Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, March 9, 2020 by Chittorgarh.com Team | Modified on Thursday, April 20, 2023

Small and Medium-sized Enterprises (SME) has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. They not only play a crucial role in providing large employment opportunities at comparatively lower capital cost than large industries but also help in industrialization of rural & backward areas, thereby, reducing regional imbalances, assuring more equitable distribution of national income and wealth. SME's are complementary to large industries as ancillary units and this sector contributes enormously to the socio-economic development of the country.

SME Capital Market is a credible and efficient market place to bring about a convergence of sophisticated investors and growing corporate in India. It offers opportunities to informed investors to invest in emerging businesses with exciting growth plans, innovative business models, and commitment towards good governance and investor interest.

SME Capital Market has customized processes and systems which will help prospective issuers in their journey of metamorphosing into listed public companies. The SME platform will provide capital raising opportunities to credible and fast-growing businesses with good governance standards. It will be an ideal platform to raise funds for companies on a growth path, but not large enough to list on the mainboard.

Listing facilitates enormous financing opportunities in terms of raising equity and beneficial treatment in terms of cost at which funds can be raised.

Listing often leads to improvement in credit rating, which in turn enables raising of loans at a reduced rate of interest.

Listing adds to the comfort of stakeholders such as customers/lenders/creditors of the company, which in turn, results in the increased order book, better-negotiated business terms like credit period, margin, favorable contractual covenants, etc.

The value is often locked or not benchmarked for unlisted companies. The companies listed on an exchange are in a position to unlock their fair value. Shares become like a currency that can be used for various purposes-M&A, ESOPs, Collateral, etc. This is one of the significant advantages offered by the capital market.

Listed shares, having their value established in the market, act as currency, and can be used as collateral to raise funds. Listed securities act as a Viable M&A Currency.

As per the Finance Act, 2012 a company is liable to tax on equity infusion, if the equity shares are issued at premium exceeding the fair price. Such tax is not applicable in case the shares are listed.

Acquisitions of shares of an unlisted company below net-worth attracts tax on investors such a tax incidence is mitigated if the shares are listed.

Tax @ 20% on buyback of shares is not applicable if the shares are listed.

The companies listed on the stock exchange get recognition, as well as is followed by the investors and analysts. Listing of the company provides a platform for recognition and visibility.

Listing help companies strengthen their internal governance systems leading to better internal control and corporate Governance.

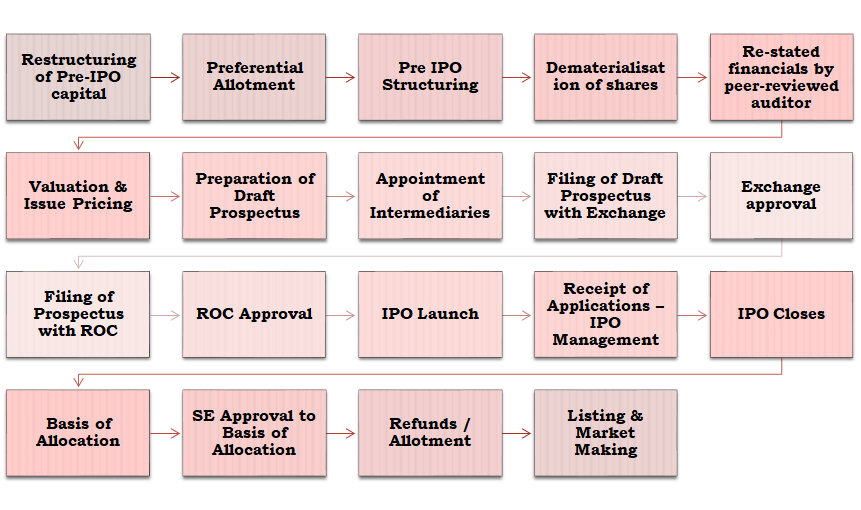

SME IPO can be completed in 60 days subject to receipts of documents and approvals.

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

I have a request plz add SME allotment procedure for HNI category.