Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

The IPO cancellation and modification facility helps investors to make these desired changes.

hide

Content:

Once an investor has applied for an IPO, there may be scenarios when the investor may want to change the bid quantity or bid price to increase their chances of allotment based on the IPO demand. Sometimes, it may also happen so that the investor may think that the IPO is not right and would like to cancel and withdraw their bid.

The IPO cancellation and modification facility helps investors to make these desired changes.

However, there are certain rules and restrictions for cancellation and modification of the IPO.

Rules for IPO application cancellation and modification requests

Note: Investors can check with their broker/bank in advance for the cancellation/modification time on the last day.

Rules based on investor category

The below table summarizes the rules for IPO cancellation and modification:

|

IPO Investor Category |

IPO Bid Cancellation Rule |

IPO Bid Modification Rule |

|---|---|---|

|

Retail Investor |

Bid can be cancelled. |

Bid size can be increased or decreased. |

|

QIB |

Bid cannot be cancelled. |

Can only increase the bid quantity or price but cannot lower it. |

|

NII |

Bid cannot be cancelled. |

Can only increase the bid quantity or price but cannot lower it. |

|

Employee |

Bid can be cancelled if the bid size is lower than Rs 2 lakhs. |

Bid size can be increased or decreased if the bid size is lower than Rs 2 lakhs. |

|

Shareholders |

Bid can be cancelled if the bid size is lower than Rs 2 lakhs. |

Bid size can be increased or decreased if the bid size is lower than Rs 2 lakhs. |

Note: The above cancellations and modifications are permitted anytime while the IPO is open for subscription.

Investors can cancel/delete the IPO application online/offline. Online cancellation is much faster than offline cancellation. However, the option to cancel/withdraw/delete the IPO request is available only after the order has been submitted to the Exchange.

Note: In case of UPI IPO application, sometimes it is required to revoke the mandate. In some cases, the bank will refund the amount after the UPI mandate expires. Investors must check with the bank for the UPI-specific procedure in advance.

The broker submits the cancellation request to the Exchange between 10 am and 5 pm. The broker updates the status of the cancellation request as soon as it receives confirmation from the exchange. Investors receive an email notification when the request is cancelled.

Note: The above is a generic process and will differ a bit for every broker/bank.

Investors can withdraw from an IPO anytime while the IPO is open for subscription. The exchange IPO bidding window is open from 10 AM of the issue open date to 5 PM of the issue closure date. Investors can cancel an IPO anytime during this bidding window.

Some brokers may have set a specific time for cancellation. On the last day, many banks and brokers have a specific deadline for submitting cancellation requests to avoid last-minute problems. Therefore, it is important for investors to check with their broker/bank in advance for the exact deadlines for canceling the IPO applications.

Important note: The online "Cancel/Withdraw" option is only visible if the IPO application has been successfully submitted. If the investors do not see the cancellation option online, contact the bank or broker through whom the application for the IPO was submitted.

IPO withdrawal time: 10 AM of IPO open date to 5 PM of IPO closure date.

Investors can cancel an IPO at any time during this window.

Note:

There are no cancellation fees charged by a bank or broker for withdrawing a bid either online or offline from an IPO.

For eg: Zerodha allows to place cancellation and modification requests between 10 AM to 4.30 PM when the IPO is open for subscription.

An investor has the option to amend their IPO bid if they wish to change the bid amount or quantity. Retail investors may adjust their bids by either upsizing or downsizing their bids.QIBs and NIIs are allowed only to upsize their bids i.e. they can only change to increase the bid quantity or bid price.

Like cancellation, investors can modify the IPO requests anytime while the IPO is open for subscription. Though the IPO window is open from 10 AM of the issue open date to 5 PM of issue close date, the investors should check with their broker/ bank for any specific timings for modification request submissions; especially for the last day as not all banks/brokers allow modification till 5 PM.

You can modify IPO bids either online or offline. The option to modify online is visible once the bid is submitted to exchange.

