Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, March 30, 2021 by Chittorgarh.com Team | Modified on Wednesday, June 15, 2022

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Nifty Futures and Options segment of Zerodha is popularly referred to as the NFO segment Zerodha. Nifty F&O or NFO in Zerodha can be traded online through Zerodha Kite Web or mobile app. In this article, we will discuss the margins, charges, trading, and activation of the NFO segment in Zerodha.

Note: NFO in the stock market generally refers to the New Fund Offer (NFO) of a Mutual Fund. Zerodha offers its investors to apply in NFO through the Coin website.

NFO Zerodha Charges refer to the charges applicable to trade in F&O segment. Zerodha charge 0.03% or Rs 20 per executed order whichever is lower brokerage for trading in Futures and flat Rs 20 per executed order for trading in Options.

Note that there are no charges to apply for NFO of Mutual Fund.

| Particulars | Futures | Options |

|---|---|---|

|

Brokerage |

0.03% or Rs 20/executed order whichever is lower |

Flat Rs 20 per executed order |

|

STT/CTT |

0.01% on sell side |

0.05% on sell side (on premium) |

|

Transaction charges |

NSE: 0.002% |

NSE: 0.053% (on premium) |

|

GST |

18% on (brokerage + transaction charges) |

18% on (brokerage + transaction charges) |

|

SEBI charges |

Rs 5 per crore |

Rs 5 per crore |

|

Stamp charges |

0.002% or Rs 200 per crore on buy side |

0.003% or Rs 300 per crore on buy side |

You can trade in NSE F&O through the Zerodha Kite website or Zerodha Kite mobile app. The facility to apply in NFO of a Mutual Fund is currently only on the Zerodha Coin website.

While opening an account with Zerodha, if you had not selected NSE F&O, NFO will not be enabled in Zerodha for trading.

You can activate the NFO segment in Zerodha anytime through the segment activation option in Zerodha Kite by submitting the income proof.

Steps to activate NFO in Zerodha

NFO trading in Zerodha refers to F&O trading on the NSE exchange. The F&O segment needs to be activated for NSE to allow you to trade NFO in Zerodha. You can buy or sell Futures and Options in Zerodha through Zerodha Kite.

How to trade in NFO in Zerodha? - Steps for NFO trading in Zerodha

You should ensure to keep sufficient margins with Zerodha to trade in F&O. As per the new SEBI rule, you are required to keep SPAN + Exposure margin to carry forward F&O positions. In case you do not maintain sufficient margins, you get charged with a margin penalty by the exchange. Zerodha may also square off your position if required.

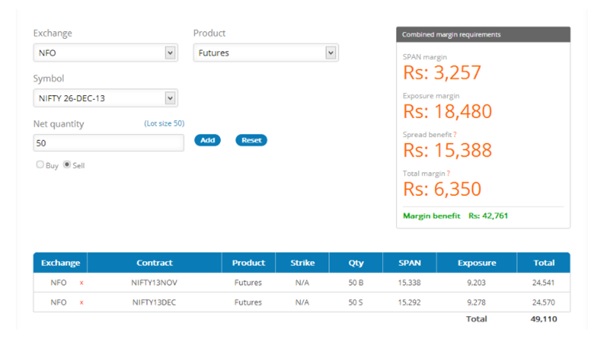

NFO Zerodha margin calculator helps you calculate overall margin requirements for futures, options, calendar spreads. The margin calculator upfront tells you of the margin requirements. Thus, you can easily take the desired positions without falling short of margins.

Steps to access NFO Zerodha Calculator

Zerodha NFO brokerage calculator helps calculate the brokerage and other charges and taxes like STT, Exchange Transaction Tax, GST, SEBI charges, and Stamp Duty for Equity Futures and Equity Options.

Brokerage for Equity Futures - 0.03% or Rs 20/executed order whichever is lower

Brokerage for Equity Options - Flat Rs. 20 per executed order

Zerodha offers to trade NFO - NSE Nifty Futures and Options through Zerodha Kite. You cannot place NFO orders in the pre-market session. Zerodha trading tools like brokerage calculator, margin calculator helps calculate brokerage, other charges, and margin requirements for NFO trades. Zerodha has partnered with Sensibull that assists the investors with options trading strategies.

Zerodha Streak Review - Algo Trading for Retail Investors

Zerodha Streak Review - Algo Trading for Retail Investors NFO (Nifty Futures & Options) in Zerodha

NFO (Nifty Futures & Options) in Zerodha GTT in Zerodha Kite (Zerodha GTT guide)

GTT in Zerodha Kite (Zerodha GTT guide) Direct Mutual Funds Explained (Meaning, Charges & Taxation)

Direct Mutual Funds Explained (Meaning, Charges & Taxation)This is a limited time offer. Open an instant Zerodha account online and start trading today.

NFO generally stands for New Fund Offer of Mutual Funds. Zerodha offers its clients to apply in NFO through the Zerodha Coin website. To read more about Zerodha NFO of Mutual Fund, click here.

Zerodha also offers its investors to trade in F&O products. The F&O segment of NSE exchange in Zerodha is known as NFO that stands for Nifty (NSE) Futures & Options.

NFO in Zerodha Kite refers to the NSE Nifty Futures & Options segment.

Zerodha offers to trade NSE F&O through Zerodha Kite's web-based trading platform or mobile trading app. Zerodha's trading tools like Zerodha margin calculator and brokerage calculator help easy calculation of required NSE F&O margins, brokerage charges, and other charges and taxes like STT, Stamp Duty, GST, exchange transaction charge.

Zerodha also offers partner products like Zerodha Sensibull that provides investors with an options trading platform. Zerodha Sensibull suggests investors with a list of strategies on the option type to be bought, strike price, expiry date, potential returns, and risks involved in each of the strategies.

NFO in Zerodha refers to the F&O segment of the NSE Exchange. BFO in Zerodha refers to BSE - F&O.

You can activate the desired segment by using the segment activation through Zerodha Console. The income proof is mandatory to trade either in NFO or BFO.

Yes, you can buy NFO in Zerodha.

To buy NFO in Zerodha, you need to activate the NSE F&O segment by using the segment activation option in Zerodha Console. You require to submit income proof to activate the F&O segment in Zerodha.

Once the F&O segment is activated, you need to maintain sufficient margins to take positions in F&O. Zerodha margin calculator can assist you with overall margin requirements upfront for desired F&O contracts.

You can activate the NFO in Zerodha through Zerodha Console.

Steps to activate NFO in Zerodha:

It takes about 48 hours to activate the F&O segment once the request is submitted.

You can enable the NFO segment in Zerodha through the Zerodha console.

You need to activate the NSE - Futures & Options segment through the segment activation option by uploading the income proof. Income proof is mandatory to trade in the Derivatives segment. You can submit any of the following documents like income proof:

You can open NFO in Zerodha by selecting NSE F&O as a trading preference while opening an account with Zerodha. You can also activate the NSE- F&O segment later through the segment activation option. Click here to read more on Zerodha Account Opening.

To open NFO in Zerodha, you need to submit income proof along with other documents like:

Scanned copy of signature proof.

To buy NFO in Zerodha, you need to have the F&O segment activated for NSE exchange. You also need to maintain sufficient margins to take F&O positions.

Steps to buy NFO in Zerodha Kite:

You can check the status of the order in the order book.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|