Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, July 25, 2019 by Chittorgarh.com Team | Modified on Thursday, April 8, 2021

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Good Till Triggered (GTT) allows you to place an order to be sent to the exchange only when the price condition gets met. GTT is a feature introduced by Zerodha to offer a similar service like 'Good Till Cancelled' (GTC) order offered by most full-service brokers in India.

GTT in Zerodha means the facility offered by Zerodha to apply Good Till Triggered orders for buy or sell transactions. The orders placed under GTT get executed anytime within one year when the set price gets hit. GTT is available for both buy and sell orders and can be canceled at any time. The GTT feature is very helpful for traders who are unable to constantly monitor their stock market investments. Such traders can set a price for their stock under GTT that will get automatically executed when the price is reached.

Zerodha GTT example

For example, say SBI is currently traded at Rs 186 but you want to buy it for Rs 175. In such a case, you can place a GTT order for SBI and set the price as Rs 175. The order will remain active until the price reaches Rs 175 or 1 year. If the price of SBI shares reaches Rs 175 within a year, then your buy order gets automatically executed. If the price doesn't reach Rs 175 within a year, then your order gets cancelled.

You can also set your GTT trigger price at any desired percentage points away from the Last Trading Price of the share. Continuing our SBI share example, you can set -5% for shares LTP at Rs 186. The order will be executed at (186.0-9.3) = Rs 176.70

GTC orders are valid until they are cancelled. These orders are useful for investors who do not track the market daily. With the GTC order, you could simply place an order with the target price and let it be there forever. When the price matches, the order gets executed.

For example, you want to buy Wipro Technologies shares at Rs 200. One option you have is to place a Limit order every day at Rs 200. With the GTC feature, you can place this order once and forget it. Whenever the price reaches, the order will get executed.

Stock exchanges in India don't support GTC orders. For this reason, a broker offering a GTC order has to place the pending GTC orders to the exchange every day in the morning. The orders that do not get executed get cancelled at the end of the day. The placing of pending GTC orders everyday causes technical challenges and increases the cost for the broker as they have a limit of placing 400 messages per second per line.

Zerodha introduced GTT orders on 26th July 2019 for equity delivery traders (CNC orders). It's an excellent substitute for GTC orders which is a very critical trading feature for passive stock market investors.

While this has similarities with GTC orders, they are not as convenient as GTC. There are many things to keep in mind while placing GTT orders with Zerodha. Please read the Zerodha GTT limit section below for more detail.

Zerodha offers to place a GTT buy or GTT sell order using a Single trigger or OCO (One Cancels the other).

The GTT orders are offered free of charge. There are no Zerodha GTT charges or Zerodha GTT fees for using the GTT feature in Zerodha.

A Zerodha GTT order remains valid for one year from the date of order placement.

The GTT trigger once hit gets deactivated irrespective of whether the order gets executed or not. In such a case, you need to place the GTT order again as the order gets expired and becomes invalid.

There are certain GTT limits in Zerodha that each investor should be aware of.

Zerodha offers to use the GTT feature through the Kite web and the mobile app.

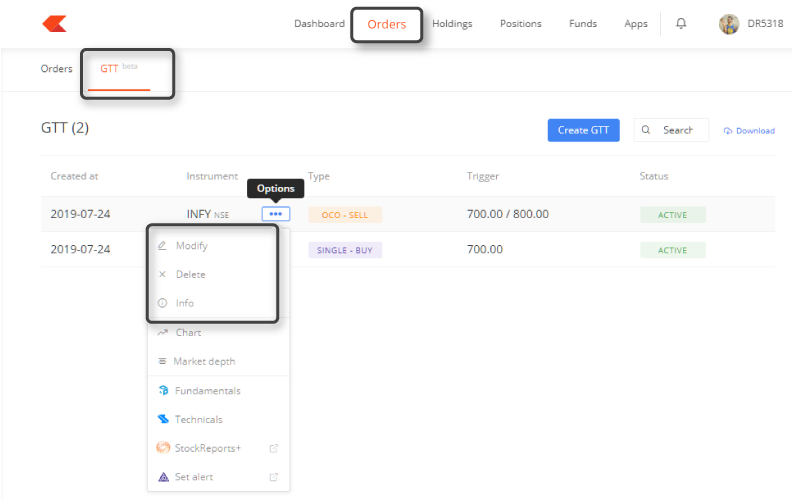

Steps to Place GTT Orders with Zerodha

Zerodha GTT order is an excellent offering for passive stock market investors. It still has a long way to go to meet the comfort of GTC orders which most investors find very convenient. Zerodha should look to add more features to bring it at par with GTC.