Steps to modify IPO bid online:

Steps to modify IPO bid offline:

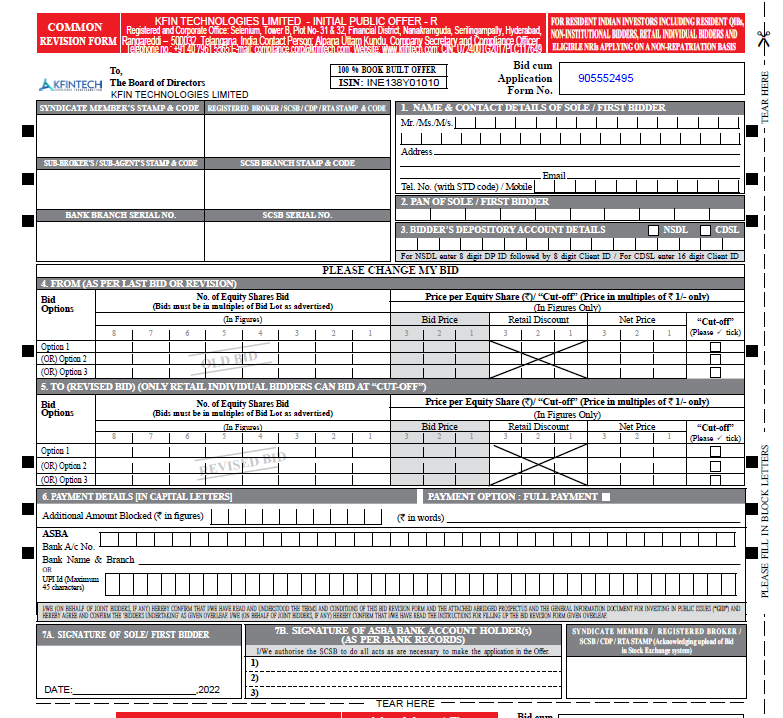

Investors can download the IPO revision form from the BSE or NSE website.

The NSE offers investors the option of downloading either a blank revision form or a pre-filled form. For more details on the IPO application form, please refer to the IPO Application process Chapter.

Sample IPO Modification or Revision Form

While submitting an IPO application, investors must follow certain points for the application to be valid, failing which the application may get rejected. There are several reasons why an IPO application may be rejected. The rejection can be on account of error by the applicant, bank or another intermediary, or due to technical problems.

The following are some of the most common reasons for the rejection of an IPO application:

Investors receive the blocked amount if their request is rejected after the mandate date.

Some banks may not refund until the mandate expires. In such cases, investors can ask the bank or intermediary whether the funds will be released after the allotment date.

Page Glossary:

1. UPI handle

UPI handle is the bank name or the payment application name that processes the UPI payment. It is the virtual payment address used for making payment via the UPI gateway.

UPI handle starts with @ and is different for every UPI mobile application. For example if the UPI payment is used making the Paytm app, the UPI handle for the said app is @paytm. Refer to the list of mobile applications for making UPI payment with the details of their UPI handle.

2. DP ID:

DP ID stands for "Depository Participant Identification". A Depository Participant, such as a bank, financial institution or brokerage firm, is assigned a DP ID number by NSDL and CDSL. DP ID varies depending on the depository institution where you have your account. The investor's demat account number is composed of the customer number ID and the Depository participant number DP ID.

Yes, retail investors can cancel the IPO. Apart from retail investors, employees or shareholders of the company investing up to Rs. 2 lakhs can also cancel their IPO applications.

IPO applications can be cancelled only during the offer period from 10:00 am to 5:00 pm. This may vary slightly depending on the broker or bank. The IPO application cancellation request submitted after the bidding window (5:00 pm to 10:00 am) will be processed by the Exchange at 10:00 am the next day.

Some brokers have a separate window for cancellation requests. On the last day, not all banks/brokers allow cancellation until 5:00 pm. Therefore, check with the broker/bank for specific deadlines.

Investors can cancel the IPO applications online or offline. The online IPO cancellation is much easier than the offline process.

Steps to cancel IPO application online (Cancel e IPO):

Note: The option to cancel/withdraw/delete IPO will be available only once the bid is submitted to exchange successfully.

