Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, May 19, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

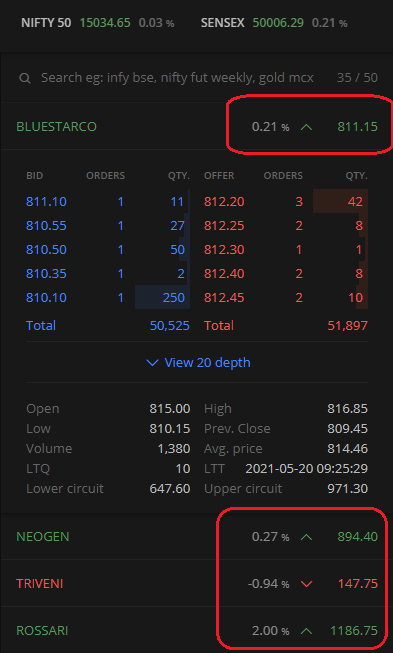

LTP in Zerodha is the last traded price of the stock at which the last transaction got executed on the exchange. LTP indicates the price at which the security is trading. It helps the investors predict stock price movement and thus helps quote relevant prices for their buy/sell orders.

Zerodha customers can view the LTP of the stock at the selected exchange once you add the scrip to your Marketwatch in Zerodha Kite.

Example: If you add BlueStar Co to your Market Watch list for NSE and BSE, you will see its LTP for both exchanges. The Marketwatch screen also displays the LTP % along with the LTP. LTP % indicates the % point movement of the stock from the closing price of the previous day. The green colour indicates that the current LTP is higher than the previous LTP. However, if the latest LTP is lower than the previous LTP, it gets highlighted in red.

In the above, we can see that the LTP of Bluestar on BSE is Rs. 811.10 and is 0.35% up from the previous day's close price, whereas the LTP on NSE is Rs.819 and is 1.41% higher than the closing price from the previous day.

|

LTP |

Closing Price |

|---|---|

|

The LTP is the price of the last transaction that got executed on the exchange. |

The closing price is the weighted average price based on the last 30 minutes of trading. |

|

The LTP gets displayed as a part of the Market Watch in Zerodha. |

The closing price gets displayed as a part of the market depth in Zerodha. |

|

During the trading hours, the LTP reflects the price of the last executed transaction. |

During the trading hours, the market depth reflects the closing price of the previous day. |

|

At the end of trading market hours, it gets updated with the price of the last transaction of the day. |

At the end of trading market hours, it gets updated with that day's closing price. |

The LTP percentage in Zerodha, by default, reflects % movement of stock from its previous day closing price. However, Zerodha offers its clients an option to view the LTP percentage change of stock from its opening price.

Steps to view LTP % movement from the opening price

This will change the setting to view the LTP % movement from the day's opening price. You also have an option to view the LTP movement in absolute value terms instead of %.

The holdings tab in Zerodha Kite also displays the LTP of the stock. The LTP on the holdings page does not change in real-time unlike, the Marketwatch screen. It usually has a buffer of few seconds. The LTP displayed on the holdings page will be the price from the exchange where the previous closing was higher.

The LTP for F&O contracts gets updated with the settlement price in the F&O position tab of Zerodha Kite at the start of each trading day.

For F&O contracts with higher liquidity, the settlement price is the same as the closing price. However, for contracts with lower or no liquidity where there have been no trades in the last 30 minutes, the exchange provides a theoretical price that gets updated in place of LTP.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

LTP or Last Traded Price in Zerodha means the price at which the stock was last traded. The LTP of stock gives a hint to a trader on the direction of price movement. The LTP is different from the Closing Price of the stock. LTP is the price at which the last trade is executed before the market closes at 15:29:59.

The last traded price (LTP) is the actual price of the last transaction.

The LTP is a real-time indicator of a stock's price performance, essential for predicting its future performance.

LTP Example

If the LTP of the stock of ABC Limited is Rs 200 and the investor believes that the price will fall, he can set a bid price of Rs 180. If he expects the price to rise, he can set a price between Rs 205 and Rs 210 to make up the price difference between placing and executing the order.

Steps to check LTP in Zerodha

LTP Meaning

LTP (Last Traded Price) indicates the last price at which the share was bought and/or sold. The significance of the LTP lies in its fluctuations, as the LTP of a share varies throughout its life.

LTP Percentage in Zerodha

The LTP percentage in Zerodha is calculated as the percentage change in the last traded price compared to the previous day's closing price.

ATP Meaning

The ATP (Average traded price) is the price that buyers pay for a share in a given period. The average traded price is also referred to as the volume-weighted average price, while the LTP is the last traded price at which the last transaction was executed on the stock exchange.

When calculating the average buy price for your shares, it is important to apply the FIFO (First In, First Out) method. This means that the shares you buy are sold first from your account. Using the FIFO method when filing your income tax return is important because the Internal Revenue Service requires it. Note that intraday trades are not taken into account when calculating the purchase average of your holdings. If you sell and repurchase your holdings on the same day, the difference will be considered an intraday gain or loss and will not affect the purchase average of your holdings.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|