Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading Account)

Zerodha (Trading Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, November 20, 2014 by Chittorgarh.com Team | Modified on Tuesday, April 4, 2023

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Brokers are middlemen or agents who help us in buying and selling shares, derivatives (Futures and Options) and other financial instruments. Brokers charge a fee called brokerage for the service they offer.

But brokerage is not the only fee customers have to pay. The total amount paid to the stock/commodity brokers is made of multiple charges, fees and taxes. This includes:

The fee brokers charges for the service they offer. Each broker has its brokerage model. There are 3 types of brokerage plans available in India:

Note: While traditional brokers charge the brokerage in % of trade amount; the discount brokers offer a flat monthly or per-trade fee.

The transaction charge is a fee charged by an exchange (BSE, NSE, MCX) for using its platform. This is the largest part of the cost of trading with discount stock brokers. The transaction fee is an addition of two charges.

Transaction charge = Exchange Turnover Charges + Clearing Charges

Visit Transaction charges are explained for more detail about transaction charges

The STT is payable on the value of securities transacted through a recognized stock exchange. This is charged only on the sell side for intraday and F&O trades. It is charged on both sides for delivery trades in equity. There are no STT on Bonds, Currency and Mutual funds.

| Segment | STT on Share Trading |

|---|---|

| Equity Delivery | 0.1% on both Buy and Sell |

| Equity Intraday | 0.025% on the Sell Side |

| Equity Future | 0.0125% on Sell Side |

| Equity Options | 0.0625% on Sell Side(on Premium) |

| Currency Futures | No STT |

| Currency Options | No STT |

| Commodity Future | 0.01% on Sell Side (Non-Agri) |

| Commodity Options | 0.05% on Sell Side |

Stamp Duty on securities transactions is the tax levied on documentation by the state governments in India. It applies to all securities market transactions including buying of Stocks, Mutual Funds, ETF, bonds etc. It is collected by stockbrokers or Clearing Corporations or by the Depositories. Subsequently, the collected stamp duty is disbursed to the respective states.

|

Trading Segment |

Stamp Duty Rate |

|---|---|

|

Equity Delivery |

0.015% (Rs 1500 per crore) |

|

Equity Intraday |

0.003% (Rs 300 per crore) |

|

Futures (equity and commodity) |

0.002% (Rs 200 per crore) |

|

Options (equity and commodity) |

0.003% (Rs 300 per crore) |

|

Currency (F&O) |

0.0001% (Rs 10 per crore) on buy-side |

|

Mutual Fund |

0.005% (Rs 500 per crore) |

Note:

Click here to find more details about Stamp Duty Rates.

GST is a tax imposed by the Government of India on services provided in India. GST on securities transactions is charged at 18% of the total cost of brokerage plus transaction charges.

| Segment | GST Rates |

|---|---|

| Equity Delivery, Intraday, F&O | 18% on Brokerage + Transaction Charge |

| Currency F&O | 18% on Brokerage + Transaction Charge |

| Commodity | 18% on Brokerage + Transaction Charge |

SEBI (Securities and Exchange Board of India) is the regulator for the securities market in India. SEBI charges a fee for all sale and purchase transactions in securities other than debt securities.

| Segment | SEBI Turnover Fee Rate |

|---|---|

| Equity Delivery, Intraday, F&O | 0.00010% (Rs 10/Crore) + GST |

| Currency F&O | 0.00010% (Rs 10/Crore) + GST |

| Commodity Futures | Agri: 0.00001% (Rs 1/Crore) + GST Non-agri: 0.00010% (Rs 10/Crore) + GST |

