and available for you to sell them on date of list at the respective exchanges.

You can check the IPO Allotment Status on ICICI direct website. Please follow the steps below:

Note: The IPO allotment status on ICICIDirect website is updated only after the shares are transferred to your demat account (usually a day before IPO shares listing). If you would like to check the allotment status earlier, please visit IPO registrar's website.

ICICI Direct allows you to apply for IPOs through your trading account. You could use the ICICIDirect.com website or its mobile trading app to apply in IPO online. It takes just a minute to apply in IPO through ICICI Direct. You could also modify or cancel IPO application, check the status and sell allocated shares through the same website or app.

Steps to apply in IPO through ICICI Direct Website

You will receive SMS and email confirming your IPO order execution by the end of the day.

For more detail please read:

You can revise or cancel an IPO application online while the IPO is still open for subscription. You can use the ICICIDirect.com website or mobile app to cancel your IPO order.

Steps to Cancel IPO Application in ICICI Direct

Note:

While an IPO is open for bidding, you can place the order for IPO share anytime (24x7) by visiting ICICIDirect website.

Yes, ICICI Direct customer can place orders to buy & sell shares, apply in IPO, buy mutual funds, trade in Equity F&O over the phone using ICICI Bank Call & Trade service. This service is offered free of charge to all its customers for up to 20 calls in a month. After that customer has to pay Rs 25 per call as Call & Trade fee.

Yes, you can withdraw an IPO Application while the IPO is still open (bidding is in progress). Simply Follow login to ICICI direct website, visit the IPO Order book for placing a withdrawal request.

After successful processing of your withdrawal request, the money will be unblocked in your bank account.

At ICICIdirect.com, IPO application is applied under ASBA and so the money only gets blocked once you apply in the IPO. In case shares gets allotted, the value of shares allotted gets debited and remaining funds if any, gets released/unblocked. This generally happens on the 5th working day post closure of IPO.

Post IPO is closed the allotment process gets completed within next 5 working days and on the 6th working day the shares are listed on the exchange.

Only 1 IPO application allowed per saving bank account with ICICI Bank.

ISec is an abbreviation for ICICI Securities. ICICI Securities a popular financial service provider to retail investors in India. The company offers its trading and investment products under the brand name of ICICI Direct.

ICICIDirect.com website and ICICIDirect Mobile app are two popular platforms offered by the company for online trading in investment in the stock market, mutual funds, IPO, Fixed Deposit, Bond, NCD, wealth products, Insurance and loans etc.

ICICI Securities Ltd offers a wide range of financial services including investment banking, institutional broking, retail broking, private wealth management, and financial product distribution.

The company is headquartered in Mumbai and operates out of 75 cities across India. It also has wholly-owned indirect subsidiaries in Singapore and New York.

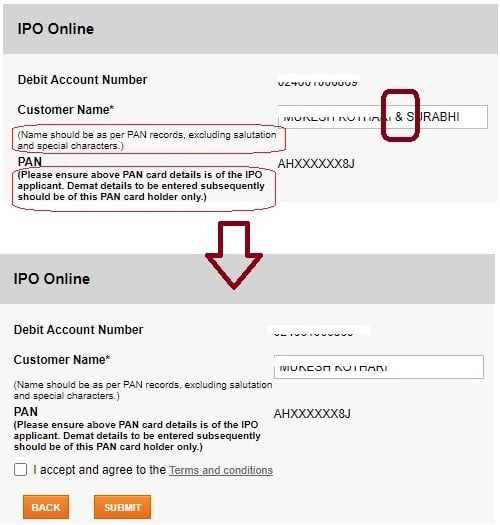

The ICICI bank permits only one IPO application through a bank account irrespective of the account type as individual or joint.

The IPO application should be on the name of the first account holder.

When applying in an IPO through ICICI bank net banking, you will have to remove the name of the joint account holder. The applicant's name should be as per the PAN number listed on the page.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Friday, November 17, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|