Read more about Zerodha

Zerodha Streak Review - Algo Trading for Retail Investors

Zerodha Streak Review - Algo Trading for Retail Investors NFO (Nifty Futures & Options) in Zerodha

NFO (Nifty Futures & Options) in Zerodha GTT in Zerodha Kite (Zerodha GTT guide)

GTT in Zerodha Kite (Zerodha GTT guide) Direct Mutual Funds Explained (Meaning, Charges & Taxation)

Direct Mutual Funds Explained (Meaning, Charges & Taxation)This is a limited time offer. Open an instant Zerodha account online and start trading today.

No, GTT orders can be placed only in the market houses.

This is unlike GTC orders (Good till Canceled) offered by full-service brokers like ICICI. GTC order can be placed at any point in time. This is a key feature for NRI investors.

Good Till Triggered or GTT is an order which is active till the set price is reached. It is valid for one year. The order gets automatically executed by the system when the set price by the trader is reached. The GTT orders are good at minimizing losses or to book profits when you are not actively tracking the markets.

Zerodha offers to place either GTT buy or sell orders through the Zerodha app only for stocks for delivery-based trading.

The GTT features to include Nifty and Bank Nifty futures and options are yet to be launched in Mobile App and are available only on the Zerodha Kite web.

Steps to place GTT order in Zerodha app:

Note: In the case of OCO trigger type, you need to input the stop loss as well as the target trigger price and order price.

Zerodha doesn't provide Good Till Cancelled (GTC) Orders. Instead of GTC, it provides Good Till Triggered (GTT) Orders. GTT orders are available in Zerodha Kite Web only.

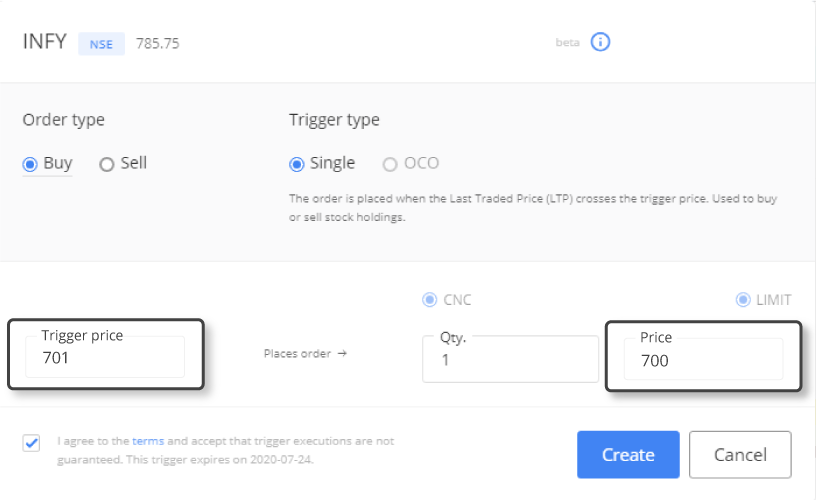

In GTT order you specify 2 prices; a trigger price and the order price. The order is placed to the exchange when the trigger price is reached. The order remains with the exchange for a day and gets executed when the stock price matches the order price. If the doesn't get executed in a day, the order gets canceled at the exchange as well as removed from GTT queue at Zerodha.

Note: GTT orders are available in Zerodha Kite Web for stocks (delivery trading) and Nifty and Bank Nifty F&O. The Zerodha Kite Mobile version currently only has the GTT order facility for stocks.

Example:

Scenario 1: After 10 days from placing the order, Infy share price reached to Rs 701. Zerodha will now place the order to the exchange. If the price reaches Rs 700, the order will get executed.

Scenario 2: In Scenario 1, if the price didn't reach Rs 700, the order will be canceled at the exchange by end of the day. The GTT order will also be removed from Zerodha GTT pending order list. This is unlike GTC where order remains in the system until it executed.

Scenario 3: If the share price doesn't reach the trigger price for 1 year, the order will be removed from the GTT Pending Order queue.

Scenario 4: If corporate actions like a bonus, dividend (if greater than 5% of market value), stock split, etc. are announced for Infosys, the GTT order will be removed for the GTT Pending Order queue.

No, there are no charges for using the GTT feature in Zerodha.

Zerodha is currently offering to use the GTT feature free of cost to its customers but may start pricing and decide Zerodha GTT brokerage in the future at any time at its sole discretion.

Yes, GTT in Zerodha is currently free. There is no GTT Zerodha pricing as of yet.

Zerodha had introduced the GTT feature as a free service as an introductory offer and had planned to charge after 3 months. However, Zerodha is still offering the GTT service free of cost.

Zerodha may start charging for GTT any time in the future at its sole discretion with due notification.

You can apply GTT on buy or sell orders in Zerodha either through the Kite web or Kite mobile app.

