Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, August 28, 2018 by Chittorgarh.com Team | Modified on Wednesday, May 29, 2024

Zerodha is one of the leading discount stockbrokers in India, offering trading services for stocks, currencies and commodity options. Zerodha clients can buy stocks, and mutual funds, participate in IPOs and trade in derivatives on the BSE, NSE and MCX.

Zerodha offers 2 trading platforms to buy and sell options:

Kite is a trading platform offered by Zerodha that is both minimalist and powerful.

Kite has extensive charting capabilities that include over 100 indicators and more than 15 chart types. Kite is used by over 6 million active customers and processes over 7 million trades daily.

It is designed to be intuitive and responsive, with a bandwidth consumption of less than 0.5 Kbps for complete market observation.

Features:

Sensibull is an options trading platform designed to make options trading easier and faster for small traders. It has tools like Options Strategies Builder, Open Interest, FII DII Data, and Options Trading Tips, for Nifty, Bank Nifty and NSE Options.

Features of Sensibull

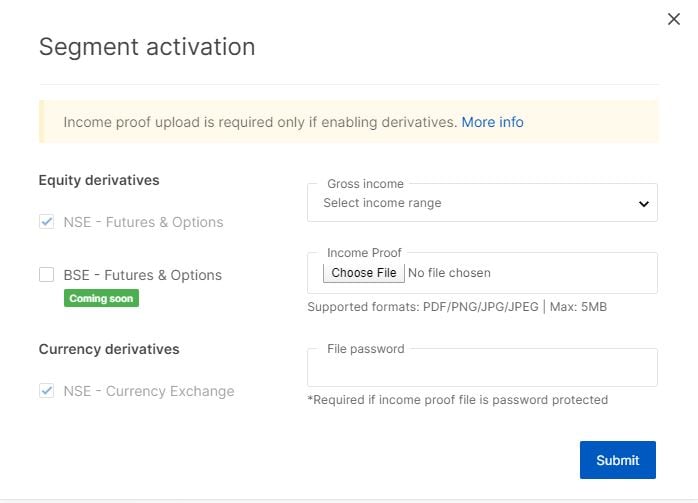

To trade in F&O in Zerodha, you need to enable the F&O segment in your trading account, if you have not opted for F&O trading at the time of account opening. You have to submit an online application and upload a few documents.

Steps to activate the F&O segment in Zerodha

Note: If you click Activate here, you will be redirected to the Kite app to complete the documentation for the segments if they have not yet been submitted. It takes 72 hours for the segments to be activated.