To cancel the IPO application offline, investors must complete the revision form or send a cancellation letter to the intermediary through whom the application was submitted, mentioning their application number.

Steps to cancel IPO application offline:

Investors cannot cancel an IPO application after the closing date.

Cancellation of IPO bids can only be done during the IPO bidding window by retail investors, employees and shareholders whose bid value is up to 2 lakhs. QIBs and NIIs cannot cancel their bids once placed or submitted.

Yes, you can modify an IPO application anytime during the IPO subscription period.

Modification rules for IPO application:

The IPO modification window on the last day of the IPO generally closes by 3 PM. Some brokers have a specific window to modify the bids. Therefore, check with the concerned broker/bank for specific timelines.

IPO bids can be modified online or offline while the IPO is open for bidding.

Steps to modify IPO bid online:

Steps to modify IPO bid offline:

Yes, you can cancel an IPO application and reapply if you are :

Before reapplying, ensure to check the cancelled status as sometimes it may take time to cancel the bid.

QIBs and NIIs cannot cancel their IPO bids once applied.

Yes, you can withdraw an IPO application if you are a retail investor or employee/shareholder with an investment worth Rs 2 lakhs.

You can withdraw your bid online or offline depending on the mode you have chosen while applying for an IPO. Cancellation/withdrawal of bid can be done at any time as long as the IPO window is open from 10 am on the day of the opening of the issue to 5 pm on the day of closing of the issue. Cancellation requests submitted after 5 p.m. (except on the last day) will be processed the next day. Some brokers, such as Zerodha, have a specific window for cancellation requests (until 4:30 p.m.). On the last day, usually, no broker or bank allows cancellations to be placed until the cut off time of 5 pm. Therefore, check with your broker/bank for exact timelines.

QIBs and NIIs cannot withdraw the IPO application.

An IPO application can get rejected on multiple different grounds that can be technical or can due to error on part of the intermediary or the investor.

Some common reasons for IPO transaction rejection:

Yes, it is possible to cancel the IPO application.

IPO applications submitted by retail investors and employees/shareholders with an investment amount of up to Rs 2 lakhs can be canceled at any time during the subscription period.

For investors planning an IPO application cancellation, here are some critical indicators to look out for :

Yes, you can reapply for an IPO after a cancellation.

Once the IPO is cancelled by the stock exchange, the retail investor can reapply for the IPO. It may take up to 24 hours after the request for cancellation for the funds to be released.

If you cancel your IPO request, your blocked funds will be released and you may submit a new IPO request if desired.

It usually takes up to 24 hours for funds to be released. The time for funds to be released varies from bank to bank.

Only retail investors are allowed to cancel IPO applications.

Investors can withdraw the IPO bid at any time as long as the IPO issue is open for subscription.

Withdrawal/cancellation of IPO bids can be done either online or offline. To cancel the bid offline, investors should submit a duly signed cancellation letter along with their application and bid details to the intermediary where the original application was submitted.

Steps to withdraw from an IPO online:

The blocked money will be released in a day or two or on expiry of UPI mandate based on the bank policy.

A mandate request, once created, can be revoked until the issue is closed.

Following are the steps to cancel the IPO mandate in Google pay:

Investors can cancel the IPO mandate in PhonePe by clicking directly on the notification link or via the PhonePe app.

Steps to cancel IPO mandate in PhonePe:

The BHIM app has a dedicated section for IPO, where all IPO mandates are listed in the "Pending" and "Active" tabs, depending on their status.

Steps to cancel IPO mandate in BHIM App:

To cancel IPO mandate in Paytm follow the below mentioned steps.

Yes, you can cancel your IPO application and submit a fresh application if you are a retail investor, employee or shareholder with an IPO investment amount of up to Rs 2 lakhs.

You can cancel the IPO application at any time before the closing of the issue. Once the original application is cancelled, you can reapply for the IPO.

QIBs and NIIs cannot cancel their IPO applications once applied.

