Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

8.96% 404,885 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Axis Bank, the 3rd largest private bank in India, offers a 4-in-1 account to NRI customers. This account is a combination of a PIS & Non-PIS Bank Account, Trading Account, and Demat Account.

Axis Bank has 10 international branch offices across the world to serve NRI customers. These branches are located across major cities around the world including London, Dubai, Singapore, and Shanghai. Axis bank does not have an office in the USA.

The Axis NRI 4 in 1 Account enables you to trade online in stock exchanges in India. An NRI customer can invest in Mutual Fund, Bond, NCD, FD, IPO, ETF and trade in Equity, Equity Derivatives (F&O) using this account. The account also gives you the convenience to trade online without worrying about settlement cycles, funds transfer from the bank to the trading account, and reporting to RBI, etc.

Note that online trading is not available to NRI's located in the USA.

Axis Bank offers trading and investment services to Non-resident Indian (NRI) investors through its subsidiary Axis Direct. The online broking and investment services are offered via its website axisdirect.in.

Axis Direct NRI brokerage charges for equity delivery is 0.75%, for equity Futures is 0.05% and for equity options, the rates are 1 paisa per lot for intraday and Rs 1o per lot on carry-forward positions.

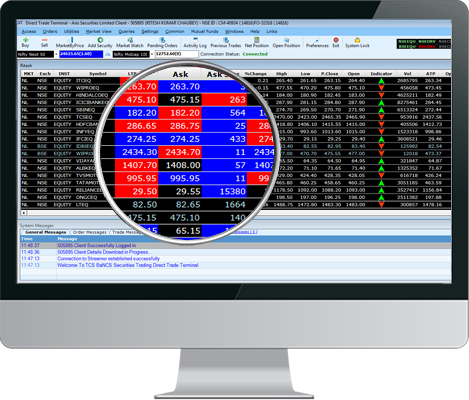

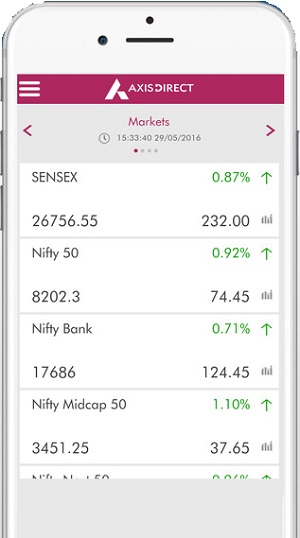

Axis Direct trading software for NRI's includes; AxisDirect.com online trading website, Axis Direct Mobile trading app and DIRECTTrade desktop trading terminal.

Axis Bank NRI customers can also benefit from research recommendations and investment advice from top global research companies such as Reuters, The Screeners, and Recognia.

Axis Bank NRI 4-in-1 investment account is a key offering to NRIs. This account offers multiple online investment options in India under one login id. The 4-in-1 NRI account is the most convenient way to invest in stock markets and mutual funds in India.

Key Features of Axis 4-in-1 Trading Account

Axis 4-in-1 investment account consists of 4 different accounts:

All these accounts are linked together for seamless transactions among them. When an NRI buy shares through the trading account, money is withdrawn from the PIS bank Account and the shares are credited to the demat account. When they sell shares, the shares are debited from the demat account and money gets deposited in the PIS account.

The 4 in 1 account include 2 bank accounts; a PIS NRI Saving Bank Account and a Non-PIS Saving Bank Account.

The PIS Account is used for buy/sell of equity stocks in India. All transactions from this account are reported to RBI by the bank.

The Non-PIS Account is for trading in derivatives, investments in mutual funds, ETFs and holding income earned from rent, business and other incomes in India.

The NRI Demat accounts help you in keeping all bought securities like stocks, IPO shares, and mutual funds, etc., in electronic format. In a 4-in-1 account, the demat account is linked with an NRI bank account and NRI trading account.

Axis NRI Demat Account Review

The trading account enables NRI customers to place buy/sell orders for stocks and derivatives trades. Customer use trading software provided by the broker to place orders, monitor market on a real-time basis and check the status of orders placed.

The step-by-step AxisDirect NRI Trading process is as follows-

Use any of the trading software provided by Axis Direct to place an order.

The system will first check the availability of funds in your linked bank account before executing the order. Orders are now send to the exchange. Once order is executed, a confirmation is received by the client.

The funds are deducted from your bank account. The shares are credited in your demat account on T+2 days with T being the day of trading.

At the end of the day, all your transaction details will be forwarded to PIS authorities.

AxisDirect NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹2500 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.75% |

| Equity Future Brokerage | 0.05% |

| Equity Options Brokerage | Intraday: 1p per lot, Carry Forward: ₹10 per lot |

| Other Charges | PIS Acct AMC: ₹1,500, Minimum Brokerage ₹50 |

Axis Direct offers the same trading platform to NRIs as well as resident customers.

The Good Till Date Orders (GTDt) and After Market Orders (AMO) makes it easy for NRIs to invest in stock market. NRIs can place buy/sell orders at any time.

Axis offers a range of online trading software and tools:

Axis DirectTrade

Axis Mobile App

The investment options available to an NRI at AxisDirect.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

The Axis Direct NRI Account Opening Process is online, simple and fast.

Below is the list of Axis NRI account documents for an individual. An NRI has to submit notarized copies of all these documents.

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

Axis Direct offers mutual funds to NRI investors. You can invest in AxisDirect NRI mutual fund schemes by using the 4-in-1 trading account.

Key Features of Axis NRI Mutual Fund

Please read our article NRI Mutual Fund Investment Online in India to know in detail about NRI mutual fund investments regulations, taxation and top brokers offering mutual funds to NRIs.

AxisDirect NRI Support Desk contact information. Find AxisDirect NRI contact number.

| AxisDirect NRI Helpline | Number |

|---|---|

| AxisDirect NRI Customer Care Number | +91 22 4257 0809 |

| AxisDirect NRI Customer Care Email ID |

AxisDirect is a good choice as a stock broker for NRIs looking to invest in stocks, derivatives, mutual funds and IPOs in India. The company offers 4-in-1 account and good trading software and investment tools to its customers. Also, the brokerage charges of the company are competitive among full-service brokers. Axis provides many customer-friendly features to NRIs like AMO orders, Call & Trade and Relationship Manager for quick assistance.

Axis NRI Account opening process is partly online. NRI customers have to fill the account opening forms online, download them in PDF format, print them, sign and sent to Axis Bank.

If you live in 10 cities where Axis Bank has an international branch or if you are visiting India, you could visit a branch and open the account conveniently.

An NRI can open an account online with Axis Bank in the following 4 steps:

No, the online trading facility is not available for NRI investors based in the USA. Such investors, however, can invest via their Relationship Manager or using call & trade facility.

Yes, Axis Direct offers the on-phone trading facility to NRIs.

You can call on the NRI trading desk number +91-22-42570809 between 8:30 AM (IST) to 6:30 PM (IST) on working days of NSE and BSE and place your orders.

A Non-Resident Ordinary (NRO) savings account can be opened to receive and manage your income earned in India, such as dividends or pensions, or to deposit existing savings. Process of opening an NRO account with Axis Bank:

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|