Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, April 27, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha, India's largest stock broker also offers commodity trading to its customer. Zerodha is a member of the MCX that allows customers to buy and sell commodities like metals, bullion, energy products, and agricultural products.

Zerodha MCX trading is a facility provided by Zerodha to trade in Commodity Futures and options (F&O). Zerodha allow commodity options trading products like Silver, Gold, Zinc, Copper, and Crude oil in MCX.

Note:

Zerodha MCX charges include the commodity account opening charges, brokerage charges, and other regulatory transaction charges and taxes as per below:

Head |

Commodity Futures |

Commodity Options |

|

Account Opening Charges |

Rs 100 |

|

|

Brokerage |

0.03% or Rs 20 per executed order whichever is lower |

|

|

Commodities Transaction Tax (CTT) |

0.01% for Non-Agri products (on sell side) |

0.05% (on sell side) |

|

Exchange Transaction Charges |

Group A: 0.0026% |

Nil |

|

GST |

18% of (Brokerage + Exchange transaction charges) |

|

|

SEBI Charges |

Agri products: Re 1 per crore Non-Agri products: Rs 5 per crore |

Rs 5 per crore |

|

Stamp Duty Charges |

Rs 200 per crore on buy side |

|

|

Call and Trade Facility |

Rs 50 per order |

|

To trade in commodity, you have to open/activate Zerodha Commodity Trading segment by submitting request.

Note: Zerodha offers commodity account opening only to existing Zerodha Equity account holders or if you opt to open Equity trading and Demat account along with a Commodity trading account. You cannot open only a commodity account with Zerodha.

If you are already an existing Zerodha customer, you can enable the Commodity trading segment online by paying Rs 100 towards Zerodha commodity account opening charges.

If you are new to Zerodha, you also need to open an Equity trading and Demat account along with a commodity account. Zerodha charges Rs 200 for online account opening of Equity Trading and Demat account. You also need to pay an AMC of Rs 300 towards the maintenance of the Demat account.

Steps to open Zerodha Commodity Account

Following are the steps to open an online commodity trading account with Zerodha:

Zerodha MCX activation (for Existing Customers)

An existing Zerodha account holder can enable the commodity trading account online through Zerodha Console by clicking on Segment activation. You are required to upload income proof for activation of Commodity Derivatives trading.

For offline Zerodha commodity account activation, you need to:

Note: Zerodha Commodity trading account gets activated in 48 hours post, Zerodha receives the online or the physical request.

Zerodha offers MCX trading through Zerodha Kite App and Zerodha Kite web. The same trading software works for Equity, Currency and Commodity trading.

Zerodha Commodity account login credentials remain the same as for Equity trading account. You need to log in to Zerodha Kite using your Zerodha User ID and password.