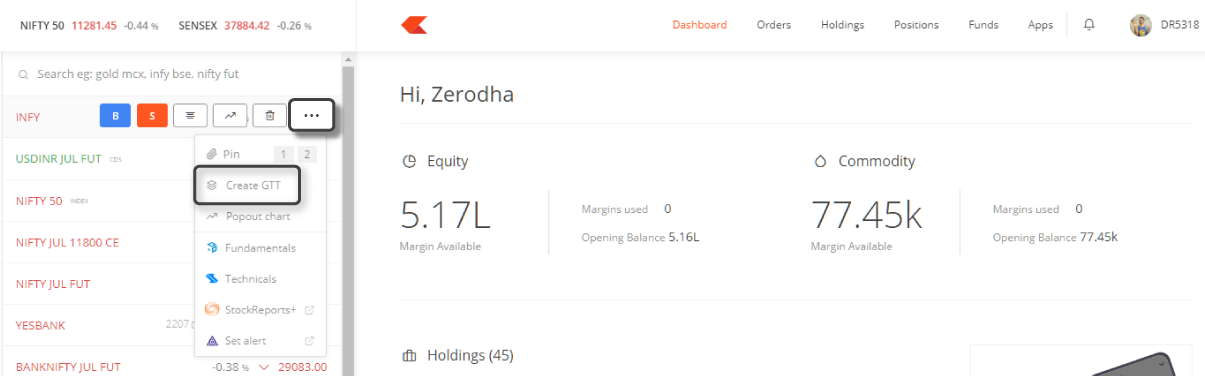

To apply GTT on the Kite web, click on the three dots displayed on the left side window. You will see an option to Create GTT in the dropdown list.

On the Kite mobile app, click on any scrip on which you want to apply GTT and click on Create GTT option available on the right just above the Market Depth.

The GTT feature in Zerodha is only for Equity Delivery trades (CNC orders) and Nifty and Bank Nifty futures and options (NRML orders). The GTT feature for Nifty and Bank Nifty F&O is currently available only on the Kite web.

You can put GTT in Zerodha for placing a buy or sell order using the Create GTT option.

To put the GTT order in Zerodha, you need to set the trigger price and the price at which you want the order to get executed. You also have an option to set a target price and stop loss.

Once the trigger price is hit, the order gets placed with the exchange. The order execution depends on the price match for the set order price. In case you want the order to get immediately executed, you have an option to change the limit order to market order.

Yes, you can cancel the GTT order in Zerodha at any time before the order gets executed.

You can remove or delete the order completely before the trigger condition gets fulfilled. Once the trigger condition hits, you have an option to modify or cancel the order before its execution from the Pending order screen.

The GTT orders in Zerodha can be canceled any time before they get executed.

You have an option to delete the order before the set trigger condition gets hit. Once the trigger gets hit, you have an option to cancel the order.

Steps to cancel GTT orders in Zerodha:

You can delete the GTT orders in Zerodha only before the trigger gets hit.

Once the trigger condition gets hit, you cannot delete an order. You can only cancel the order.

Steps to delete the GTT order in Zerodha:

A triggered GTT order can be canceled from the Pending Orders before it gets executed.

Once the trigger condition gets hit, the status of such GTT order under GTT tab gets updated to 'Triggered' and moves to the Pending order tab.

To cancel these triggered orders, go to the Pending order window and select the desired order. Click on Cancel to cancel the desired order.

You can check the GTT orders in Zerodha under the Orderbook.

There is a separate tab for GTT orders with the name GTT. You can check the status of your GTT orders from that screen.

The GTT orders in Zerodha are visible under the GTT tab of the order book. There is a separate tab called GTT where you can see all the orders placed using the GTT feature. the order status can be either Active or Triggered.

The Active status means the trigger is not yet hit.

The Triggered status signifies that the trigger is hit and the order gets placed to exchange. The GTT triggered order may or may not get executed based on the order price set.

You can create GTT in Zerodha for placing a buy or sell order using the Create GTT option.

Steps to create GTT in Zerodha:

The GTT order in Zerodha works based on the trigger and the order price set.

Until the trigger price gets hit, the order remains valid for one year from the date of order placement. Once the trigger gets hit, the order gets placed with the exchange. The execution of the order depends on the price match with the set order price.

Zerodha offers to place GTT buy or sell order as Single order or OCO.

In Single order, you need to set one trigger price and the order price for the required quantity. The single trigger order gets placed with the exchange once the trigger price matches.

In OCO (One cancels the other), you need to set a stop-loss and target trigger price or %. Once either of the trigger condition hits, the order gets placed with the exchange canceling the other trigger.

There is no requirement of any margins at the time of GTT order placement. However, once the trigger matches, you need to have sufficient margin or stock in your account as the case be failing which the Zerodha GTT order gets rejected.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Bank nifty option Sell order GTT created by mistake. GTT was also triggered once...order status is showing placed ...now tab is showing in blur....how I can delete this GTT.