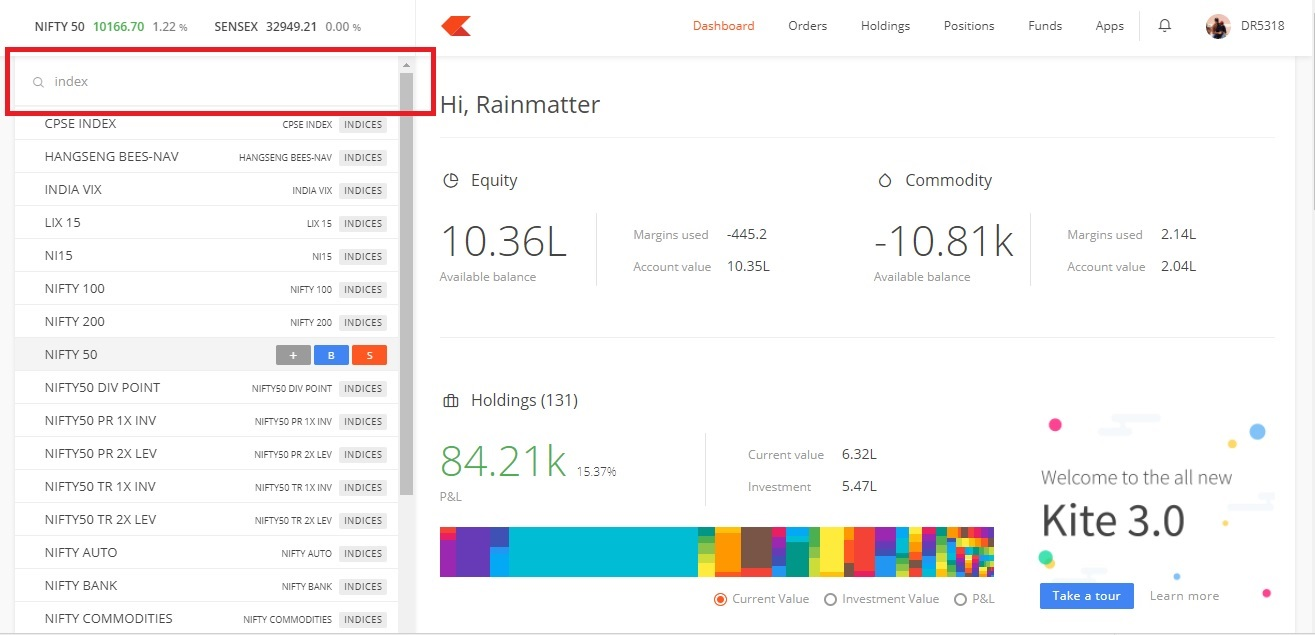

On the successful opening of an account with Zerodha, you will be sent a welcome email with login ID details for Zerodha Kite and a link to reset your password.

Open https://kite.zerodha.com/ webiste or Kite mobile app and login.

The next step is to add funds to your Zerodha trading account. Upon logging in, you will be taken to the Zerodha Kite dashboard. This page gives you an overview of your trading with data on Funds available, your existing holdings and positions, etc.

Click 'Funds' from the top menu to add funds to your account. You will be taken to the 'Funds Page'. Now click on the green coloured 'ADD FUNDS' button. This will open an online payment gateway. You need to select your bank and complete the process as you do while transferring money online.

To buy a Call/Put Options contract on Zerodha, you need to first add the scrip to your marketwatch. You can create up to 5 MarketWatch's, with maximum 40 scrips per marketwatch. To add a scrip to market watch, you need to use the 'Universal Search'.

On your left of the page, you will find the search box (marked in red). Zerodha calls it 'Universal Search'. The search box gives you access to all Option contracts across all the exchanges.

Enter a few characters of the name of the Option contract you want to add and click on '+'. For example, to add Nifty 50 index, enter Nifty 50 in the search bar, select and click on +. Similarly, you can search and add option contracts of companies and bank nifty.