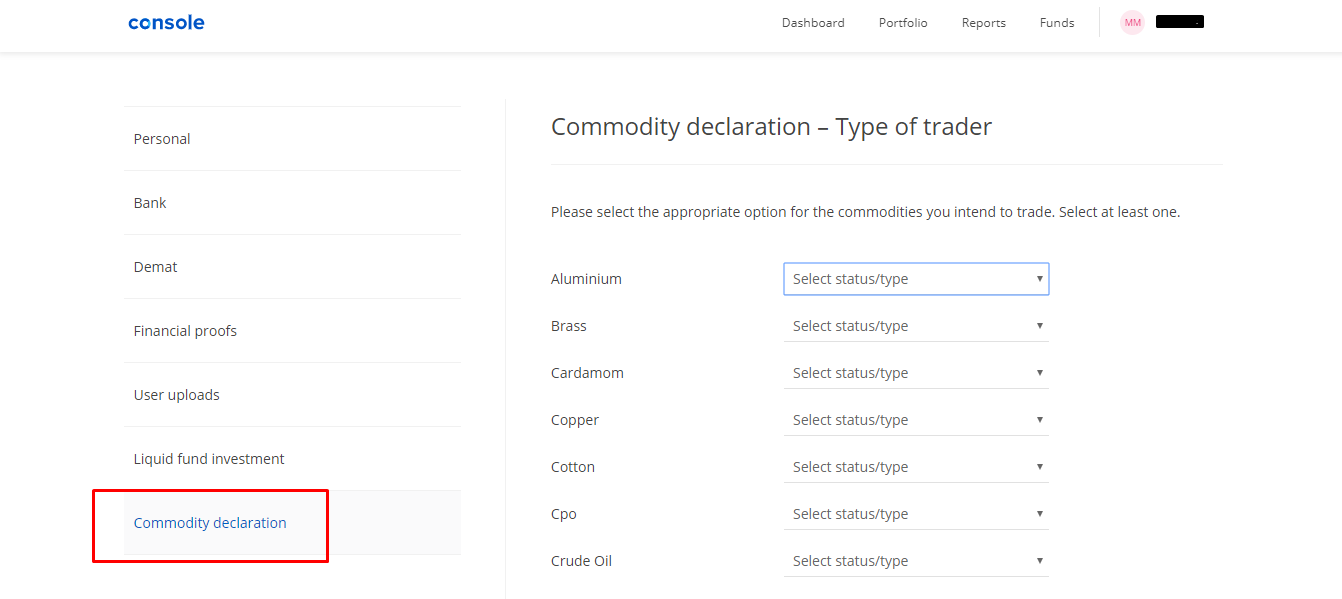

As per the recent SEBI guidelines, MCX needs to submit the trader classification of each commodity market participant in various categories as specified by SEBI. As a result of this, Zerodha requires each client to declare the trader category for each commodity in Zerodha Console. Every client must provide this declaration failing which the commodity trading gets suspended.

You need to select any one of the below trader categories that best suits you:

The commodity trader classification is now included in the Commodity account opening form as well.

The commodity market timings are longer than Equity markets.

|

Commodity Product |

Commodity Market Timings |

|

Cotton, CPO, Kapas (Cotton) |

9 am to 9 pm |

|

Other Non-Agri products |

9 am to 11.30 pm* |

|

Agri products |

9 am to 5 pm |

*During daylight savings, the Non-Agri product market closes at 11.55 pm.

Zerodha MCX margin allows its customers to trade many times over the funds available in their account. The leverage is provided only for Intraday (MIS) and Cover orders for Commodity Futures. There is no leverage for Commodity options.

|

Zerodha Commodity Intraday margin |

Intraday - 40-50%(2-2.5x), Carry forward - 100%(1x) of Span |

|

Zerodha Commodity cover order margin |

Intraday - 40-50%(2-2.5x), Carry forward - 100%(1x) of Span |

The commodity futures contracts are generally cash-settled or physically settled. However, Zerodha does not offer physical delivery of commodities. Hence, you are required to close your open positions in Zerodha Commodity before the delivery period starts. A delivery period is the period before the expiry of a commodity futures contract when the buyers or sellers submit their intent to take or give the delivery of their open positions.

The commodity options contract gets either converted to a respective futures contract on the expiry day or gets cash-settled based on its moneyness.

You need to maintain sufficient margins with Zerodha for the options contracts to get converted to a futures contract, failing which Zerodha will square off the positions.

Zerodha has separate bank accounts for Equity and Commodity as stipulated by SEBI. You cannot utilize, adjust or move the funds within Equity and Commodity.

You need to transfer the funds to the ZERODHA COMMODITIES PRIVATE LIMITED MCX account from your linked bank account each time you want to trade or in case of any margin requirement in Commodities.

You can transfer the funds using the UPI, instant payment gateway, or net banking. Zerodha charges Rs 9 + taxes for the funds transferred through the instant payment gateway. There are no charges by Zerodha for UPI and Net banking (bank charges may apply).

Zerodha also provides a convenient online withdrawal through Zerodha Console and Zerodha Kite. The commodity withdrawal requests get processed at 8 AM on weekdays in Zerodha (except on holidays). It takes up to 24 hours for the amount to get credited to the bank account. The withdrawal requests placed after the processing cut-off time get picked up for the next day.

Zerodha commodity account can be closed either online or offline. Before initiating the closure of the commodity account, you need to ensure that no dues are outstanding on your commodity trading account.

Steps to close the Zerodha commodity account online:

Steps to close Zerodha commodity account offline:

Zerodha takes 5-7 working days to process the closure request on receipt of the account closure form.