Investors investing up to 2 lakhs in an IPO application can cancel their IPO order either by contacting the intermediary or online.

Generic steps to cancel IPO order online:

Investors can cancel a subscribed IPO online or offline.

An IPO bid can be canceled only by investors with an investment amount of up to Rs 2 lakhs. Cancellation is allowed only before the issue is closed for subscription. Investors cannot cancel or withdraw their bid once the issue is closed for subscription.

The online procedure for cancellation of the IPO is much more convenient than the offline procedure. To cancel the IPO bid online, investors just need to go to the IPO section and cancel the desired IPO transaction by logging in to their broker/bank's app.

To cancel the IPO bid offline, contact the intermediary through which the original application was submitted.

An IPO application can be easily deleted online through the bank/broker.

Steps to delete IPO application:

If the original IPO application was made by submitting a physical form, investors need to contact the respective intermediary to cancel the application by submitting a properly signed cancellation letter.

Yes, you can withdraw an IPO application if you are a retail investor or an employee or shareholder with bid value up to Rs 2 lakhs.

You can withdraw your IPO application before the issue closes for subscription.

No, HNIs are not allowed to withdraw, cancel or delete their IPO application once it has been submitted.

HNIs may modify their IPO application to increase bid size. HNIs cannot modify their application to decrease the bid quantity or price.

As per SEBI guidelines, only investors with an investment of up to 2 lakhs can cancel or amend their bids. HNIs are investors with a bid value of more than Rs 2 lakhs and hence cannot cancel their IPO application.

You can withdraw IPO applications only while the IPO is open for subscription.

The IPO window is open from 10 a.m. on the issue opening date until 5pm on the issue closing date. You may cancel your bids online at any time during this period once the "Cancel/Withdraw" option is visible to you. Issue cancellation requests submitted after 5 p.m. will be processed the next day. The "Cancel/Withdraw" option is visible only if the IPO application has been successfully submitted.

Some brokers (like Zerodha - 10 am to 4:30 pm) have a specific window for cancellation. On the last day of the offering, cancellation requests are generally only allowed until 2 or 3 p.m. to avoid last-minute problems. Check with your broker/bank for specific cancellation deadlines.

Yes, you can edit your IPO application.

A retail investor and an employee/shareholder with a bid value of Rs 2 lakhs may lower or raise their bid. However, QIBs and NIIs may only increase the bid size in terms of quantity or price or both. They cannot decrease their bids.

You can change your bids as per the above guidelines or any other details in your application as long as the issue is open for subscription. The time window for submitting bids is from 10:00 a.m. (opening of the issue) to 5:00 p.m. (closing of the issue). On the last day, applications for amendments are generally accepted only until 3:00 p.m.

You can process your IPO application online through the broker/bank's platform or submit the revised application form at the nearest bank or broker branch.

Yes, you can modify IPO bids online or offline before the IPO issue closure date.

Rules for IPO bid modification

The below table summarizes the rules for IPO application modification:

|

IPO Investor Category |

IPO Bid Modification Rule |

|---|---|

|

Retail investor |

Can increase or lower the bid size. |

|

QIB |

Can only increase bid size. |

|

NII |

Can only increase bid size. |

|

Employees (bid value up to Rs 2 lakhs) |

Can increase or lower the bid size. |

|

Shareholders (bid value up to Rs 2 lakhs) |

Can increase or lower the bid size. |

The submitted IPO applications can be modified online or offline during the IPO bidding window.

Generic steps to modify the IPO application online:

Steps to modify IPO application offline:

Yes, you can cancel IPO subscription if you are an investor with an IPO application amount of up to Rs 2 lakhs.

QIBs and NIIs are not allowed to cancel their IPO bids once placed. They can only modify it to increase the bid size.

An IPO application can be withdrawn by retail investors online or offline.

To withdraw an IPO application online, log into the broker app or banking platform and cancel the originally submitted IPO application.

To withdraw an IPO application offline, contact the intermediary through which the application was submitted and request cancellation.

Investors can withdraw IPO applications at any time before the issue is closed for subscription.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|