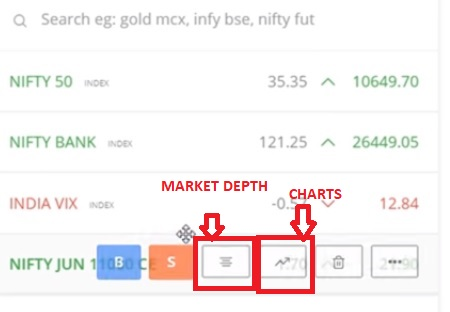

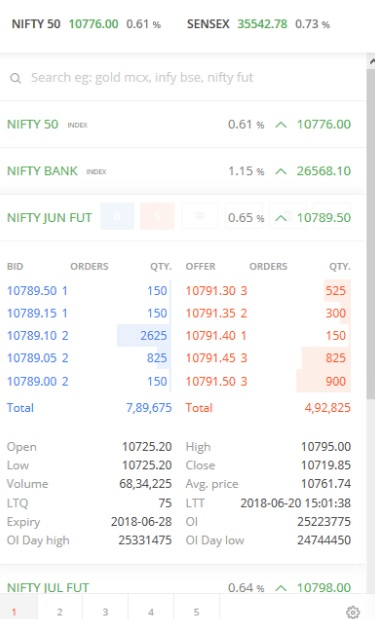

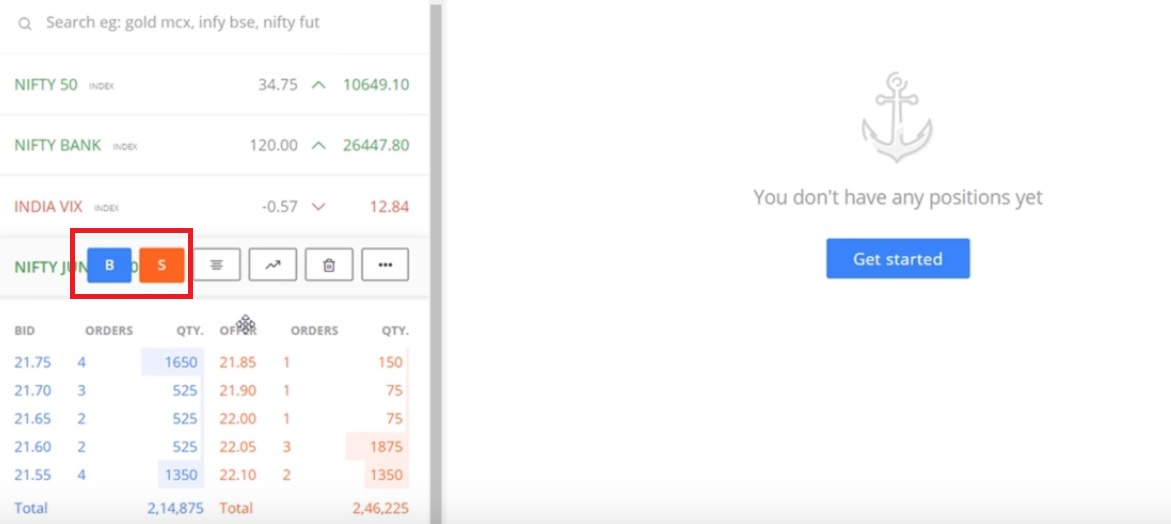

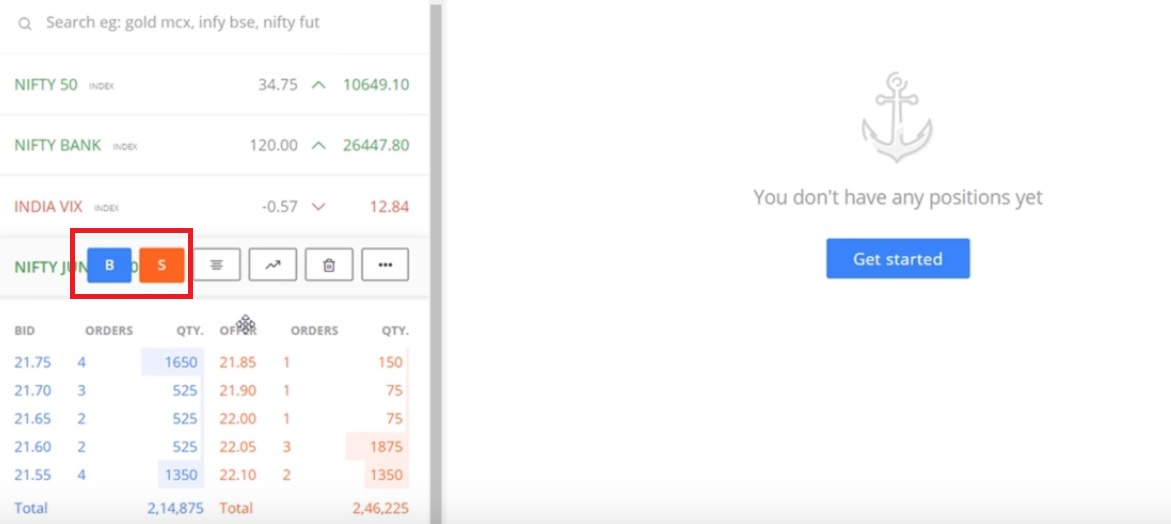

Hover your mouse over any of the Option contracts on your market watch and a buy (B) and sell (S) button will be activated. When you hover your mouse, in addition, to buy (B) and sell (S) buttons, you will get access to 4 other buttons that get activated. Two of the highly useful buttons in options trading are:

Market Depth:

It provides you with the best 5 bids and offers/asks for a particular Option contract.

Qty indicates the quantity available for buying/selling at a particular price

Orders indicate the number of orders pending at that particular price on the exchange.

Charts:

The charts are used by experienced traders to do technical analysis of the stocks.

Once you have added desired option contracts in your market watch, you are ready to buy it.