| Commodity Options | 0.00010% (Rs 10/Crore) + GST |

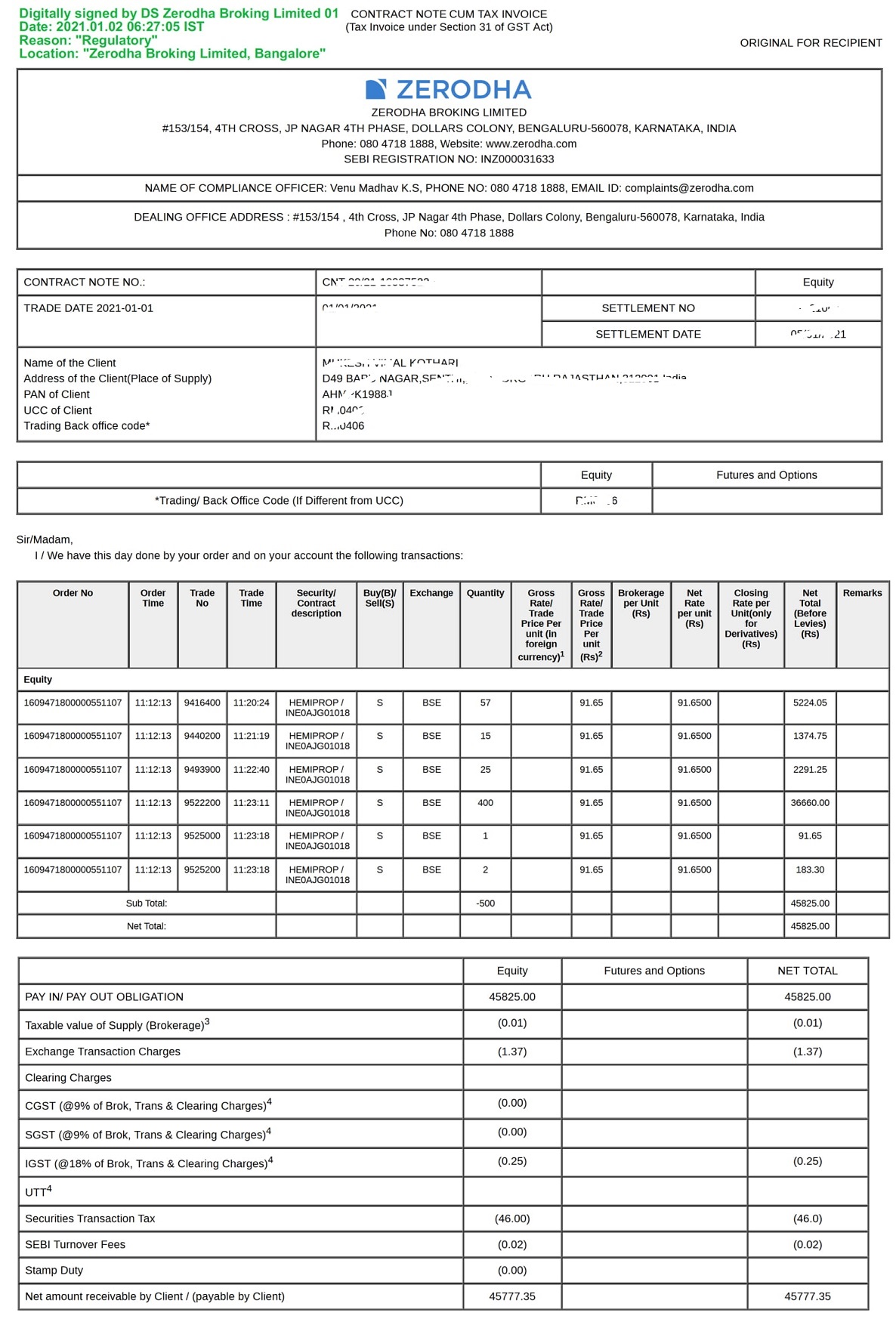

The above fees or charges are provided in detail in the form of Contract Note by the broker.

Contract note, a document sent by the broker to the client at the end of the trading day to provide detail about the transaction with the broker.

This document includes detail of buy & sell transactions for the day, brokerage charged, other fees or charges applied and total amount due to customer.

The broker provides an electronic copy of the contract note (in pdf format) for free and charges an additional amount to send a paper copy by mail. One contract note is sent to the customer every day; which include all the transactions for the day with the broker.

Here is a 'Contract Note Sample' which shows all these charges:

No, a stock trader in India cannot claim GST input for transactions done in the stock market.

GST Credit cannot be claimed by anyone except if they are rendering services where they are paying GST and this is as input to provide this service.

For example, Mutual Funds are paying GST on the cost charged to the corpus of the fund, and a contract note from a stockbroker is input to provide that service.

Except for PMS, AIF, and MF, no one can take GST credit.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|