Zerodha offers a seamless and convenient commodity trading experience to its customers through its powerful trading platform Kite, an online fund transfer facility, and margins that allow trade up to 2-2.5 times for intraday commodity trading. Zerodha commodity calculators help customers to know about the cost of trading and margin requirements and upfront. It is important to note that you also need to have or open an Equity trading and Demat account in Zerodha along with a commodity trading account. Zerodha does not offer physical delivery of commodities.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Commodity trading in Zerodha allows investors to invest and trade in commodities like gold, silver, metals, oil, and other agricultural products through Zerodha Kite.

Zerodha provides commodity futures and options trading to its customers through Zerodha Commodities Pvt Limited that holds MCX membership. You cannot open only a Commodity account in Zerodha. You also need to have an Equity and trading account.

Zerodha offers online commodity account opening to its customer. Click here to open Zerodha Commodity Trading account online.

The online account opening takes just a few minutes and accounts get activated for trading on the same day. Note that your Aadhar Number should be linked to your current phone number for OTP verification to open online account.

If you are an existing Zerodha customer that already holds an Equity trading and Demat, you only need to activate the commodity trading.

Steps to enable commodity account online

Steps to enable the Zerodha Commodity account offline:

Zerodha brokerage charges is lower of 0.03% or Rs 20 per executed order for Commodity trades. The maximum brokerage charged for Commodity trading is Rs 20 per executable order. Note that one order could be of any size or number of lots. For example, if your order consists of 10 lots that got executed together, you will pay Rs 20 for the entire order.

Zerodha Commodity trading account can be activated online through Zerodha Console. Zerodha charges Rs 100 for online commodity account activation.

To enable commodity trading in Zerodha, you need to go to the segment activation option under your profile in Zerodha Console. You need to upload income proof to trade in Commodities.

Alternatively, you can also activate the Commodity trading offline by submitting a physical account opening form. Zerodha charges an additional Rs 100 for offline account opening due to the paperwork involved.

Commodity trading in Zerodha requires a commodity trading account and sufficient margins to place commodity orders.

You cannot open only a Commodity trading account in Zerodha. You also need to have an Equity trading and Demat account along with a Commodity account.

Once the commodity trading account gets opened, you can buy or sell required commodity futures and options contracts in Zerodha through Zerodha Kite, provided sufficient margins are in place.

Note:

To trade in commodity through Zerodha, you need to have a Commodity trading account with Zerodha.

If you already have an Equity trading and Demat account, you need to activate the commodity trading segment through Zerodha Console. Zerodha does not offer only Commodity trading account to clients.

Steps for Zerodha Commodity trading:

You need to ensure to have sufficient margin in the Commodity trading account for successful order placement.

Zerodha does not offer only Commodity trading account. You need to either have an existing Equity trading and Demat account with Zerodha or open a new Equity trading and Demat account along with a Commodity trading account.

Commodity contracts are either cash-settled or physically settled. Thus generally, commodity trading does not require a Demat account. However, since Zerodha does not allow only Commodity trading, you are required to open a Demat account with Zerodha for Commodity trading along with an Equity trading account.

Zerodha does not provide an installable trading terminal to trade in stocks and commodities (MCX).

You can trade in Equity and Commodities through Zerodha Kite. Zerodha Kite is available in the form of a web browser and a mobile app that also allows trading and investment in Equity Derivatives, Currency Derivatives and bonds.

Yes, Zerodha Kite offers the mobile trading app 'Zerodha Kite' to trade commodities in MCX. The same app can be used for trading stocks, commodities and currency at BSE, NSE and MCX. It is one of the best mobile trading platforms in India.

Zerodha Kite mobile app supports Android and Apple iOS devices and is available for Android smartphones, iPhone, and iPad users. The app is available for download in the App Store and Google play store and search for Zerodha Kite.

Yes, Zerodha customers can trade in commodities at MCX using its Kite platform. The commodity trading is available in both Kite Web and Kite Mobile App.

Zerodha Kite offers to trade in Equity, Currency, and Commodity at BSE, NSE, and MCX exchanges.

No, Zerodha doesn't offer trading at the NCDEX exchange. Zerodha only provides commodities trading at the MCX exchange. You could choose full-service brokers like Angel One or Edelweiss for trading at NCDEX. Both Angel One and Edelweiss offer online trading at a flat rate of Rs 20 and Rs 10 per executed order.

NCDEX offers agricultural and non-agricultural commodity trading. NCDEX leads in agricultural commodities trading while MCX is popular in metal and energy commodities trading.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|