There are two ways to place a BUY order:

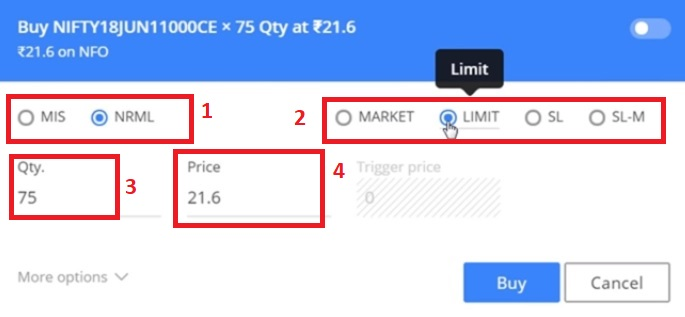

Hover your mouse over any of the Option contracts on your market watch and a buy (B) and sell (S) button will be activated. Click on 'B' to activate the order form.

There are key 4 elements (boxed in red) of the order form:

MIS stand for Margin Intraday Square Off and is useful for traders who are doing intraday trading in Options. Intraday trading means to buy and sell of the order on the same day. The trade is completed on that day. Nothing is carried off to the next day. Zerodha offers margin leverage for intraday traders. There is no margin provided for traders buying options as there is no margin requirement for such a trade. However, the seller of options is required to maintain a margin. When you use an MIS code, you only need to maintain 50% of the margin. So, entering this code gives 50% margin leverage to Option sellers and allows them to do more trade with the same amount of money.

NRML stands for normal orders.

You have 4 options in orders to choose from:

Each option contract has a lot size. Each lot size consists of a fixed number of shares as decided by the exchange. Nifty contracts have lot size of 75 shares. Enter the qty as per the lot size.

You need to enter the premium price for each share.

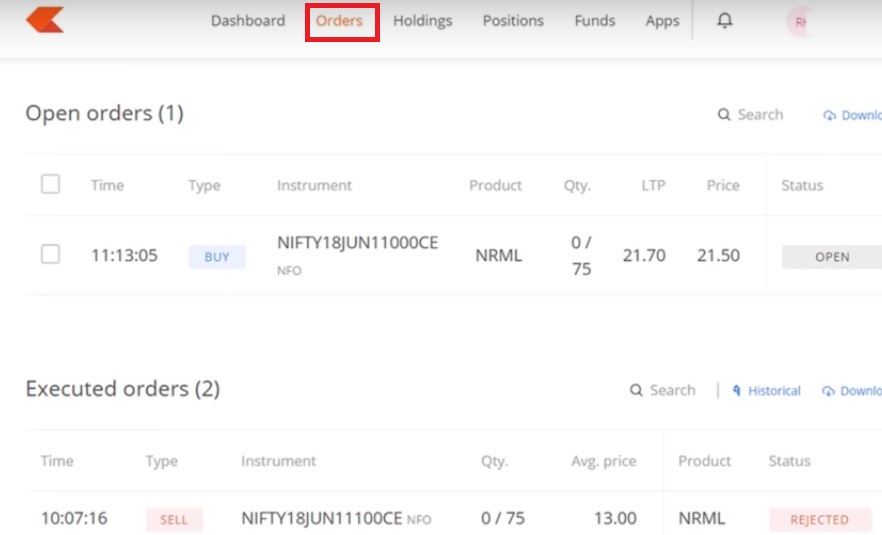

Most beginners to Options trading commit a mistake that successful placing of an order means the order is executed. But it doesn't always happen. Many times, there are no sellers available for the price you quoted and hence the order remains open. You can check if your order is executed or not by clicking the 'Orders' button in the top menu:

The orders page will inform you of Open and Executed orders. You can either wait for the Open orders to be executed when the price comes down and sellers are available or can cancel or modify the order.

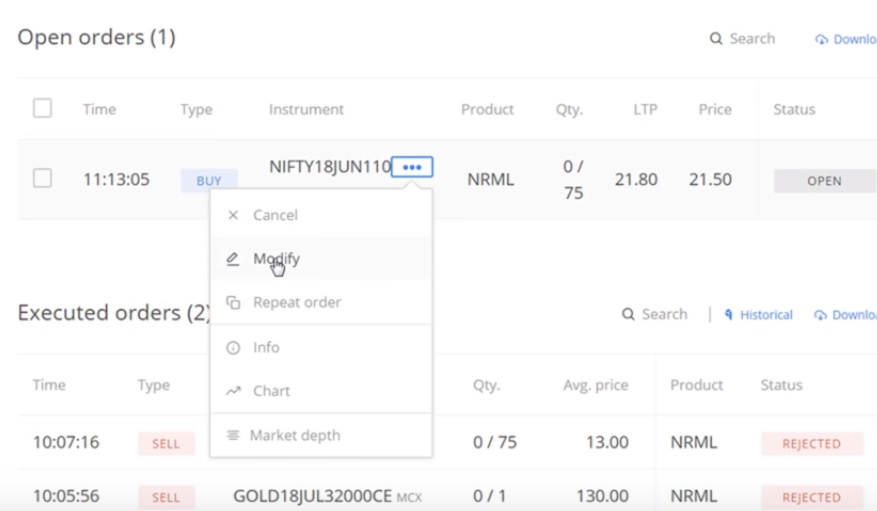

To modify an open options contract order in Zerodha, you can:

To cancel an open options contract order in Zerodha, you can:

To sell options in Zerodha, you can do the following:

Here are some other things to consider before executing the trade:

Sell the option with an NRML order and check the margin on the order screen.

You can sell an existing Call/Put option contract in Zerodha in two ways:

Go to Market Watch and hover your mouse on the specific contract you wish to sell. This will activate the buy (B) and the sell (S) button. Click on 'S' to activate the order form. Enter price and Qty and click on Sell button. Click on 'orders' on the top menu to check if your order is executed. Modify or cancel the order if required following the steps explained above.

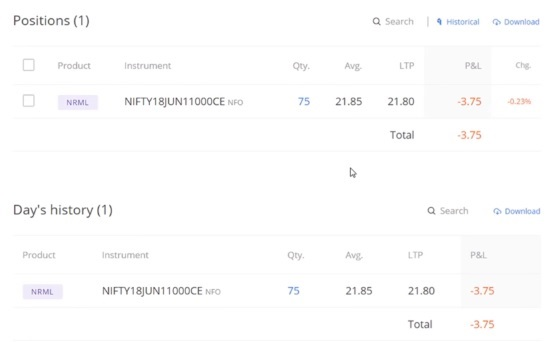

Alternatively you can also click on the 'Positions' tab on the top menu. The page looks like this:

Here, tick the box of the specific contract, you want to sell and a blue-colored 'Exit Button will get activated. Click the 'Exit' button to open the order form. Choose the order type and enter price and quantiry details.

Read more about Zerodha

Zerodha Streak Review - Algo Trading for Retail Investors

Zerodha Streak Review - Algo Trading for Retail Investors NFO (Nifty Futures & Options) in Zerodha

NFO (Nifty Futures & Options) in Zerodha GTT in Zerodha Kite (Zerodha GTT guide)

GTT in Zerodha Kite (Zerodha GTT guide) Direct Mutual Funds Explained (Meaning, Charges & Taxation)

Direct Mutual Funds Explained (Meaning, Charges & Taxation)Using the Kite website or mobile app, you can trade Nifty Options and other Options with Zerodha. Before you get into trading Nifty options, check whether the F&O segment is activated for your account. If not, visit the Zerodha Console > My Profile > Segment activation page to activate the F&O segment.

Steps to place buy order for options in Zerodha

Steps to place sell order for options in Zerodha

Selling options contact in Zerodha is easy and online. You could use the Zerodha Kite website or Kite mobile app to sell options.

Steps to sell options in Zerodha

You can activate Options in Zerodha online in the Zerodha Console.

Steps to activate the F&O (derivatives) segment in Zerodha

The F&O segment will be activated in 48 hours.

You can add weekly options in Zerodha on Kite Web or Kite Mobile App using the steps mentioned below.

Steps to add Weekly Options in Zerodha

Zerodha offers a Stop Loss order facility in Zerodha Options to help you minimize your losses in case the price of the contract moves against your expectations. The process to place a stop-loss order is the same as any normal order.

You can place 2 types of Stop Loss order:

While filling the order form, you need to select SL or SL-M, enter quantity and Trigger Price.

Zerodha charges flat Rs 20 per executed order brokerage on Options trading. One order may have 1 or more lots in it. The brokerage is charged on the order and not on the lots. In addition customer has to pay government taxes including STT, exchange transaction changes, SEBI charges, GST ect. Visit Zerodha Brokerage page for more detail.

You can activate options online in the Zerodha Console. Once your online request for segment activation is received, it takes up to 48 hrs for Zerodha to enable the segment. You receive a message once the segment is enabled.

Steps to enable options in Zerodha

To log in to Kite web, follow these steps:

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|